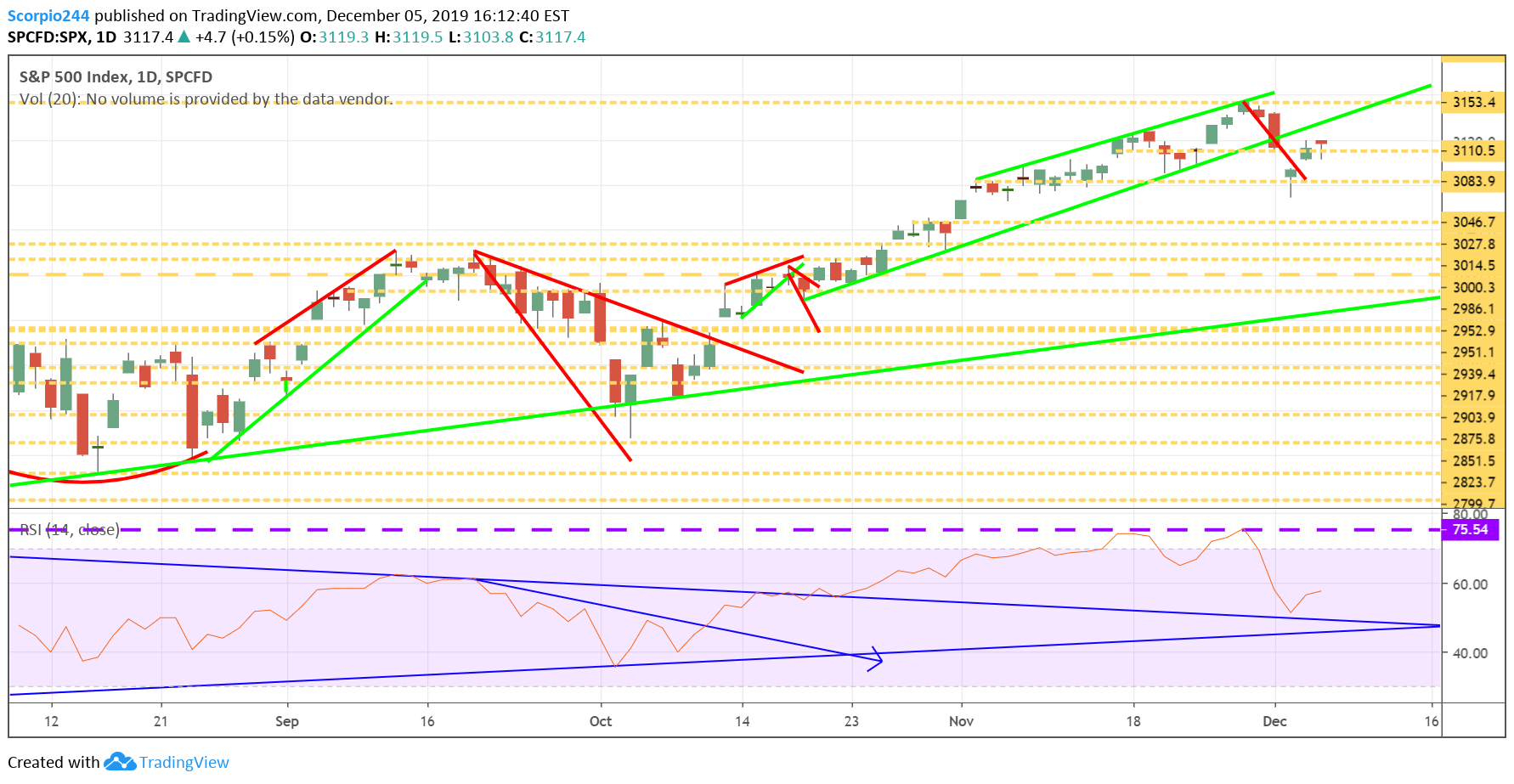

S&P 500 (SPY)

Stocks had a dull day yesterday, which is fine by me after the moves earlier this week. Now today, we get that big jobs report, which could very quickly determine just which way the market goes for the rest of the year. After it all, it was on November 1 that we got the good jobs data that sent the market ripping higher for the entire month. You probably forgot it was so long ago.

