Yesterday’s session was not like the previous ones – in the previous days, the precious metals sector moved lower together and mining stocks were leading the way. Yesterday, gold and silver declined, but miners were barely affected. Does this strength indicate a likely turnaround?

Miner’s Outperformance

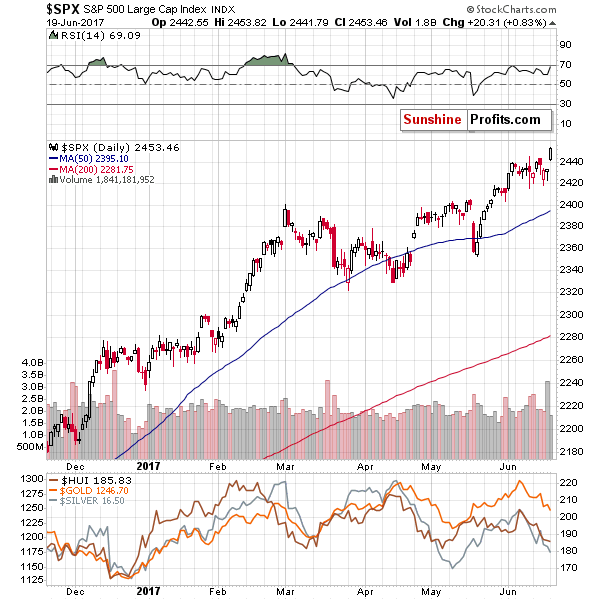

In short, that’s not likely. Miners had a very good reason to rally. The general stock market soared yesterday and mining stocks, being stocks themselves were positively affected by this development.

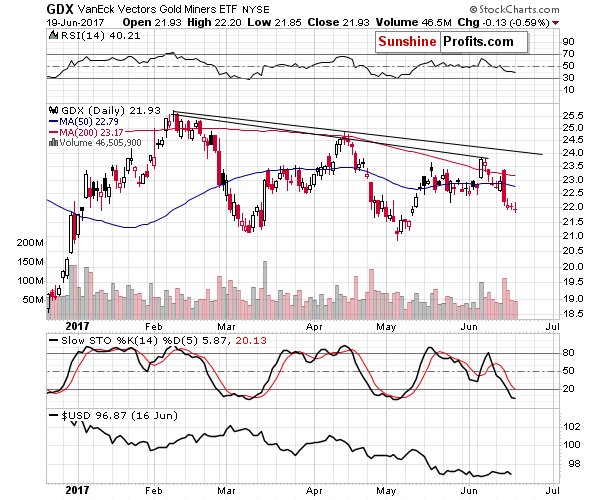

This is something that happens quite often, but let’s keep in mind that this effect is usually temporary. Ultimately, the gold stocks’ profits depend on the price of gold and thus this is the key driver of the miners’ prices. Let’s see exactly how much the mentioned markets moved (chart courtesy of http://stockcharts.com).

The GDX (NYSE:GDX) ETF was down by 13 cents which is next to nothing. The volume was rather average and the entire session was yet another day of a post-decline pause.

