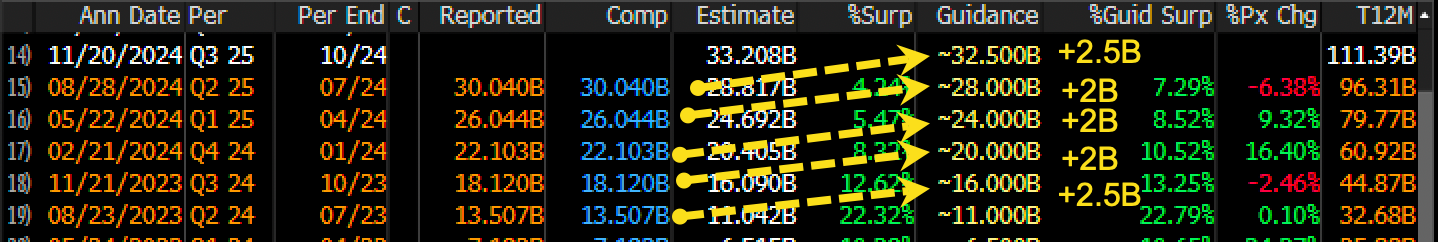

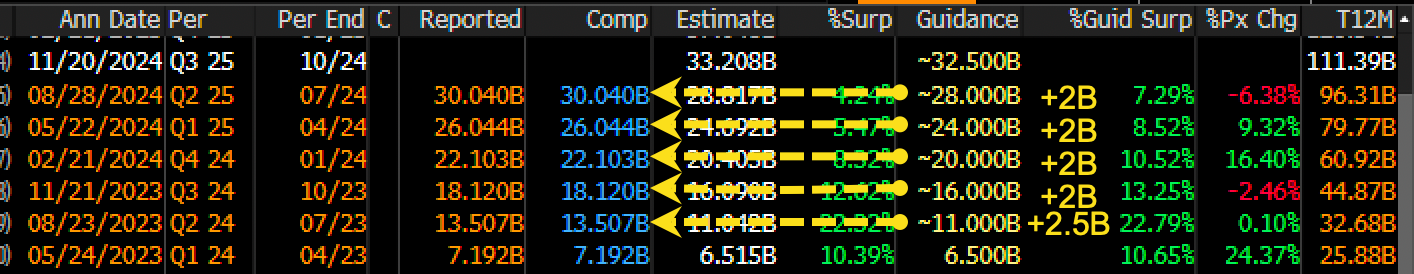

This week is all about Nvidia (NASDAQ:NVDA), as the market anticipates the company’s fiscal third-quarter results. The biggest question is whether the AI giant will continue beating expectations by $2 billion and raising guidance by an additional $2 billion, or will it present something new?

If Nvidia delivers another ‘2-and-2’ quarter—beating expectations and raising guidance by $2 billion each—it may not suffice this time, as the market likely already anticipates this move. Isn’t that quite apparent? Given these expectations, I predict they will report revenue of $34.5 billion and forecast $36.5 to $37 billion.

The introduction of the new Blackwell chip could potentially disrupt this pattern, but that remains to be seen.

It’s not entirely clear what’s behind Nvidia’s revenue pattern, though it may be related to how new supply is introduced to the market compared to existing orders. Unless the company unexpectedly guides next quarter’s revenue to between $38 and $40 billion, there’s little room for an upside surprise.

This could explain why the stock has been mostly range-bound since mid-June, moving within a rising wedge pattern. A break below $140 would likely be bad news not only for Nvidia but for the entire market as well.

The entire semiconductor sector appears to be struggling currently, with the SMH (Semiconductor ETF) trading at the lower end of its own rising wedge pattern and on the verge of breaking down.

