Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

S&P 500 (SPY)

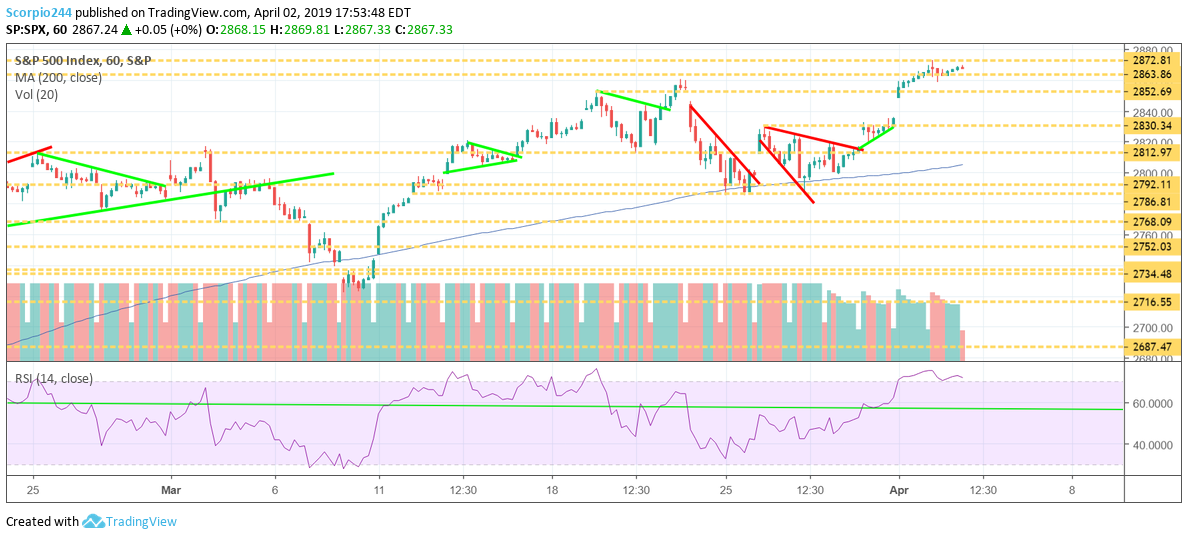

The S&P 500 held on to yesterday’s gains finishing the day flat. This was a relatively good scenario if you ask me. At this point it keeps momentum rising, and 2,872 as the next significant level of resistance to get over.

The RSI is suggesting there is still plenty more room for the index to continue to rise. We could get some data tomorrow that fuels that increase in the ADP private payroll number. We shall have to wait and see what the overnight session brings us.

Housing (HGX)

HGX broke out and I think it is getting ready to move higher towards 315. That is a good sign for the broader market as well.

Apple (AAPL)

Apple Inc (NASDAQ:AAPL) is slowly rising and once again testing resistance at $195. It could be about to break out and could push the stock towards $209.

Facebook (FB)

I was focused on Facebook Inc (NASDAQ:FB) today because the stock has flirted with this level for months and failed every time. I am using $175 to confirm a breakout. I have no confidence that this stock will continue higher. Should the break out be confirmed, then a push to $186 seems like the next likely stop.

Nvidia (NVDA)

NVIDIA Corporation (NASDAQ:NVDA) is on the cusp of breaking out too. Should it get over $185.50, we can confirm the breakout and a push back to $200.

Goldman (GS)

Goldman Sachs Group Inc (NYSE:GS) is quickly approaching resistance at $200. That has been a wall for the stock since January. If the stock can break out, it has room to climb to $215. I’m just not sure that it can.

Morgan Stanley (MS)

Morgan Stanley (NYSE:MS) is also near resistance at $44.10, and a break out can see the stock rise towards $46.40.

Disclaimer: Michael Kramer owns SPY calls.