Investing.com’s stocks of the week

Stocks finished the day (Monday) flat, with volume levels that continue to underwhelm. The S&P 500 finished the day at 4,128, and the Invesco QQQ Trust (NASDAQ:QQQ) finished around $336.70.

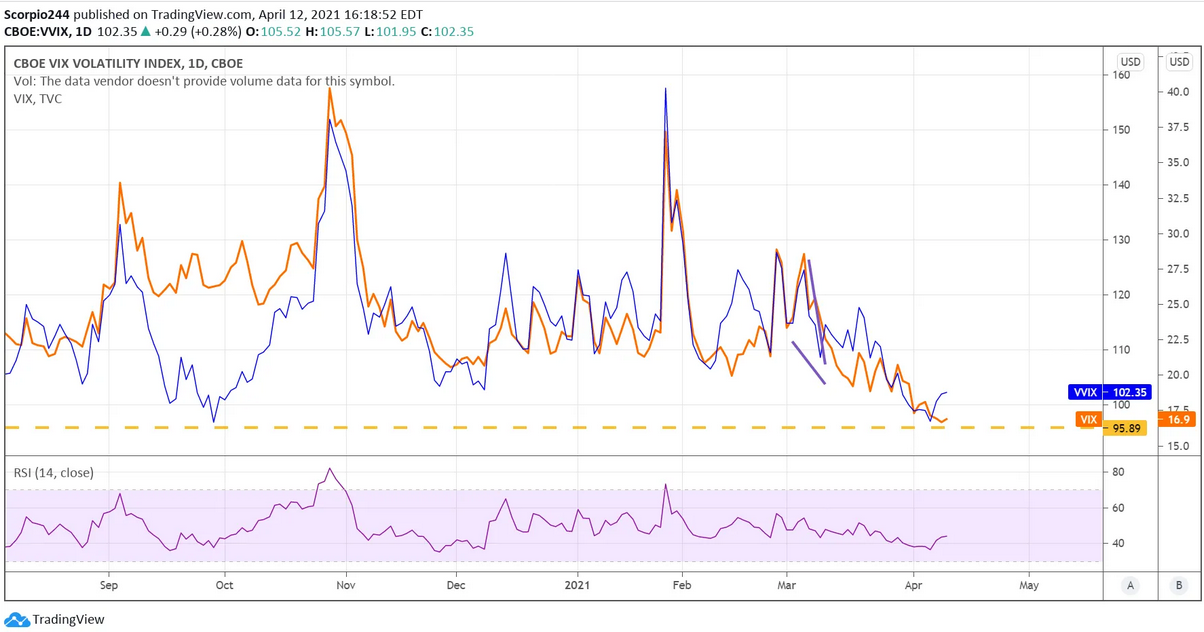

But what was kind of surprising, despite a very tight trading range, was the CBOE VIX Volatility Index, which rose for the third day in a row. We need to take note of this because it typically proceeds a move higher in the VIX index, which we know has an inverse relationship with the S&P 500.

Biotech

Additionally, our risk-on indicator, the SPDR® S&P Biotech ETF (NYSE:XBI), continues to trade badly. The ETF closed Monday, just above support, with rising volume and falling RSI. This tells me the ETF is likely going lower, which is likely to be bad news for the equity market’s overall health.

10-Year

Meanwhile, the iShares 7-10 Year Treasury Bond ETF (NASDAQ:IEF) looked as though it was getting ready to take its next major leg higher, with the potential to push towards 1.95%.

NVIDIA

NVIDIA (NASDAQ:NVDA) had a good day, though, rising by 5.6% after it said that first-quarter revenue was tracking ahead of guidance and said it would begin to produce CPUs for the data center.

The stock finally made it through $575, but I will be curious to see what happens. The deal for ARM is still dilutive to holders since it will give Softbank (OTC:SFTBY) a huge stake in the stock. Additionally, the stock is already overbought, so the timing of this news doesn’t seem ideal. It probably means the stock will struggle to move higher from here.

Advanced Micro Devices

Good news for NVIDIA can sometimes spell bad news for Advanced Micro Devices (NASDAQ:AMD), and bad news was the case yesterday for AMD. AMD fell 5% and moved below $80 again. I still think this stock trades sub $70. The trends still point lower.

Intel

Intel (NASDAQ:INTC) also got hit pretty hard on Monday. The stock hit resistance near $69, and the NVIDIA news sent Intel sharply lower; I guess it was perfect time. Intel needs to hold support at $65.40 because if it can’t, it will likely fall to $59.75.

Ok, have a good Tuesday; I won’t be around, but I will be back on Wednesday.