Seems like the bearish correction has finally arrived at the global stock markets. It all usually starts in the US. Once the American Indices cough, the rest of the world catches the flu. The S&P 500 had one of the worst weeks in recent history and created a major bearish reversal pattern. It is all strongly affecting the DAX, where on Friday the price action created a dangerous sell signal.

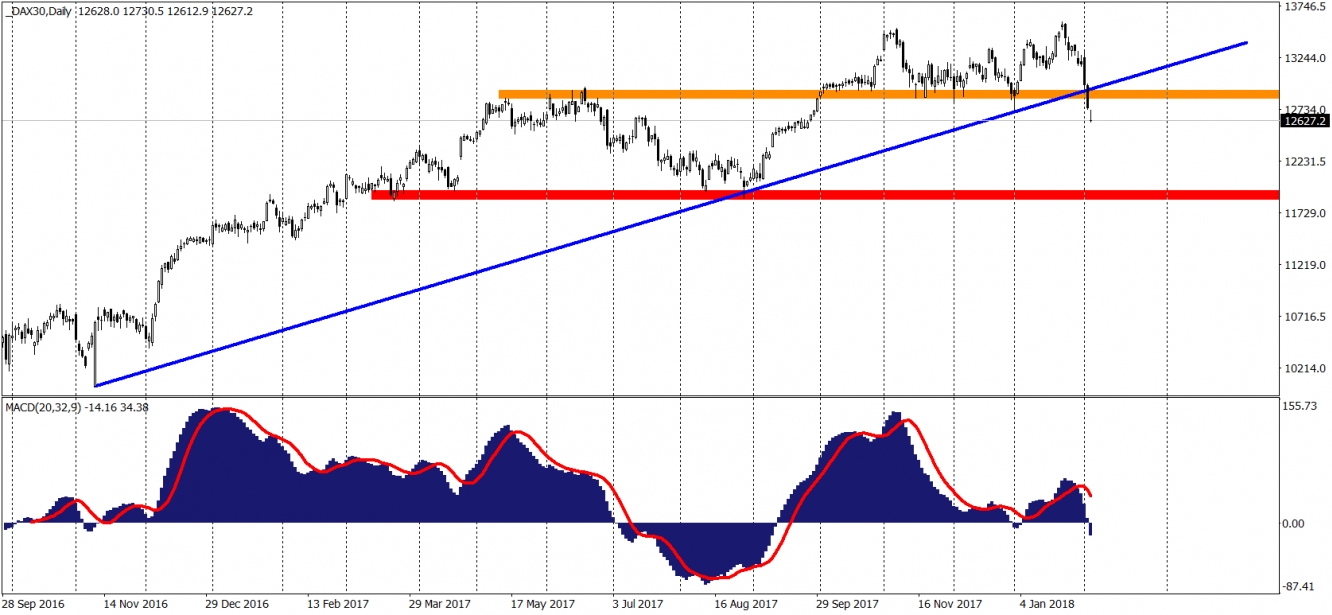

Last week, traders on the DAX ended Friday in a very bad mood. The situation there is bearish from both the technical and fundamental point of view. First technicals: on the 2nd of February, the DAX managed to break the important long-term support created by the combination of the major up-trend line (blue) and the horizontal S/R level around 12,900 points (orange). Simple, and with no other fireworks this breakout itself should, in theory, kill all the demand here. Well, we could add here a double top formation but I personally think that it is not the most reliable pattern on the record and should not be taken too seriously. Fundamentally, DAX is pushed lower by the higher yields and stronger euro.

As long as price stays below this area, the sell signal is ON. A comeback above the orange level will create a false breakout pattern and would definitely be a positive outcome, but chances of that are limited, for now. The target for the current drop is the red area around the 11,900 points.