Friday was an interesting day — and not unexpected, given it was quarterly OPEX. The session wasn’t as strong as it may have seemed, considering the sharp drop at the open, followed by a steady rally throughout the day, capped off by a strong finish in the final 10 minutes. That end-of-day spike was driven by a market-on-close buy imbalance of nearly $4 billion on the SPX, which isn’t unusual on OPEX days.

Another noteworthy development was that the S&P 500 avoided a fifth straight week of losses. I noted last week how rare such a streak is, and the index was due for a bounce on that factor alone. However, the index was unable to reclaim its lower Bollinger Band — a clear sign of how weak the rally attempt was.

The 10-day exponential moving average continues to act as resistance, just as it has since the downtrend began. When you take these basic technical factors into account, it suggests to me that the move lower may not be finished — at least not until we see the index close above that exponential moving average for at least two consecutive days.

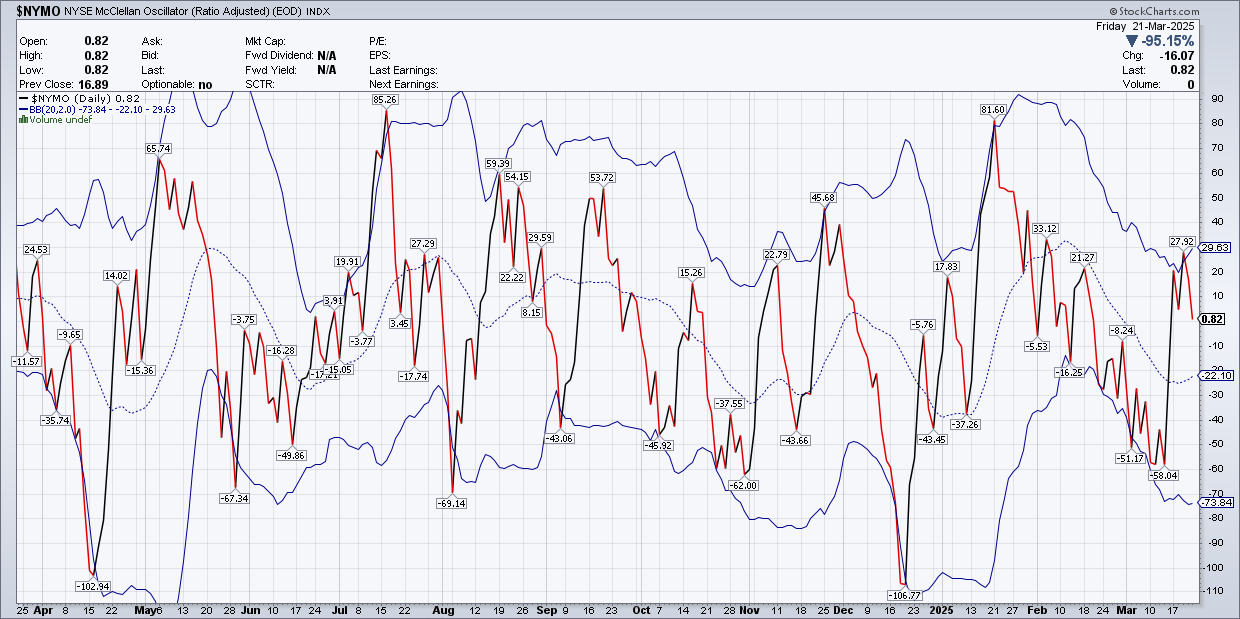

Additionally, breadth on Friday was weak, with 796 more decliners than advancers — pushing the NYSE McClellan Oscillator (NYMO) back to the zero line. NYMO also moved above its upper Bollinger Band on Wednesday, then crossed below it on Thursday and continued lower on Friday — typically a short-term sell signal.

