Stock markets around the world have been on a downhill slide this month with no end in sight. Top economists and traders have been sounding the alarm for months on an economic downturn. Well known fund managers and investors such as Ray Dalio and Byron Wien have also expressed concern over mounting recessionary risk. Dalio — one of the world’s 100 wealthiest individuals and the founder of investment firm Bridgewater Associates which is one of the world’s largest hedge funds — recently outlined for Business Insider his next recession scenario, comparing conditions to the Great Depression era. And Wien — “the vice chairman of Blackstone’s private wealth solutions group — mentions that people are ill-equipped to handle the meltdown,” just like last time in 2008.

According to a recent New York Times survey, Opens a New Window, almost half of all 134 CEOs polled believe that the U.S. will be in a recession by the end of next year. With 2 out of 3 of these leaders citing U.S. political instability and trade negotiations as the major triggers, while 17% point to the national debt as a big cause for concern. Additionally, 86% are worried about the growing market instability in Europe. All of these uncertainties are to blame for the recent volatility we are seeing the financial markets.

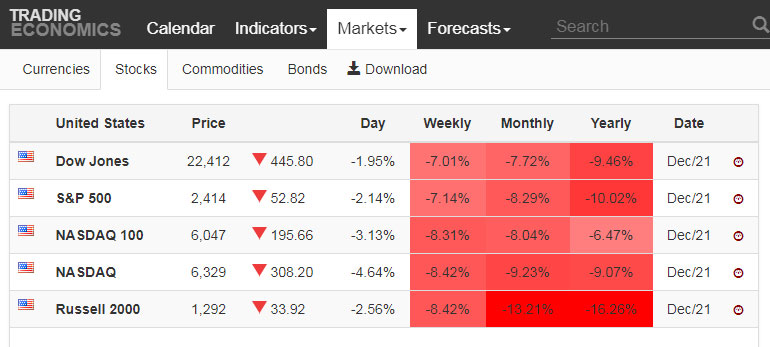

According to Trading Economics, all major stock indexes in the U.S. are down significantly so far this year. The last few months of stock market declines have completely wiped out any gains made earlier in the year. There will always be risks in the markets and economy, but that doesn’t mean investors should be concerned about the future.

Despite the negative news in today’s media headlines, there is a silver lining to all of this. If we look at history, we can see that while it is almost impossible to predict when a financial crisis will occur, we can do a lot to prepare for one. When you have nearly 10 years of financial growth, it shouldn’t be a surprise when the trend suddenly reverses. That’s why it’s always a good idea to maintain a recession resistant financial plan. The good news is it’s not hard to create one.

Instead of choosing stocks that are largely recession proof, the best way to protect ourselves from a falling stock market is to own other types of investments such as bonds, precious metals, or prime real estate. Continuing to earn a steady stream of income also helps bolster one’s financial situation. For example, I have various investments spread across Canada and the U.S. and only 33% of my assets are in the North American stock market. Despite the overall S&P 500 index falling 10% year to date, my personal net worth is actually up 5% so far in 2018. Even though the stock market is falling other assets such as my farmland, private loans, and apartment have gone up in value.

Stocks should always have a part in our portfolio, but they shouldn’t be the only thing in there. I believe there is still time to prepare before the brunt of the next recession hits. Based on the recent economic data such as unemployment rate and inflation, I expect the U.S. stock market will remain relatively flat going into next month. We may even see a small bounce in January. However, by mid 2019 all the rate hikes by the Federal Reserve will be felt more in people’s wallets as their mortgage interest rates are going to be higher. Around that time Wall Street will become very concerned and that’s likely when we’ll see a major sell off in the stock market. In the meantime I am continuing to pay down debts, saving up cash, and looking at purchasing more bonds.