Sun Life Financial Inc. (TO:SLF) reported second-quarter 2017 underlying net income of $512 million (C$689 million), up 24% year over year.

Sun Life witnessed strong performance across its four segments.

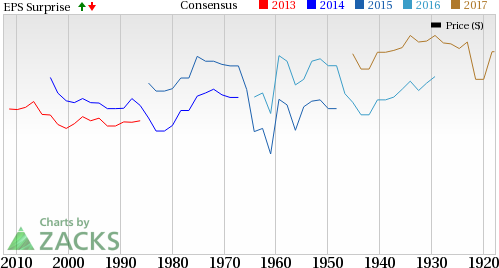

Sun Life Financial Inc. Price, Consensus and EPS Surprise

In the quarter, the company also witnessed strong revenue growth with wealth sales rising 12%.

Adjusted premiums and deposits were $30 billion (C$40.6 billion), up 5% year over year, fueled by higher managed and mutual fund sales and increased net premium revenue.

Adjusted revenues came in at $5.5 billion (C$7.4 billion), up 5.7% year over year. Net premiums increased to $2.9 billion (C$3.9 billion).

Segment Results

SLF Canada’s underlying net income increased 33% year over year to $198 million (C$266 million). The company witnessed business growth and strong new business gains in Group Retirement Services and individual insurance, as well as a favorable morbidity experience in Group Benefits, plus a positive credit experience. However, higher expenses, including investment in wealth businesses, partially offset this improvement.

SLF U.S.’s underlying net income was $106 million, up 17.8% from the year-ago quarter. The company witnessed gains from investing activities on insurance contract liabilities, favorable credit experience and a favorable mortality experience in In-force Management and International as well as a favorable morbidity experience in disability. However, an unfavorable morbidity experience in stop-loss related to business written in 2016 was partial offset.

SLF Asset Management’s underlying operating net income of $144 million, increased 26.3% year over year, driven by higher average net assets and lower taxes.

SLF Asia reported underlying income of $60.2 million (C$81 million), up 4.7% year over year. Business growth, partially offset by higher new business strain, favored the quarterly performance.

Financial Update

Global assets under management were $710 billion (C$944 billion), up 4.5% from the level at 2016-end.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (MCCSR) ratio was 248% as of Jun 30, 2017 compared with 249% as of Mar 31, 2017.

Sun Life reported operating return on equity of 11.4% in the second quarter of 2017, thus expanding 110 basis points year over year. Underlying ROE of 13.7% improved 180 basis points year over year.

Dividend Update

The board of directors of Sun Life approved of a dividend of 43.5 cents per share.

Zacks Rank

Sun Life sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Insurers

Among other players from the insurance industry, having reported second-quarter earnings so far, both Brown & Brown, Inc. (NYSE:BRO) and Fidelity National Financial, Inc’s. (NYSE:FNF) bottom lines beat their respective Zacks Consensus Estimate while The Progressive Corporation (NYSE:PGR) missed the same.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Brown & Brown, Inc. (BRO): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

Progressive Corporation (The) (PGR): Free Stock Analysis Report

Fidelity National Financial, Inc. (FNF): Free Stock Analysis Report

Original post

Zacks Investment Research