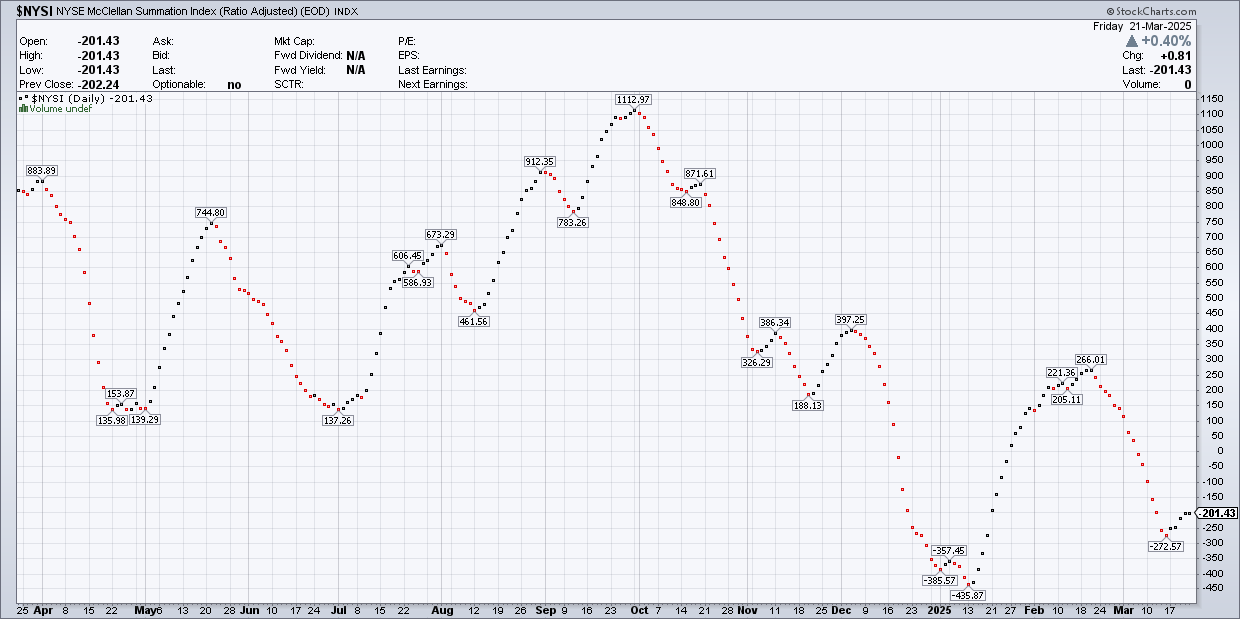

The Summation Index also shows that this recent rally lacked the velocity to indicate anything more than a pause in a broader downtrend.

On the funding side, equity financing costs continue to fall. The BTIC S&P 500 Total Return Futures for December 2025 dropped to 58 basis points on Friday — its lowest level since May. It’s not a perfect indicator (nothing is), but it’s pretty good at identifying peaks, troughs, and turning points — just as it did back in December. The further it falls, the more likely it is that the declines in the index aren’t over.

