As we approach only the second Fed rate hike in a decade, bond traders took bond yields higher, as not only do they view a Fed hike as certain, but continue to increase their bearish positions by sounding the inflation alarm bell as the UST 10-year rose to 2.48, the highest close since June last year. However, interestingly enough the surge in the long-term US yields was little deterrent to the equity markets, which saw the S&P post another record day on Friday.

Underpinning the move on US Treasuries, was Friday’s China’s inflation reports that were remarkably robust with the PPI rising 1.5% mom/3.3% yoy – which clocks the fastest pace of annual inflation seen since Q4 2011.The CPI increased 0.1 % mom/2.3% yoy, the highest since early Q1 2014. Indeed, the robust China CPI and PPI cemented the global reflationary trade, and Bond and Forex markets were quick to respond

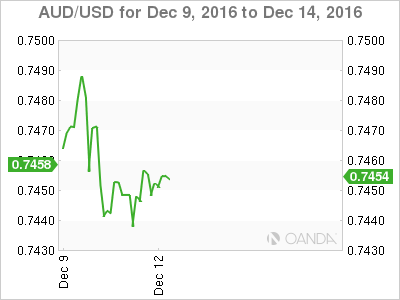

Australian Dollar

Aussie dollar remains mired in the middle of the current short-term range .74-.75 ranges as traders will likely express little interest until a convincing break of .7375 -.7535 range. Last week’s depressingly eye-watering Australian GDP print remains counterbalanced by the surge in China imports and the buoyant Mainland inflationary prints, and the negative impact of rising US interest rates remains temporarily neutralized by commodity prices, specifically iron ore which breached the psychological $80.00 per ton level last week.

While much of the momentum is on the heels of “Mainland” speculators, and despite regulators clamping down, there appears little to curb this voracious appetite for fast and ready money in the Dalian pits rules the day. Also, with global equity markets surging, there is still a huge appetite for Australian growth differentials, which continues to whet investor appetite.

The Australian dollar continues to struggle above .7500 against broader USD strength and while exhibiting little if any trend of late, the Aussie is certainly not the flavor of the day when it comes to currency trading. Not much interest or excitement today with all the action occurring on the EUR and JPY. Nonetheless, no time to get too complacent as we could be in for frenzied activity given this will likely be the last major trading week for 2016

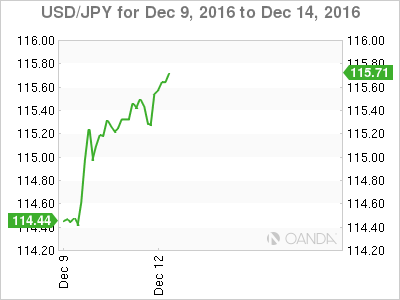

Japanese Yen

With a 25bp Fed, hike priced in expect the USD to remain well supported unless, of course some, odd policy signals are offered by the Feds. While strangers things have happened, it is highly unlikely they will throw a curve ball and the current trend in UST’s, and the USD should remain intact.

USD/JPY continues to rally impressively as the market took direction from surging bond yields as the divergent UST and JGB yields remain the primer for this trade. However, The FOMC is the most important event for the yen and will likely solidify the current USD move and set the stage for further USD appreciation in early 2017.

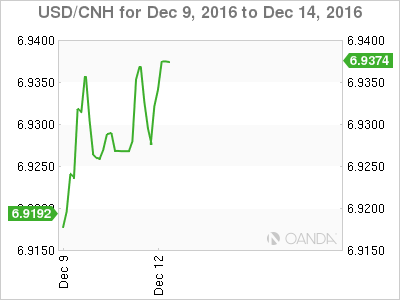

Chinese Yuan

The surging USD is causing a headache for the PBOC. While dipping into the Reserve Cookie Jar provides a short term fix, mind you at considerable expense, the Chinese continue to view US investments more attractive, leaving the PBOC struggling to stem the waves of capital outflow.

With the USD expected to strengthen into year end, the feedback look accelerates leaving the PBOC with little option to burn through reserves to stem the tide. Moreover, while I suspect the recent measures to curb loopholes in captial outflow will turn the tide for the depreciating yuan, the problems is these capital control curbs will likely accelerate in 2017

Trading volumes on the yuan picked up into week's end as the global reflationary trade took hold.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.