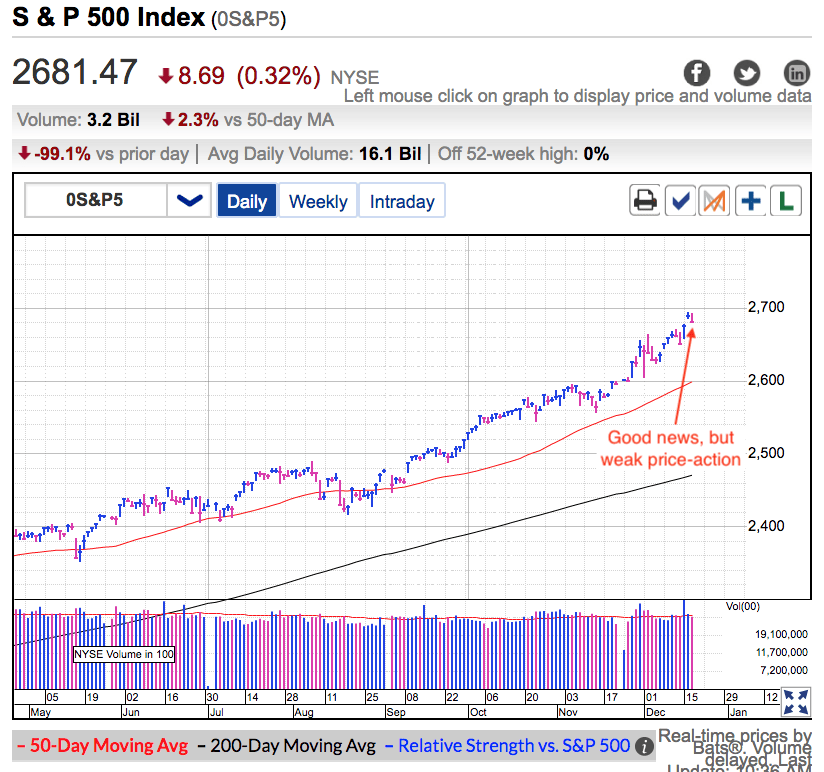

The S&P 500 stumbled on Tuesday as Congress moved closer to approving Tax Reform. The joint tax bill sailed through the House with plenty of room to spare, but a technicality means they will need to re-vote on Wednesday. The Senate is voting as I write this and could be approved by the time you read this.

If everything is going so well, why did stocks slip 0.3% and break a two-day winning streak just when everything was looking so good? It appears expectations have built up to the point the crowd now assumes Tax Reform is a done deal. Few skeptics remain and those that wanted to buy the Tax Reform pop have already jumped in. If everyone buys before the event, who is left to buy when it finally happens?

“Buy the rumor, sell the news” is a popular stock market saying and it appears that's what is happening here. Everyone bought the rumor and the closer we get to the news, the fewer new buyers there are left to keep pushing prices higher. At this point Republicans have the votes and the rest is a formality. That’s why each new milestone is met with such apathy. If a person wanted to buy the Tax Reform pop, they missed their opportunity by several weeks. The time to buy is when the outcome is uncertain. By the time everyone knows what is going to happen, the profit opportunity has passed.

While we might get a reflexive, knee-jerk pop when both the Senate and House approve the combined bill, more interesting will be what happens after that. If the early strength fizzles and reverses, that will be a sign Tax Reform is fully priced in and the market needs to consolidate recent gains. Few things make me more nervous than a market that fails to go up on good news. That tells us the rally is exhausted.

This market has been propped up by hopes of tax cuts since Trump won the presidency 13 months ago. Once this becomes law, traders will no longer have this big thing to look forward to. The last year has been remarkably calm because minor bumps along the way didn’t bother owners who knew bigger things were coming. But now that those things have come and gone, what are traders going to fixate on? That is the million dollar question.

It’s been a nice ride to this point but there are definitely warning signs this rally needs to rest. I’m not bearish by any stretch, but I’ve been doing this long enough to know that every bit of up is followed by a bit of down. At the very least we should expect a minor exhale as the market digests the last 13 months of gains.