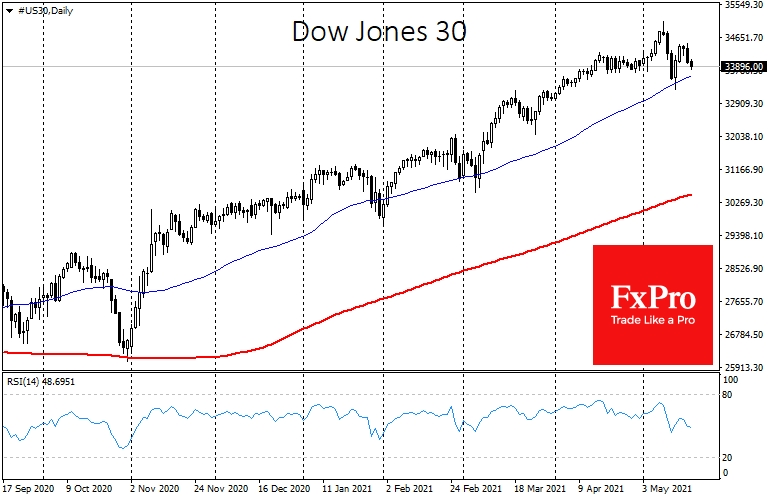

Optimism in stock markets has failed to reveal itself fully. The pressure on equities has returned, once again testing the depth of buyers' pockets.

Performance of indices futures, which are traded almost around the clock, showed the sell-off in stocks took shape at the beginning of European trading and is still intact, taking away 1.6% from the DJ30 and over 2% from the NASDAQ 100 during that time.

Germany's DAX 30 hit new all-time highs in the same time frame before coming under pressure, losing 2.2% from its peak at time of writing. The European Euro Stoxx 50 Futures was losing 1.8%, also encountering resistance near global peaks.

The caution and profit-taking near the extremes seem to be the main driving force in the stock markets. If that is the case, we see a local retracement, which may not necessarily translate into a global risk-off.

A confirmation of the short-term nature of the correction is the dynamics of the currency market. EUR/USD was attempting to reach the area of January's highs, having climbed above 1.2240 in the morning. Often, euro rising against the dollar is an image of the more robust demand for risks.

But, except for short-term market fluctuations, it does not prevent a break in the trend for rising equities. During 2002-2008 we saw how the euro and national stocks rose together, and in 2009-2011, went down simultaneously.

The Chinese yuan and British pound were again testing yearly highs against the dollar, also confirming their interest in risky assets. Gold maintained its bullish momentum, breaking through the area of the highs since the beginning of January this year, above $1870.

At the same time, the short-term dynamics in the American markets are worthy of cautious attention. NASDAQ 100 failed to rise above its 50-day average and once again stayed near the lower boundary of the uptrend channel at 13150. A further test of the previous lows at 12910 might be a harbinger of severe pressure in the markets.

In that case, a decrease in stock prices is to be expected and a renewed interest in the USD. However, this development seems less likely for the time being.

An improvement in the coronavirus situation, while the ultra-soft monetary policy remains in place, is a fundamentally important demand factor for risky assets, which helps to attract buyers in a downturn.

The FxPro Analyst Team