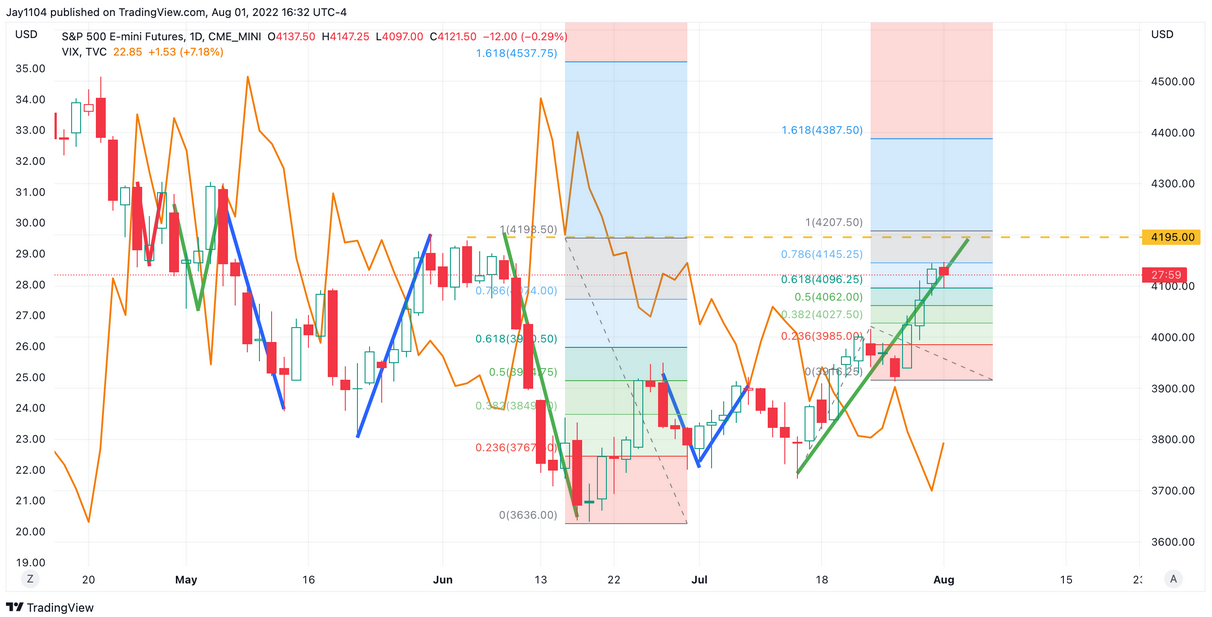

The S&P 500 finished yesterday down by around 28 bps, as investors seemed to be a little bit nervous about Nancy Pelosi’s visit to Taiwan. The index tried to rally and even managed to take out Friday’s highs, but it couldn’t hold on to those levels. Today financial conditions tightened some, with the IEF/LQD ratio moving up by 45 bps. Financial conditions have eased a lot, which has helped this market rally over the past few days and added liquidity.

But yesterday’s ISM report was better than expected and corresponded to a real GDP growth rate of 1.4%, certainly not recessionary. Additionally, the prices paid index slowed to 60 from 78.5. That is not the same as prices falling. The decline in the ISM price paid index means that prices just rose at a slower pace but are still very much rising. Inflation has not suddenly disappeared.

Additionally, Fed governors will be plentiful today I suspect they will carry an even more hawkish message than governor Kashkari, who was out all weekend, saying the market got Powell’s statement all wrong. If this is the case, financial conditions will begin to tighten again.

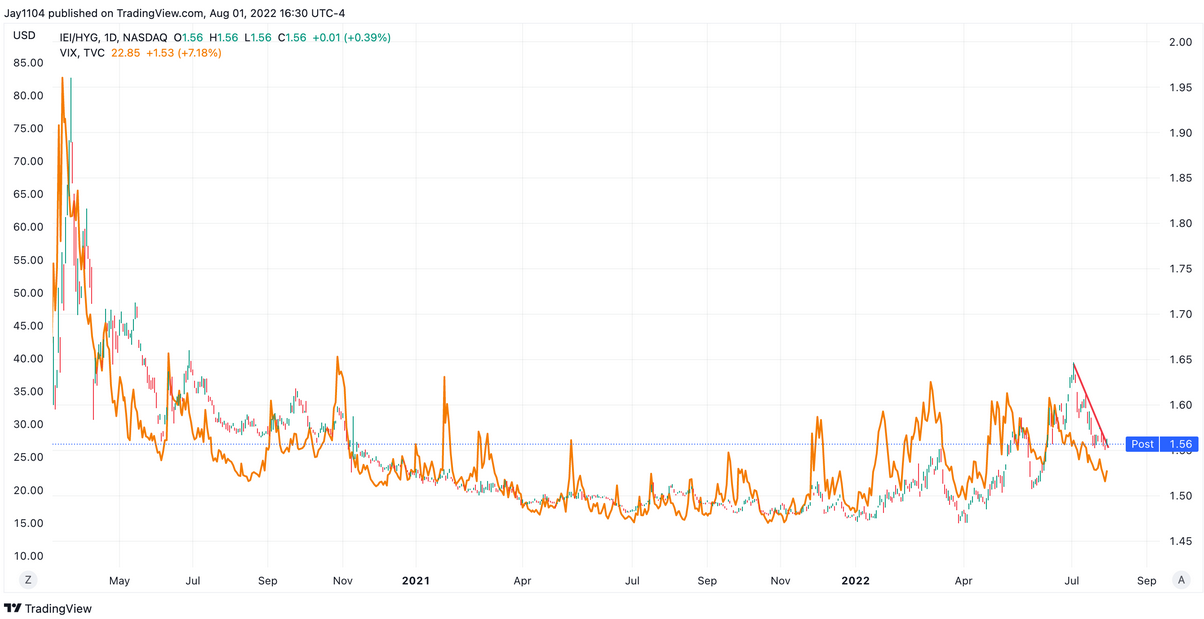

The IEI/HYG ratio is also very close to starting to move higher here.

Tightening financial conditions will lead to a higher VIX over time, which will feed into the equity market’s rally.

So, for now, the mantra remains that as long as financial conditions continue to ease and the TIP continues to rise, the stock market can continue to move higher. But as soon as financial conditions suggest the easing is over, stocks will begin to move lower again.

Yes, we could see 4,200 on the S&P 500; we could even see higher if the conditions remain favorable to stocks. However, yesterday’s ISM provides further evidence the economy is not a real recession, it is in an inflation-induced stagflation period, where prices are rising faster than growth, and that means, the Fed’s work is far from being over, and that in time financial conditions will tighten and become restrictive on the economy. The idea that the Fed is done raising rates or will pivot due to slow going is asinine. The high inflation rate is causing the negative GDP print; we are in stagflation.

XBI

Also, the XBI ETF is down nearly 2%, and this sector tends to be very sensitive to changes in credit conditions. A drop below $79 could see a decline to around $75.5. The XBI could be a leading indicator here, and if the XBI breaks, I would expect that market would break soon thereafter.

Cisco

Cisco (NASDAQ:CSCO) is not the most exciting stock, but it is in an interesting spot as it approaches resistance at $45.50 and has a big gap up to $48.5 to fill from the end of May. The RSI is strongly pushing higher and suggests that momentum is bullish.

Block

Block (NYSE:SQ) still looks strong and is consolidating below resistance at $79. The RSI is very much bullish and suggests a higher price for Block, with the potential to rise to $91.

Have a good day.