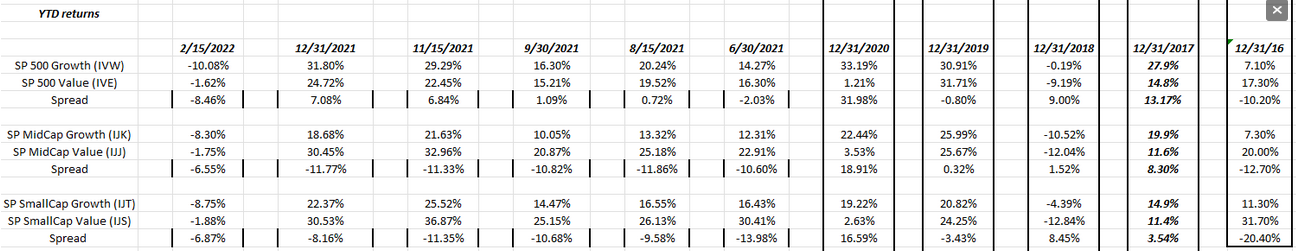

The first style-box update for 2022 shows what everybody and their brother already knows i.e. that value is outperforming growth for the first 6 weeks of the year, probably led by the incredible run in the Energy sector, which was up 25% as of last Friday, 2/11/22 while the Financial sector was up 2% YTD. (Source: Bespoke).

Value started to outperform growth in the last 6 months of 2021 (see above spreadsheet) and then in 2022, the large-cap asset class finally succumbed as most investors felt that the incredible run in the S&P 500’s top 10 positions by market cap or what Ed Yardeni calls the “Megacap 8” had seen its limit.

While International and non-US aren’t shown above, on other spreadsheets where YTD returns are updated every weekend, the international and non-Us asset classes do have positive returns YTD, while a lot of US equity is underwater YTD.

As of 2/15/2022, the S&P 500 was down 6.08% YTD while the QQQ’s were down 10.5% and the RSP (equal-weight) was down a little over 3%.

Maybe what’s more interesting is that while many bond and fixed-income ETF’s are oversold on weekly charts, the EMLC (emerging market local currency) ETF is up 1% YTD. That caught my eye, but have no positions at present.

It’s not my place to give advice here to readers, but what clients are being told at the annual meetings is that what’s worked for the last 5 – 10 years is far less interesting today, and owning non-correlated or uncorrelated assets to the S&P 500 offers better risk / reward.

Readers should do their own homework and might benefit from what’s been boring and out-of-favor for a while.

Thanks for reading.