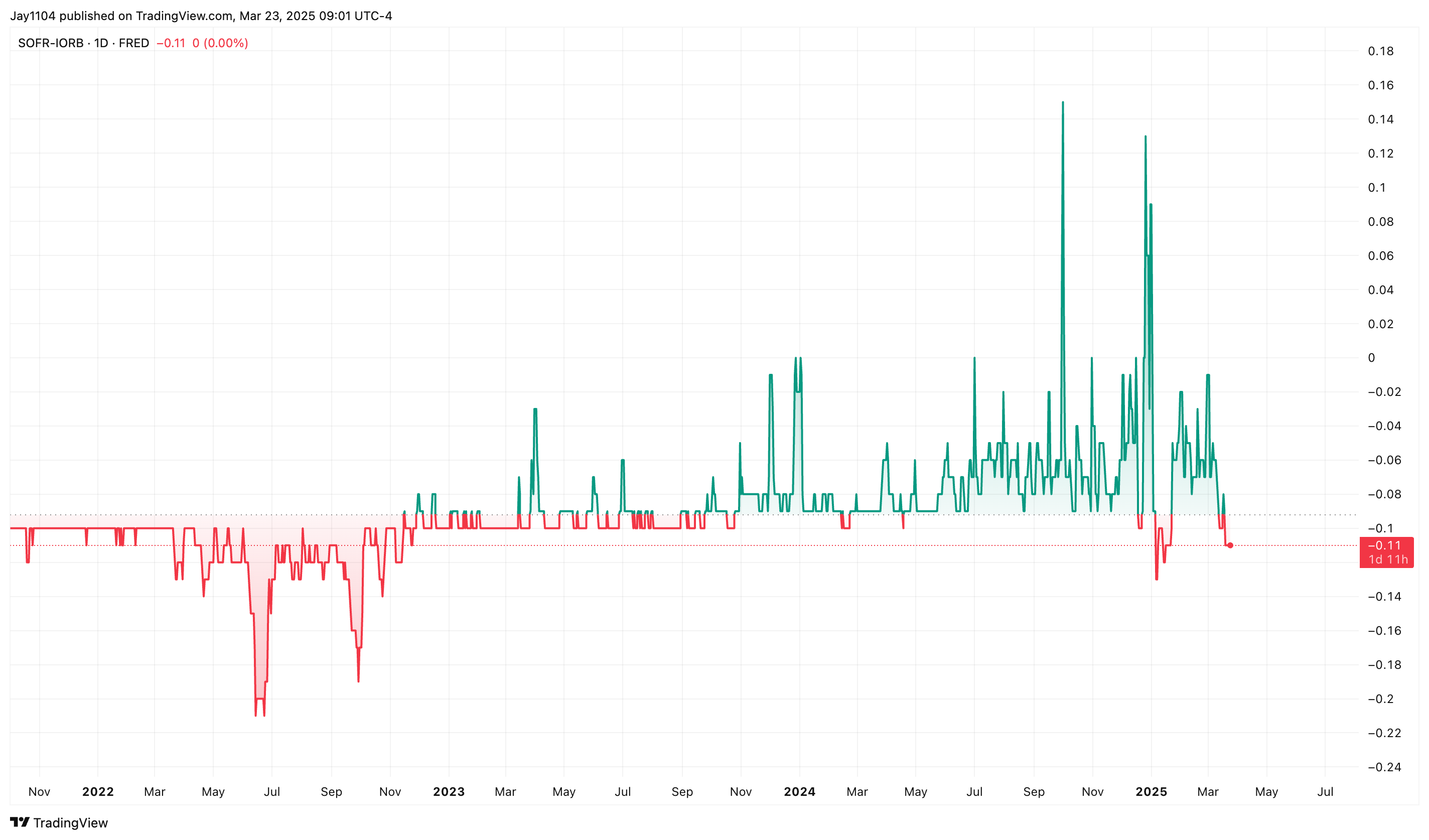

We’ve also recently seen the Secured Overnight Financing Rate (SOFR) fall 11 basis points below the Interest on Reserve Balances (IORB) rate. That’s a significant drop, suggesting the overnight funding market is flush with cash and that demand for borrowing is limited — similar to what we saw throughout much of 2022.