Anyway, the S&P 500 did manage to finish the day higher by about 15 bps, but it couldn’t get over 3,120. So we can see what tomorrow brings.

ACADIA (NASDAQ:ACAD)

Acadia had a great day rising by 14% to almost $51. It’s about time. Anyway, the chart is very choppy, making it extremely hard to read. That said, the stock likely has some consolidating to do in this region. Even a mild pullback to $48 seems possible. But based on the data presented last night on the Dementia-related psychosis trial, I don’t see how this doesn’t continue to climb long-term.

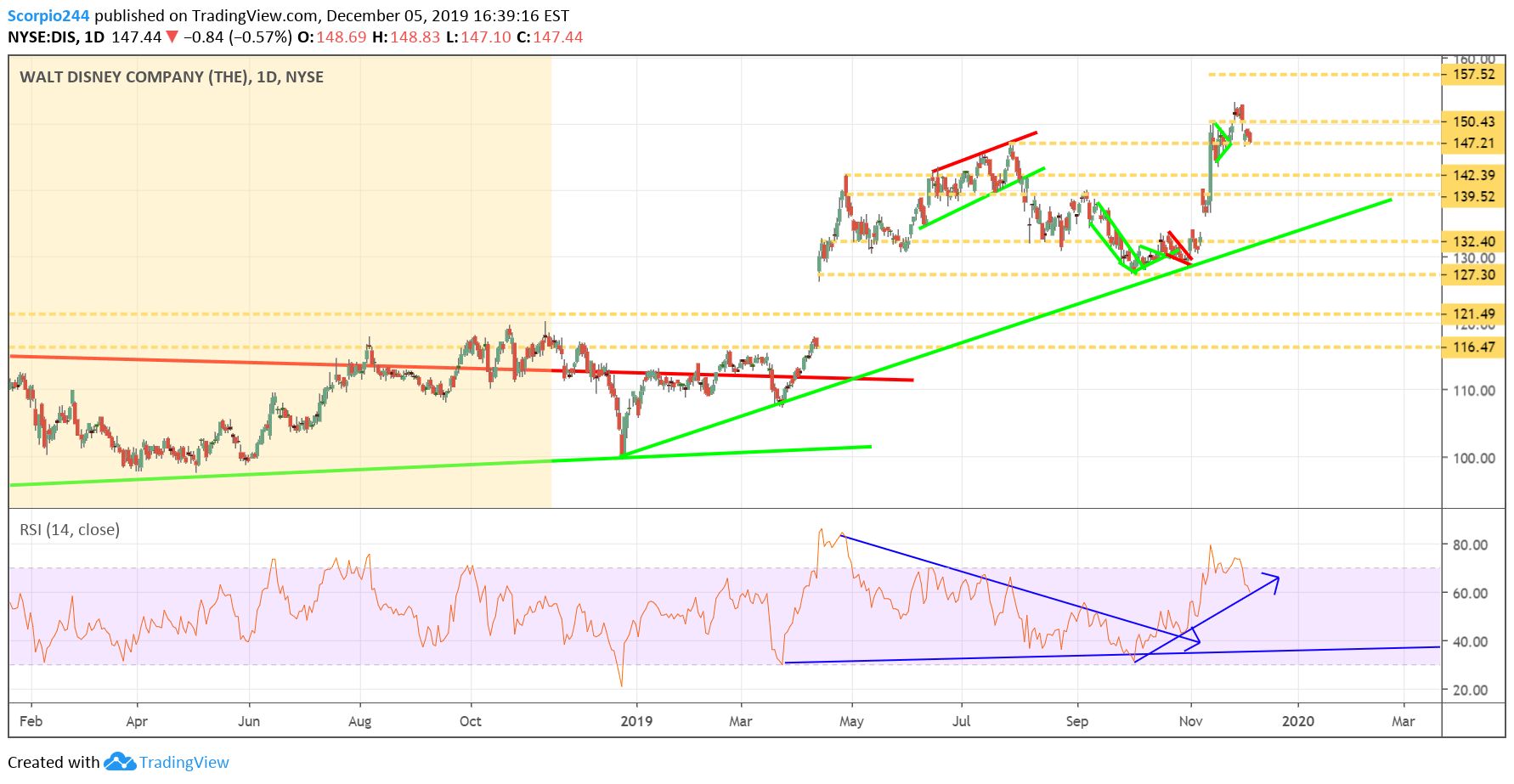

Disney (NYSE:DIS)

Disney is showing signs of a stock that may be heading to $142 over the short-term.

