In my experience as an investment advisor and student of the markets, investors are always concerned about the “why” on the way down. They MUST know exactly what caused a specific drop in the market and what could potentially curb that price action. Yet for some reason, that same level of scrutiny doesn’t apply on the way higher.

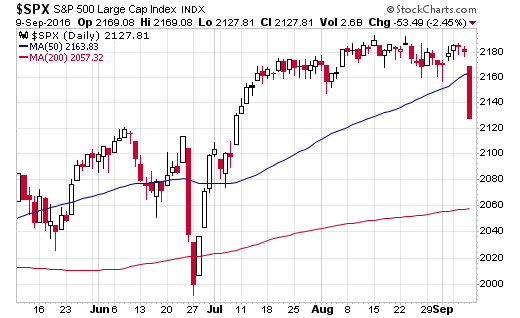

Take Friday for instance. Coming into this big one-day drop, the S&P 500 Index was trading in one of the narrowest ranges in recent history. This period of minimal price action and slow upward trajectory caused a great deal of complacency. Even technical indicators such as the famed bollinger bands were compressed to a historically tight level. Then suddenly, an explosion of relentless selling caught everyone off guard.

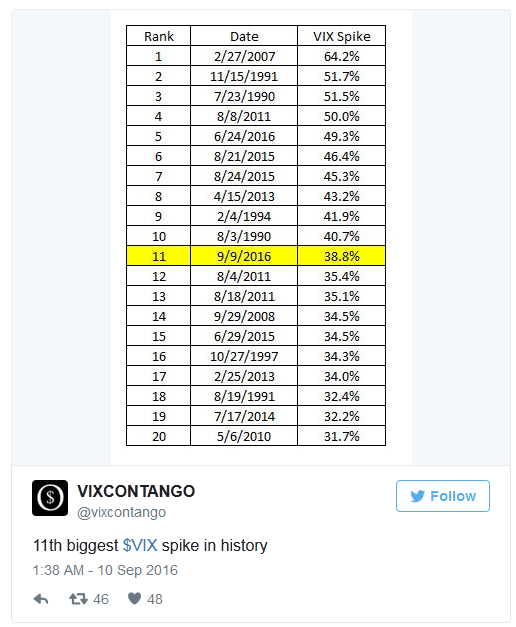

For those who like tracking volatility in historical terms, that one-day move was the 11th largest jump ever recorded on the CBOE VIX Volatility Index (VIX).

I received calls, texts, and emails asking about what precipitated this type of selling. Everyone wants an answer and they want it right now.

Was it caused by reports of nuclear tests in North Korea? Was it driven by rhetoric from members of the Federal Reserve? Was it a hedge fund blowing up or some other liquidation event?

The truth is that no one knows for certain and any jawboning is a mixture of speculation and conjecture. Logic tells us that there were a much greater number of seller than buyers, but that doesn’t sound good on TV. It’s too simplistic. Doesn’t drive any headlines. The collective actions of millions of investors must be interpreted with conviction!

Even if you knew with exact certainty what drove the one-day price action of hundreds of stocks, what would you do with that information? Would it influence any real investment action on your part? Would it give you an edge over your peers or enhance your returns?

Sometimes there is no readily available narrative. Things just happen because they happen. You can’t spend your day worrying about every little blip and what it means to the sanctity of your portfolio. If you do, then you are headed for an emotionally-charged mistake that you will likely regret down the line.

In my experience, knowing the “why” is rarely profitable and can’t be determined with any accuracy. Price is the ultimate arbiter of reality. Everything else is just opinion.

I would instead urge investors to focus on the qualities of their portfolio that they can control. These aspects include: security selection, position sizing, asset allocation, risk mechanisms (i.e. stop losses), and emotional fortitude. If you are properly prepared, then any actions (or lack thereof) should just be automatic.

The bottom line is that sticking with any investment strategy takes a high degree of discipline and time to achieve satisfactory results. It will often be tested by periods of under performance or scary price action that can usher in uncertainty. Nevertheless, you can’t let speculation or outside forces beyond your control lead to weakening resolve. Trust in your process and the results will follow.

Disclosure : FMD Capital Management, its executives, and/or its clients June hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.