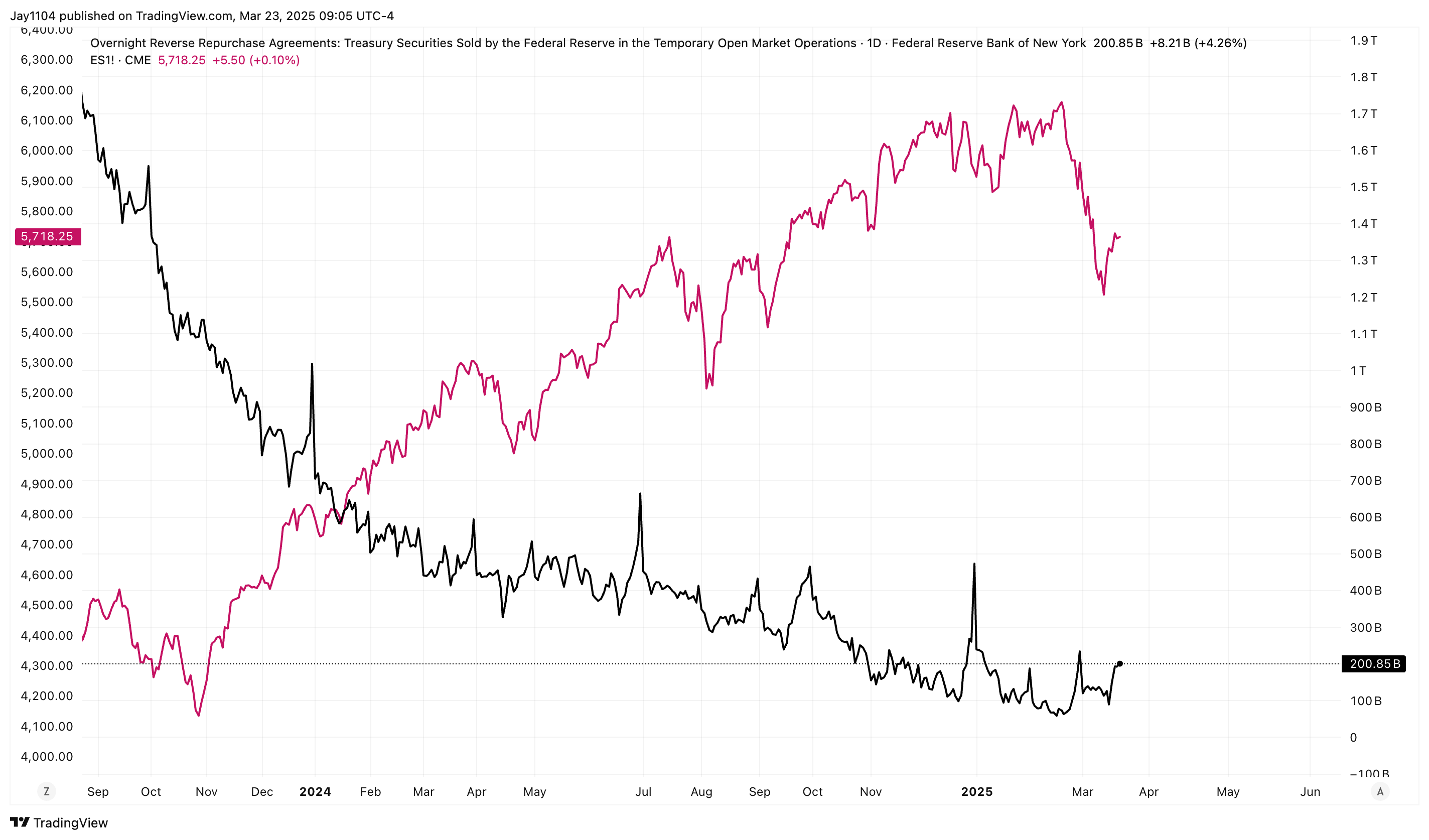

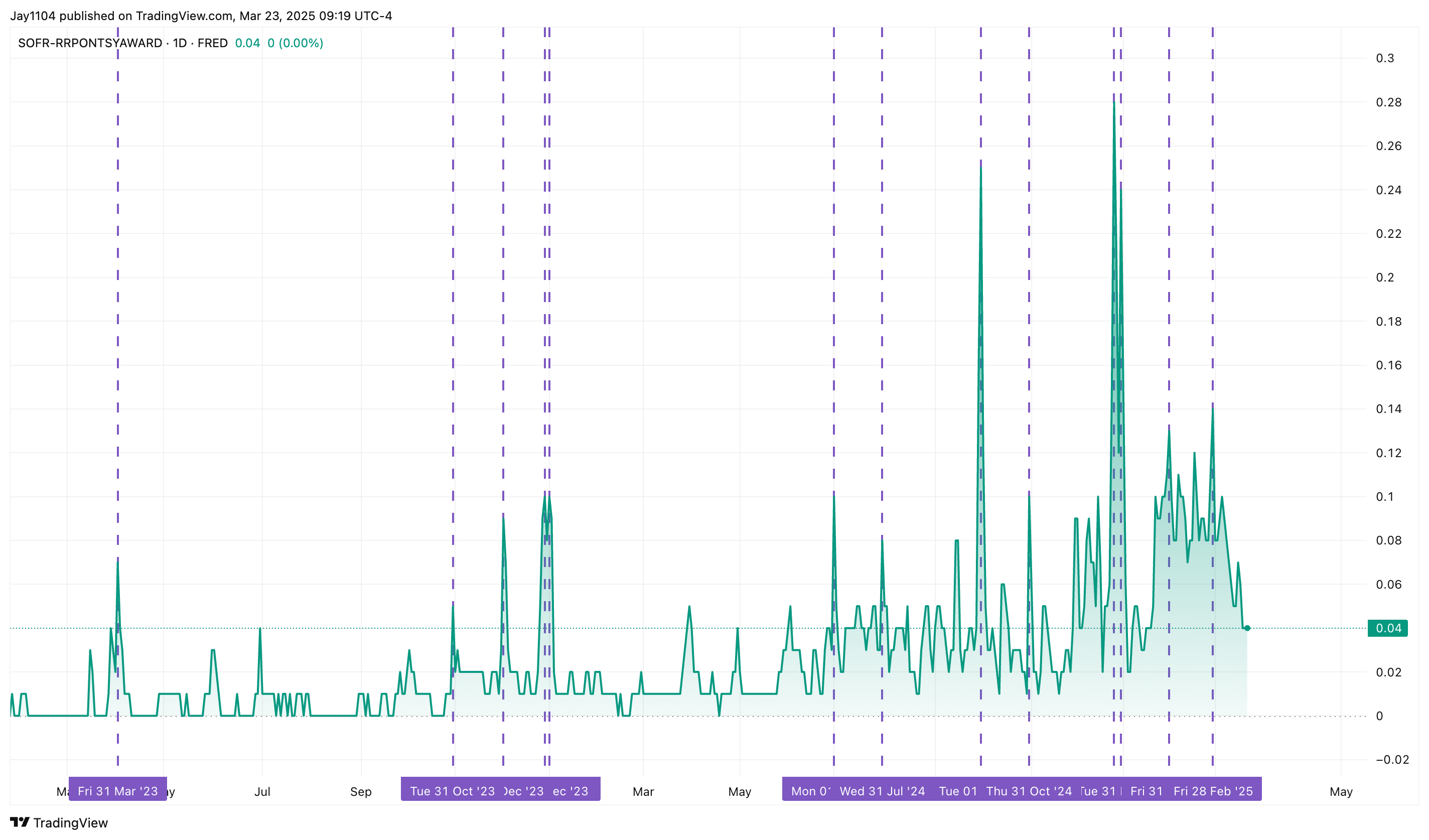

At the same time, usage of the Fed’s reverse repo facility has started to rise again. In fact, SOFR relative to the RRP rate has been falling, which suggests investors — particularly money market funds — are increasingly choosing to park cash with the Fed rather than lend it in the repo market.

This, combined with the drop in SOFR relative to both IORB and the reverse repo rate, suggests that risk is being pulled out of equities and redirected into safer, more liquid assets.

Some of this could be tied to quarter-end, but to be honest, we don’t usually see this behavior begin so early. In fact, SOFR rates typically rise into quarter-end as liquidity tightens — not fall.

All of this really speaks to me of leverage and margin being yanked out of the market. And it’s not likely to improve in the days ahead — it may actually get a bit worse, especially if the reverse repo facility usage continues to climb into March 31.

We’ll see what happens between now and then. But stay alert to the “plumbing” of the market — it matters, especially in a highly levered environment.