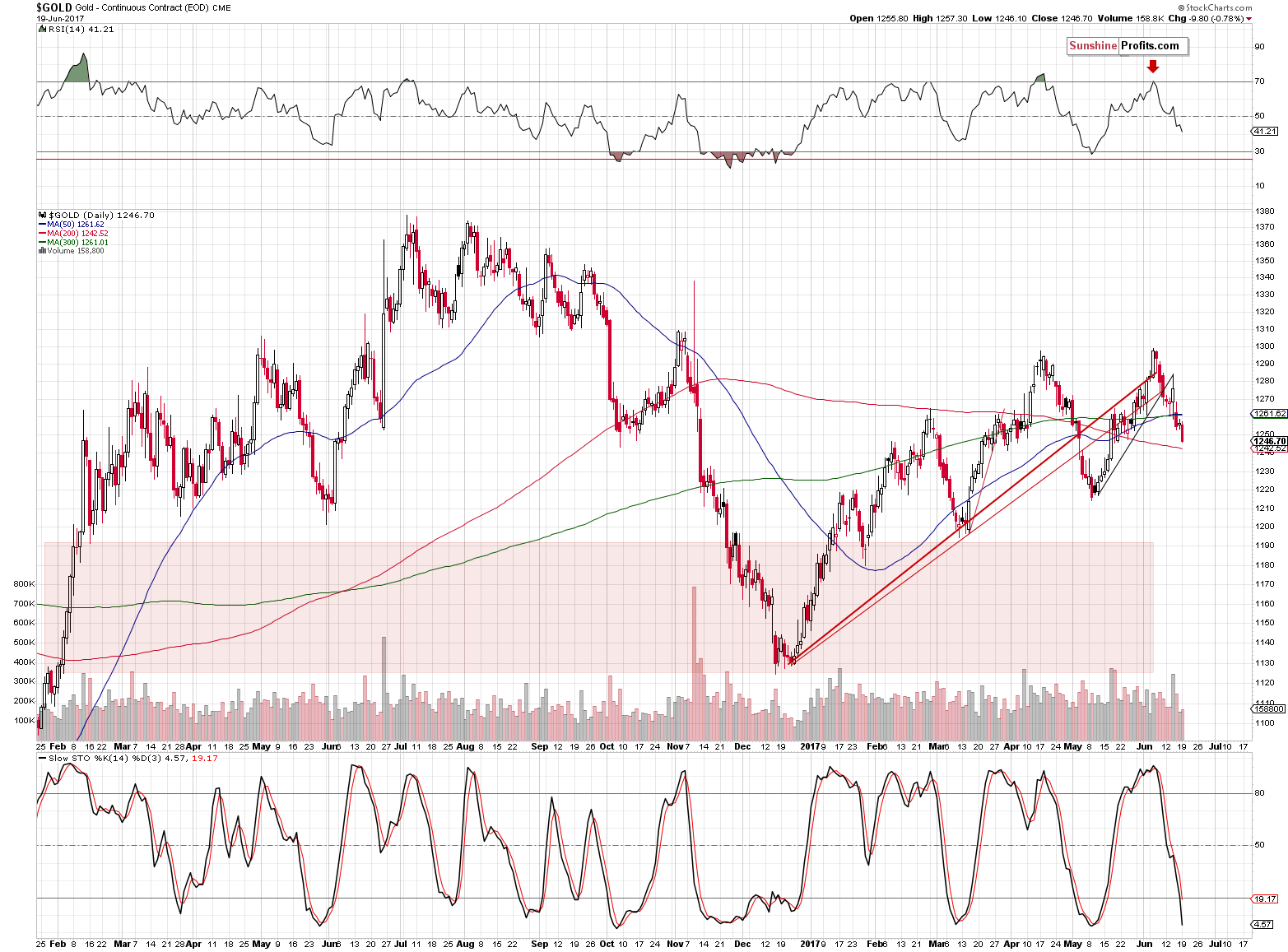

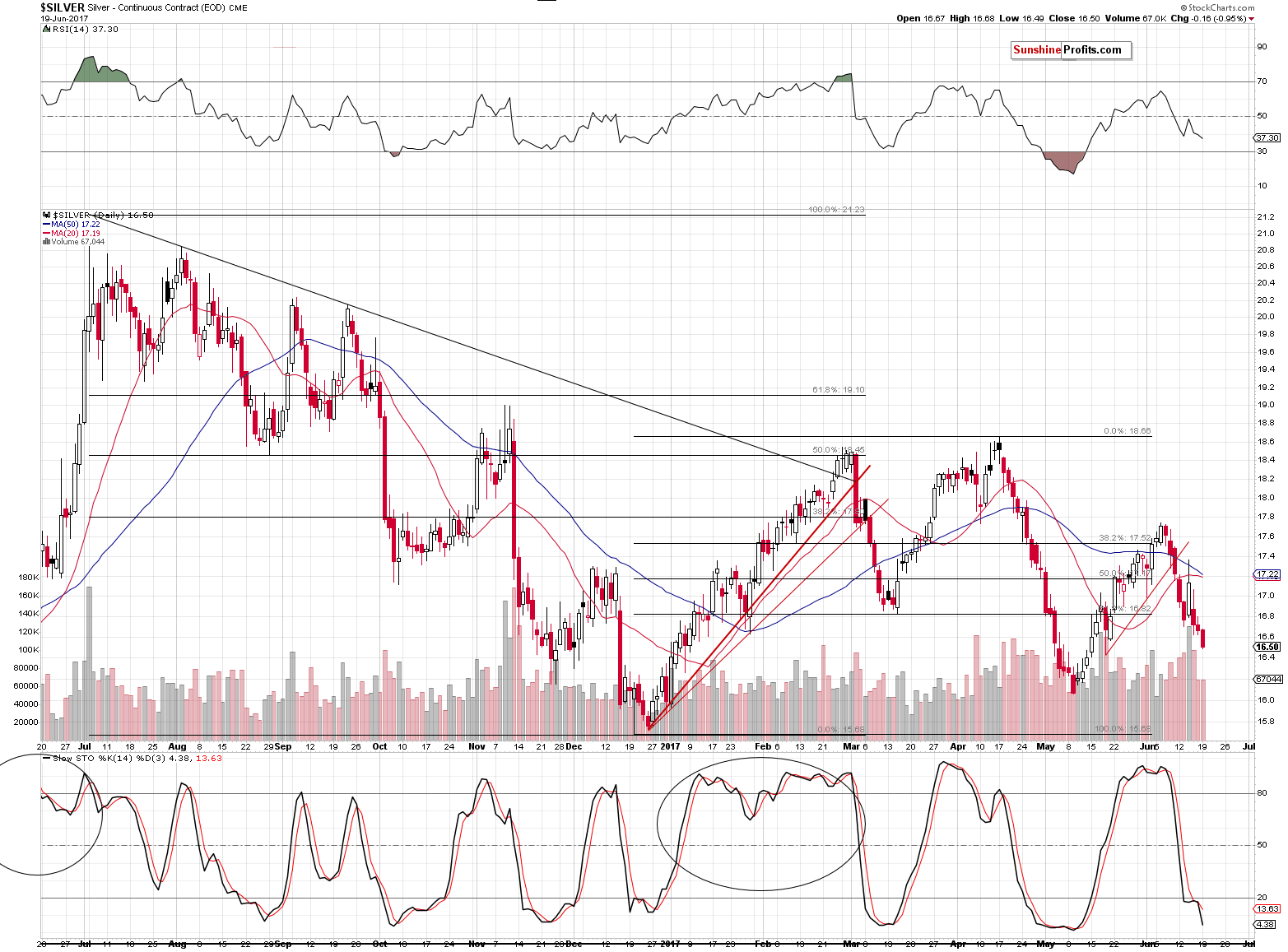

Gold and silver both declined quite visibly, so the pause in mining stocks is no longer neutral by itself – it might appear bullish as the miners’ lack of decline despite gold and silver’s declines means that the former outperformed.

Likely Reason Behind Miners’ Strength

The action in the S&P 500 Index, however, makes the action in mining stocks neutral once again. The broad market moved sharply higher to new highs, which is both: important and very visible. Consequently, it’s no wonder that this tide lifted also the boat with mining stocks and the miners’ “strength” is therefore not a true sign of strength. This, in turn, means that there are generally no bullish implications of the mining stocks’ lack of decline, despite it might look so at first sight.