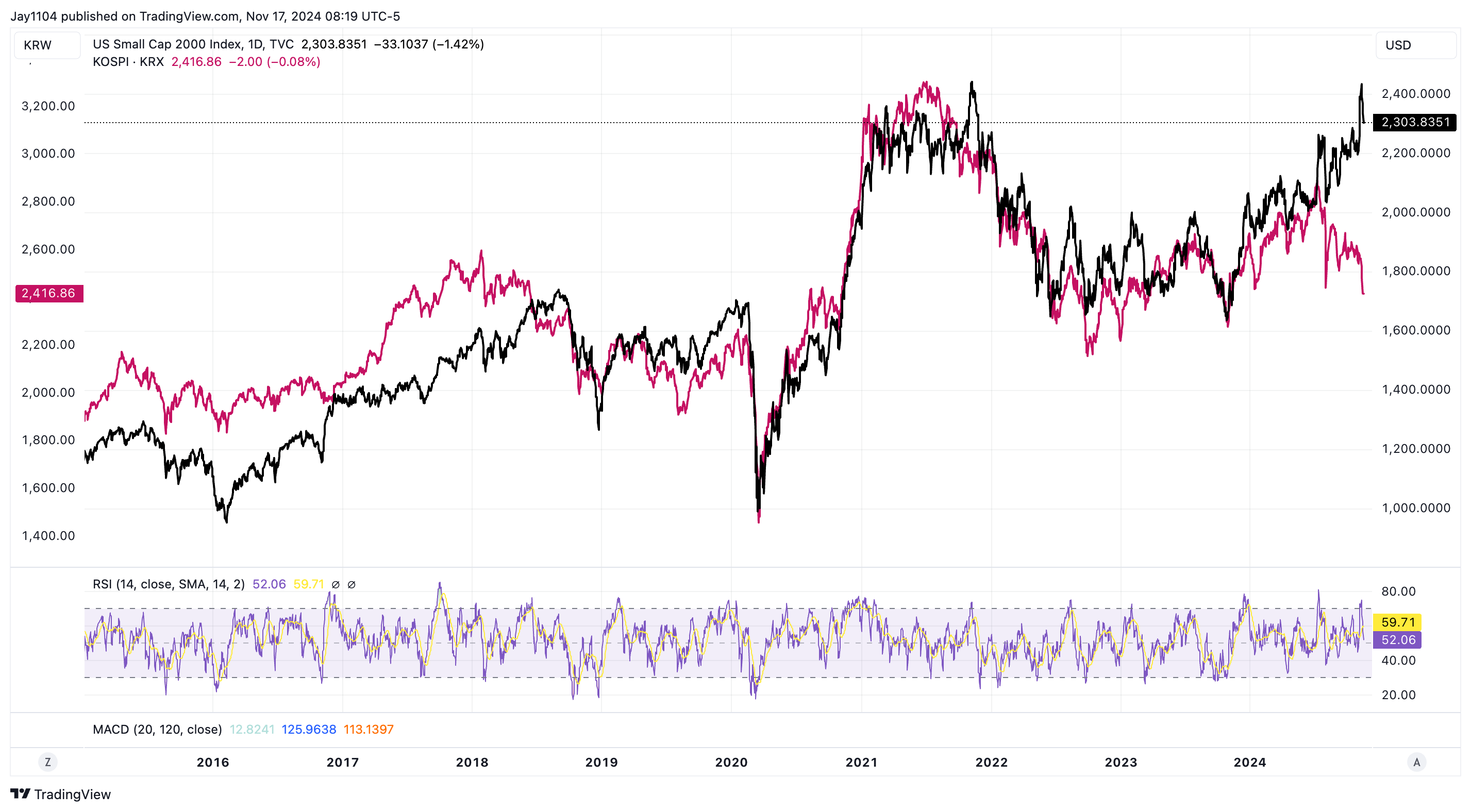

Small caps took a hit on Friday, and trends in the South Korea KOSPI suggest that the Russell 2000 is relinquishing its post-election gains. The Kospi’s performance has been dismal, showing a steady decline recently. This indicates that the rally in the Russell is unlikely to persist.

