Investing.com’s stocks of the week

Data Source: Morningstar

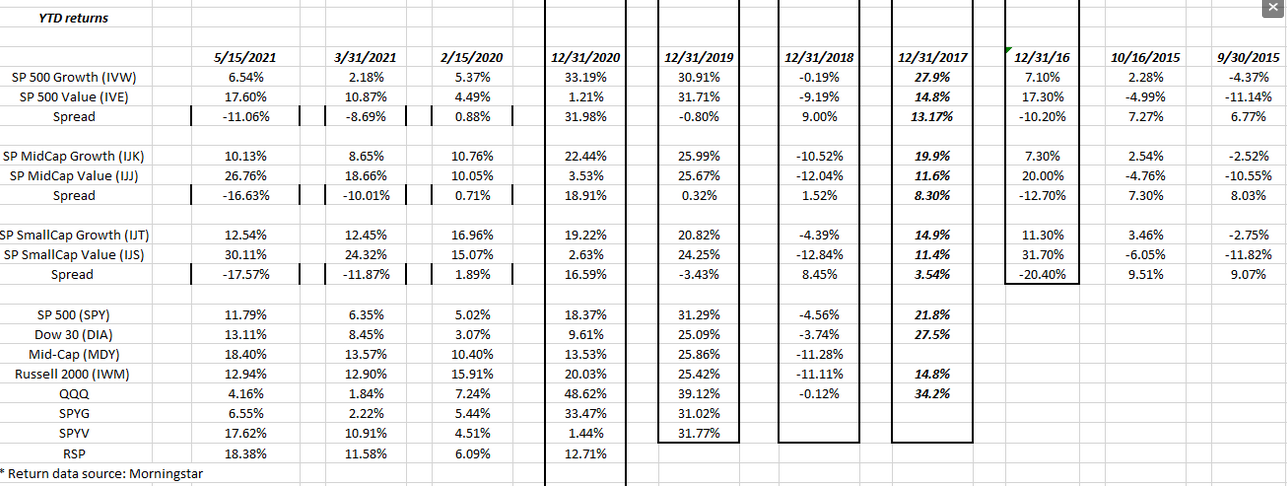

For the first time really since 2016, “Value” stocks are outperforming “Growth” by a material margin.

The value outperformance on the S&P 500 really started around Election Day, 2020 or the first few days of November, 2020 and has continued ever since. As well, the absolute return increases the further down you go in the market-cap class, i.e. small-cap value has outperformed large-cap value by almost 1,300 bps thus far in 2021.

Given the outperformance by the Russell 2000 since last fall, all the R2k positions were sold for clients in February–March ’21 when the momentum gauges hit decade highs, with the proceeds put into the Invesco S&P 500® Equal Weight ETF (NYSE:RSP).

Given last quarter’s earnings reports, it’s hard to think the mega-cap Tech names are completely done from a return perspective.