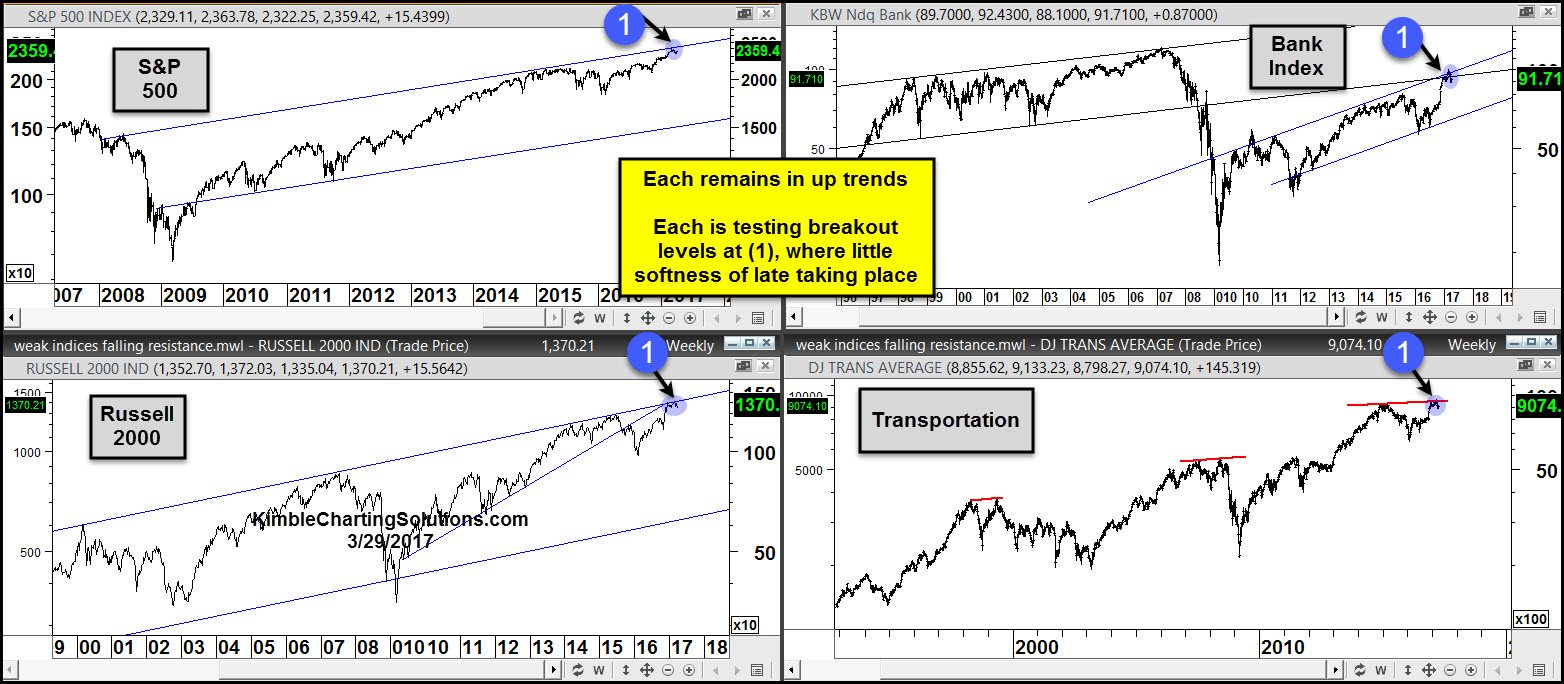

The S&P 500, banks, small caps and transportation indices continue to climb higher, as the long-term trend remains up. The two charts below, look at performance over the past month and how each index is testing long-term breakout levels.

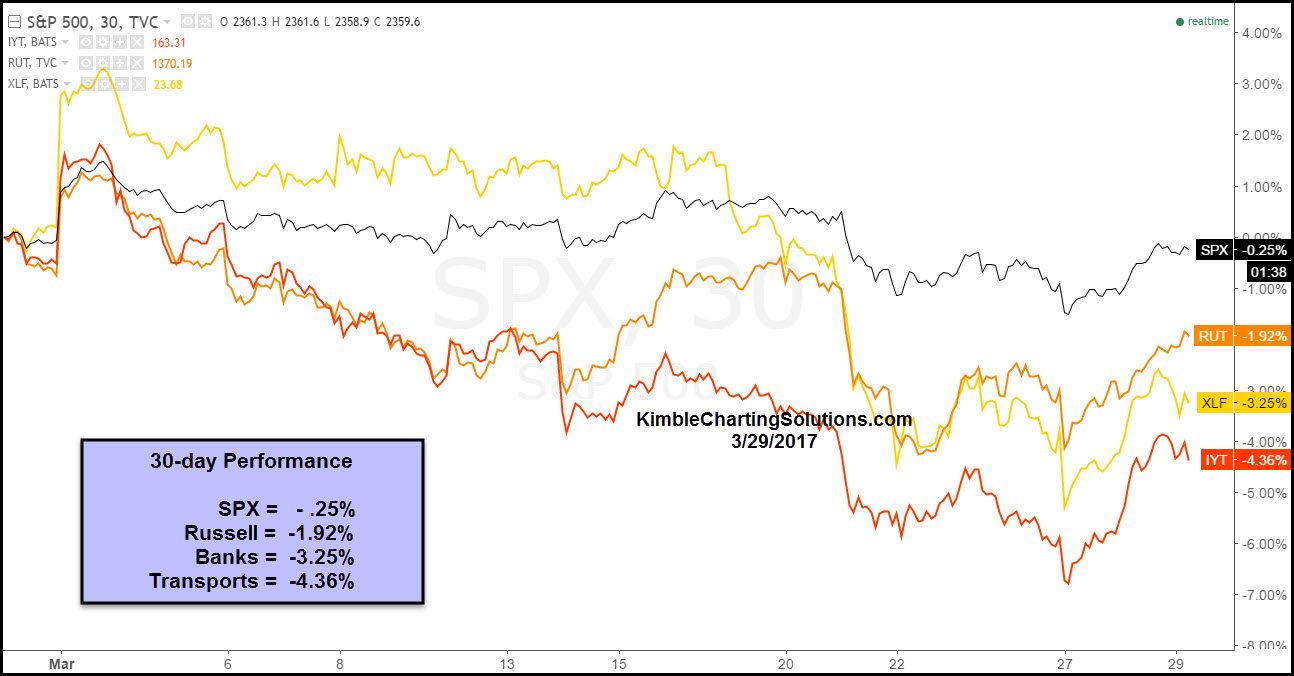

The chart below looks at how the above mentioned indices have performed over the past 30-days.

These key markets have been a little soft the past 30 days. The Power of the Pattern below looks at where this softness is taking place.

Multi-year trends remain up for each of the indices as they create a series of higher lows and higher highs.

Each is testing key breakout levels at (1), where a little softness has taken place the past month. The Transports index (lower right) could be creating a pattern similar to what it did in 1999 and 2007. The odds of Transports creating an identical pattern to the 1999 and 2007 highs are low for sure. If Transports do weaken at (1), bulls might want to keep a tight stop on positions.

Great news for bulls: if these stocks do breakout at (1), they should attract buyers. Bulls don’t care to see weakness start taking place at (1).

And so it will be very interesting to see just where each of these are 30 days from now.