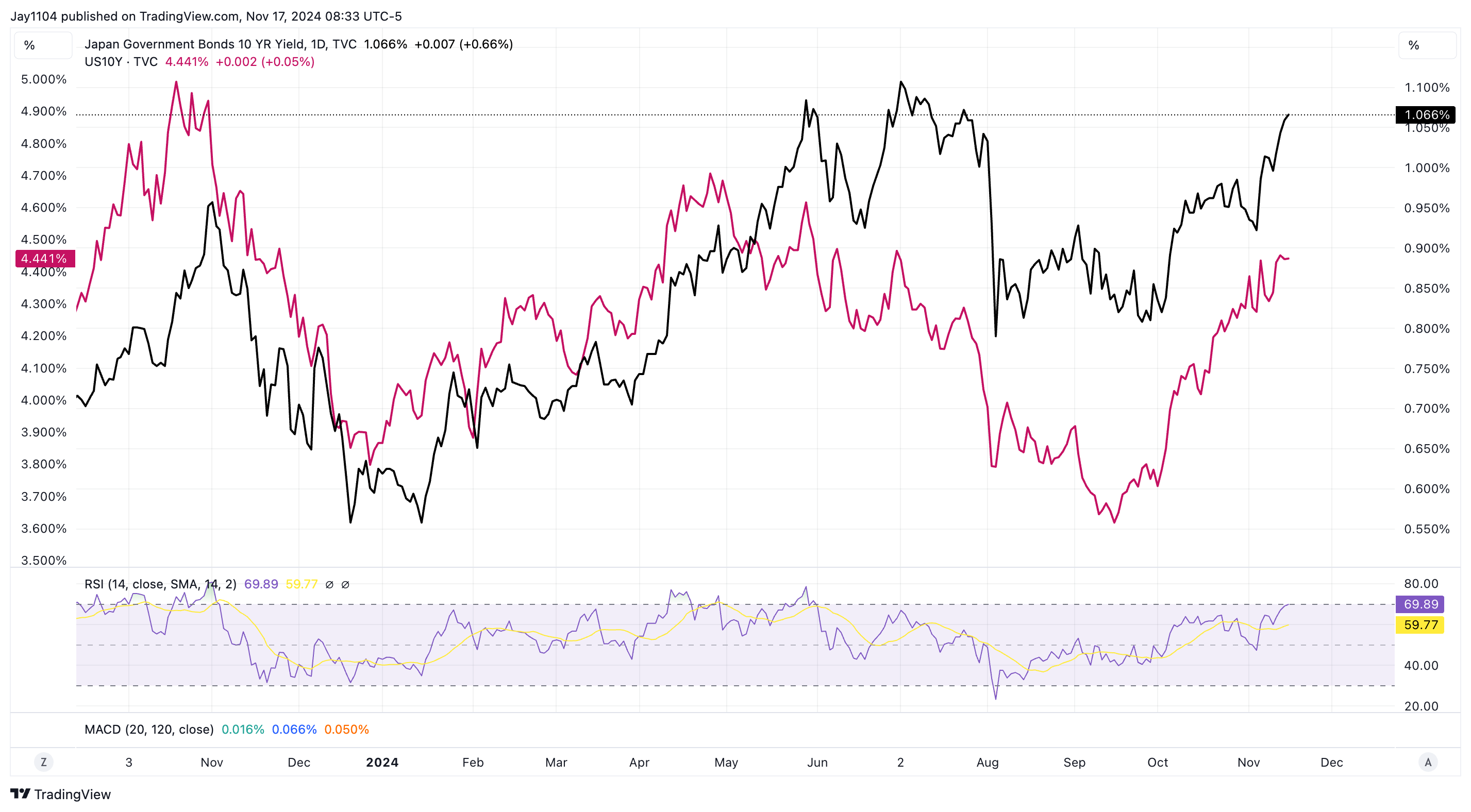

In the meantime, US rates continue to rise, with the 10-year closing this week at 4.44%—its highest close since June. The uptrend seems driven by several factors. First, there’s a rising term premium, as investors demand more return for holding longer-duration bonds. Additionally, concerns about inflation are escalating, as evidenced by the upward movement in inflation swaps.

Another contributing factor is the recent increase in the Japanese 10-year JGB yield, which has risen from approximately 0.80% to about 1.06%. This surge reflects market anticipation of a potential Bank of Japan rate hike as soon as December.

Similarly, British United Kingdom 10-Year have climbed from approximately 3.75% to 4.46% over the same period. This indicates that the rise in US rates is part of a broader global trend, not an isolated phenomenon in the US alone.

Of course, the key question is whether rising rates will adversely impact the stock market, and whether Nvidia can save it. Perhaps a more pertinent question is not if Nvidia will save the market, but whether Nvidia could be the catalyst for its decline, with rising rates exacerbating the situation.

The answer is likely to be Yes.