A solid week for stocks in the end after seeing the breakouts early in the week weaken initially.

Strong closes are most important and that includes a strong weekly close and we did see that.

I remain heavily long of leading stocks who are doing very well and markets are confirming this strength.

By the looks of it, it won’t be too long until we make an assault on new all-time highs in the S&P 500.

The metals weakened and are still looking to move lower so let’s check into support areas I’m looking at.

Gold gained 0.53% this past week but is acting quite weak.

Gold chopped around this past week and having large range days usually leads to lower prices, unless we are breaking out one way or another, rather than chopping around as we’re doing now.

I’m still looking at the major $1,180 pivot area as support and a possible buy point unless we can move past $1,240 on the upside.

We did have one strong day this past week but it was on Fed news, and as I’ve said here a hundred times before, moves from gold on Fed news rarely last more than a few days.

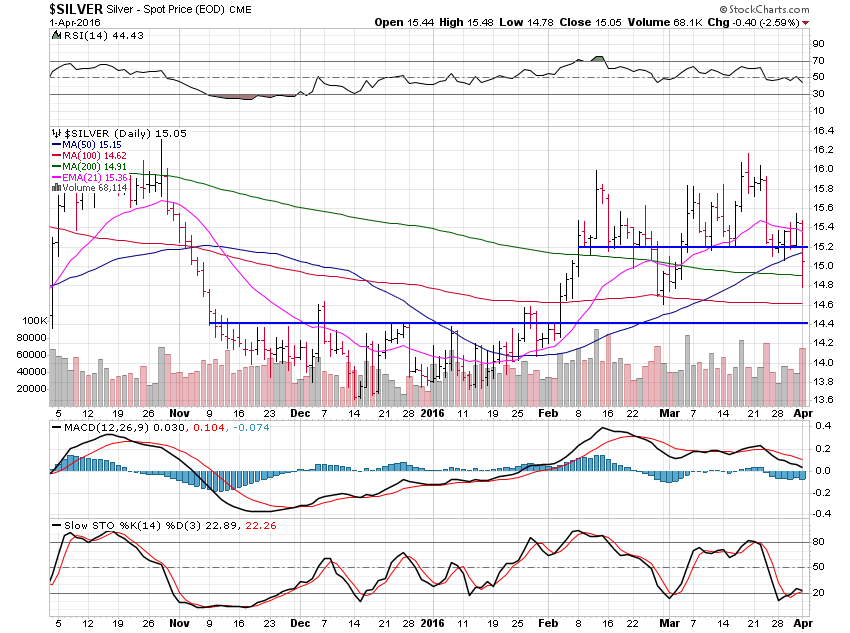

Silver lost 0.99% and is acting much sloppier than gold.

Silver is leading gold lower now and looks sloppy.

$14.40 is the support area I’ll be watching as it may be a buy area.

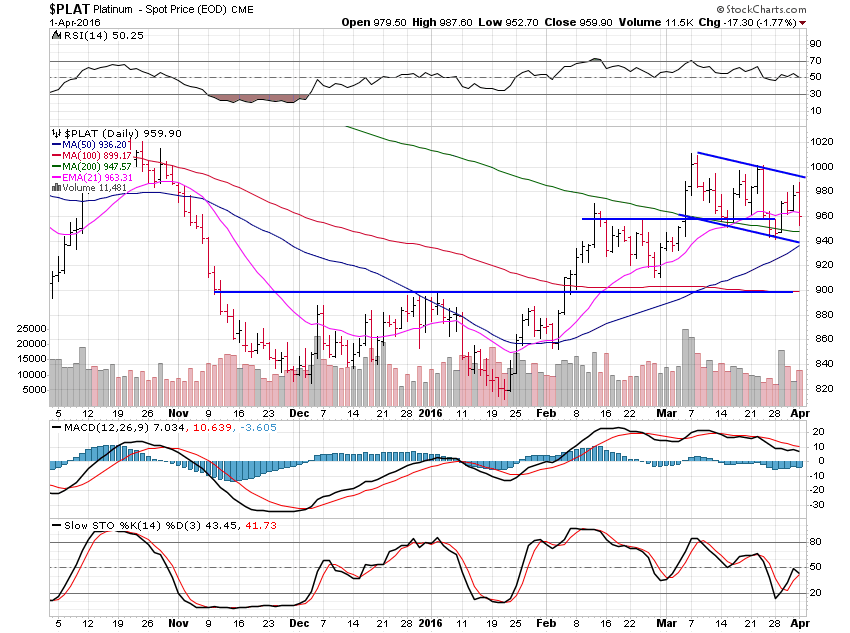

Platinum gained 1.13% for the week and is holding this descending channel for now but it will soon weaken if gold and silver do.

$960 is a pivot area and a break either way out of this descending channel can be bought or sold.

Chances are platinum will fall and find support at $900 before we begin to move higher again so I’d look to buy off the $900 area.

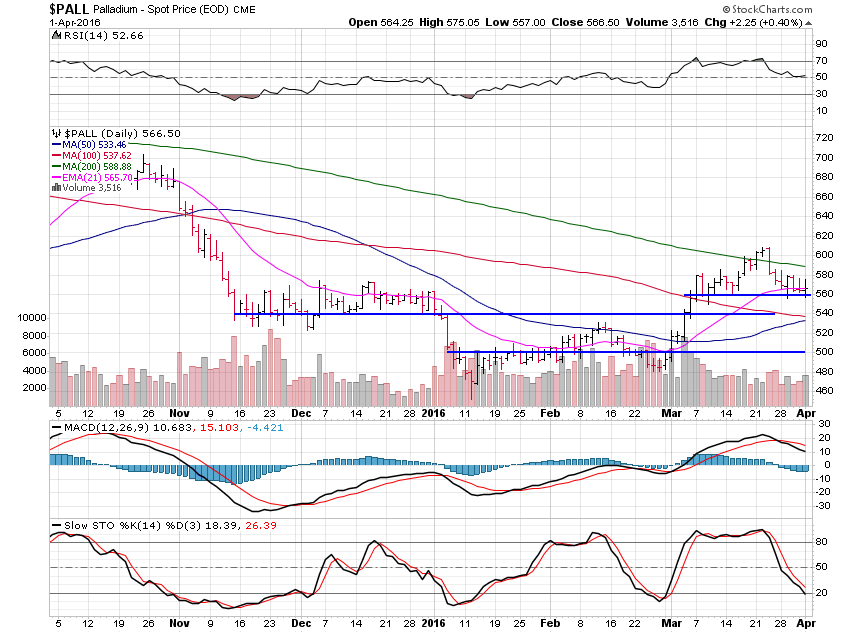

Palladium lost 1.43% this past week and now has a small head and shoulders pattern, which is bearish.

This head and shoulders pattern targets a move to substantial support at $500 in this wave lower, but if gold and silver turn higher then palladium will as well.