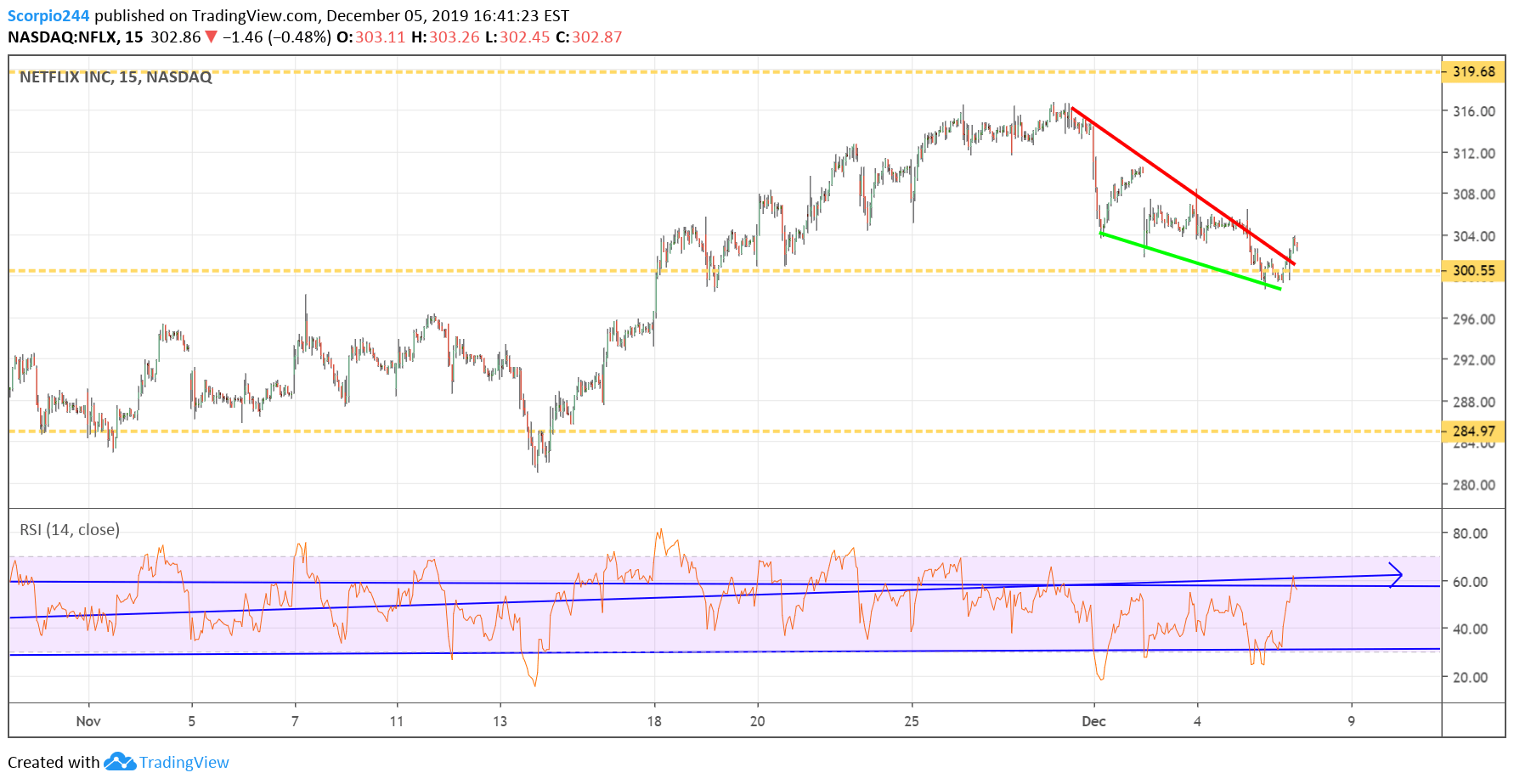

Netflix (NASDAQ:NFLX)

Netflix (NASDAQ:NFLX) tested support today at $300, and it held. Now shares appear to be forming a bullish reversal pattern, also known as a falling wedge. Perhaps it means shares reverse higher to $315.

