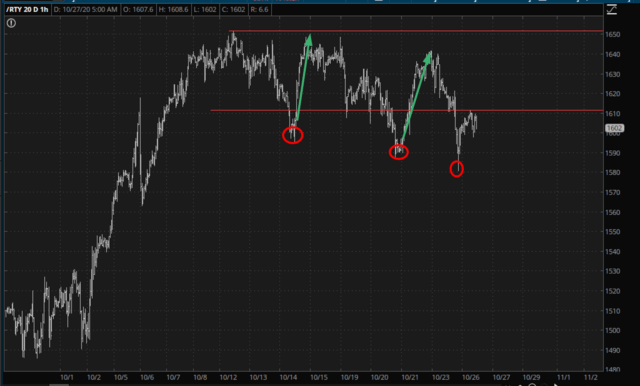

It’s nice to wake up to a Russell, which is actually a tiny bit red. We had a good hard down day yesterday, and naturally it fought back. But at the moment, all is well. My principal interest and concern is whether or not this is merely the third “bounce point” we’ve seen on the /RTY in recent weeks.

I’ve drawn those horizontals above as a crude range guide, but clearly we’re not bouncing neatly within that range. Instead, it is a steady series of lower lows and lower highs. But, see, I like lower lows and awful lot. It’s the lower highs that are a nuisance to endure.

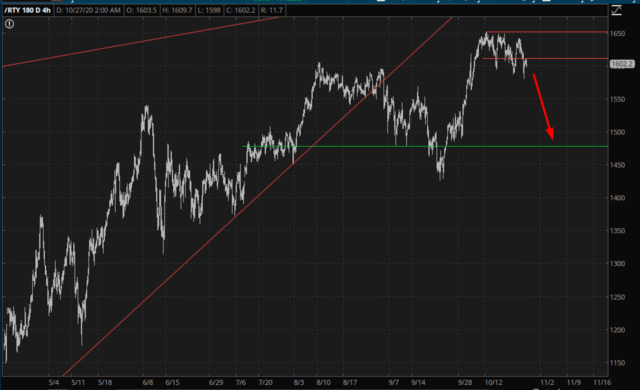

The ideal, of course, would be if this broken range actually does succumb in a meaningful sell-off, sort of like this:

It would actually make a clean push into next Tuesday’s election, as people start to freak out.

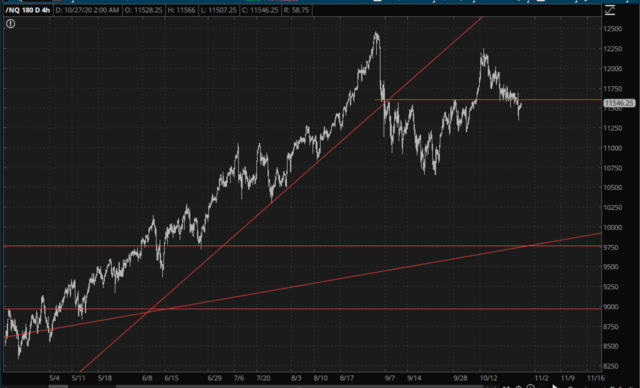

One other nice thing that happened with yesterday’s selloff is that we quite plainly busted the bullish formation on the /NQ (Nasdaq 100), as illustrated by this horizontal line.

The moment of truth, however, will come after the close on Thursday, when an absolutely tidal wave of mega-cap earnings will hit.