Boeing (NYSE:BA)

Boeing (NYSE:BA) is looking pretty horrible here; look at the RSI grinding lower. I think we go back to $320.

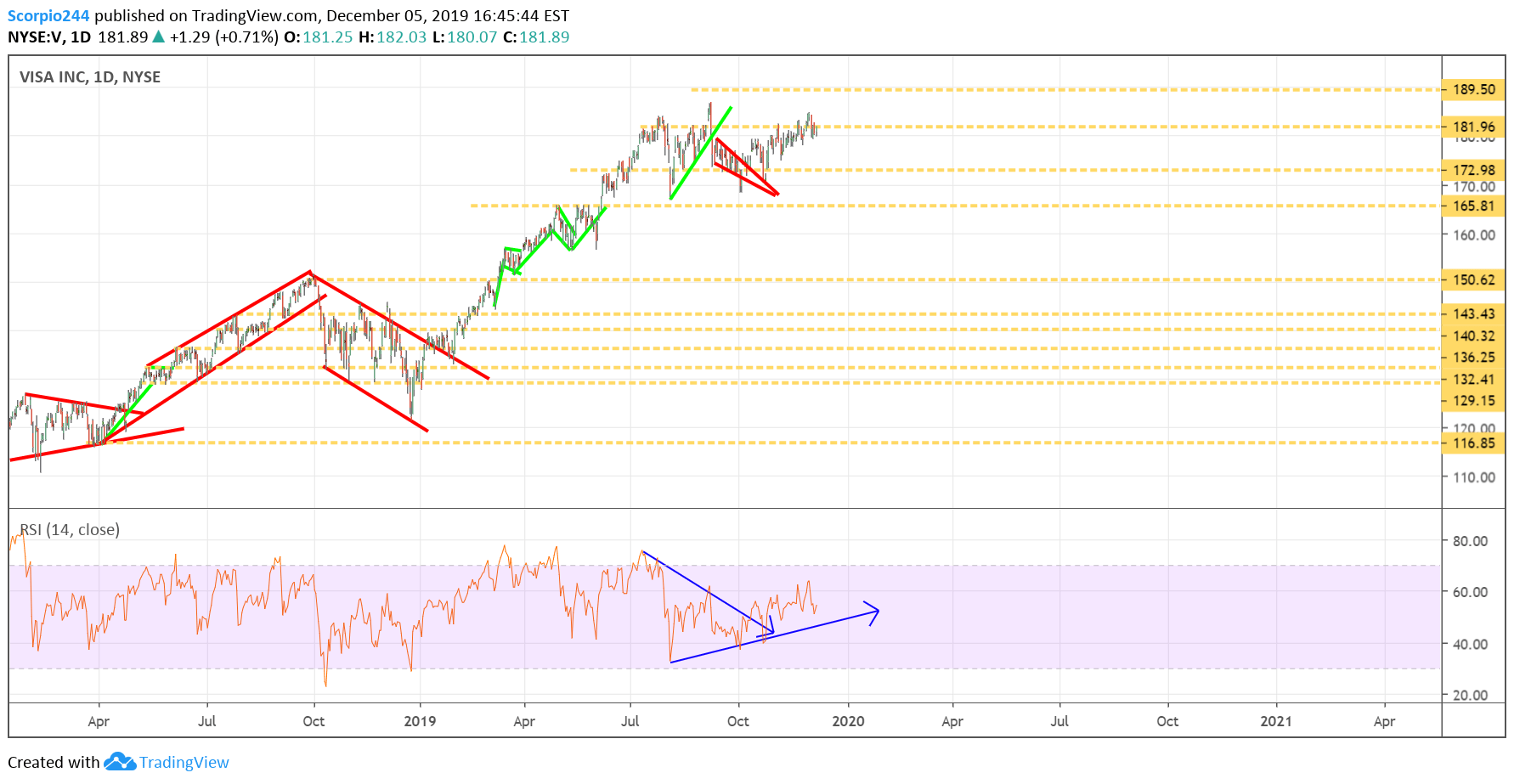

Visa (NYSE:V)

Visa (NYSE:V) continues to look strong, and perhaps the stock is finally on a path that can send it to $189.