US stocks posted strong another round of strong gains as Fed rate cut bets continue to rise. Some analysts are starting to believe the June meeting could be a live one, if we see a dismal non-farm payroll report on Friday. On the trade front, continued optimistic tones are coming from Mexico, but that does not matter until we hear from President Trump, who is busy concluding his European trip. Asian equities are likely to get a boost in early trade following mostly positive tones regarding trade and increased odds stimulus is coming to the world’s largest economy.

The Dow Jones Industrial Average and S&P 500 Index both rose 0.8%, while the Nasdaq climbed 0.6% higher. Treasuries bulls steepen after the ADP miss, with the 2-Year and 5-Year yields settling lower, while the 10-Year and 30-Year yields rose. With Treasuries surging, led by the front and belly of the curve, markets are overly confident that the Fed will cut rates soon. Oil got crushed from a very bearish EIA inventory report and gold continued to rally but pared gains after hitting some key technical resistance levels.

- ADP – US Labor Market Shows Weakness

- Beige Book- Mostly positive

- Oil – Crude weakness underpinned on trade uncertainty

- Gold – Slightly softer on easing of trade tensions

ADP

The ADP Research Institute’s jobs report posted the lowest creation of private sector jobs since March 2010. The May reading showed 27,000 jobs were created, much lower than prior month’s 271,000 reading and a huge miss of the 185,000 jobs expected. The report highlights growth is slowing and that the economy is weakening. With markets so focused on further deterioration with US economic data, today’s release raises expectations that we could see softness with Friday’s nonfarm payroll. Current forecasts are calling for Friday’s report to show 180,000 but as analysts downgrade their forecast, we could see that settle closer to the 160,000 region. Markets are firmly pricing in rate cuts, with a 24.5% chance for a cut at the June 19th meeting and 69.8% odds of a cut at the July 31st meeting, but if we see a big miss with non-farm payrolls, we could see the June meeting become a live one.

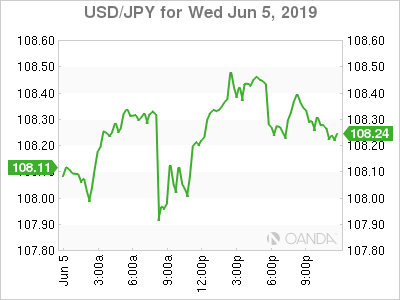

The ADP reaction saw USD/JPY initially fall 50 pips to 107.81 before recovering all of its losses and turning positive.

Beige Book

The Beige Book’s first line told you everything you needed to know about Fed’s take on the current economic conditions. The report stated, “Economic activity expanded at a modest pace overall from April through mid-May, a slight improvement over the previous period.” The report’s broad strokes were encouraging, but markets appear more focused on Friday’s employment report. As expected, the Beige Book did not provide any clarity as to what the Fed’s next move will be. The outlook going forward was solidly positive but modest, with little variation among reporting Districts.

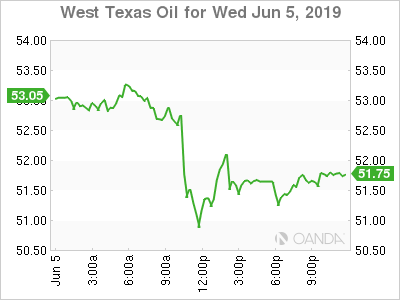

Oil

Crude prices got crushed after an extremely bearish EIA report. Crude inventories rose 6.77 million barrels, compared to analyst expectations for a 1.6-million-barrel draw. With inventories continue to rise despite the government’s release of supplies from the Strategic Petroleum Reserve. A key highlight was the biggest rise in crude and products stocks in data since 1990. Glut fears and damaged sentiment from multiple trade wars could leave WTI vulnerable to breaching the $50 a barrel level. Brent already breached the $60 a barrel level for the first time since January.

The risks are high for further downward pressure, but we should see prices stabilizing as several geopolitical risks remain in place. Oil should remain volatile because we could see strong bullish momentum return if we see a softer US dollar, trade progress from the G20 Summit, prompting the alleviation of demand fears, geopolitical risks will keep supplies tight and rising summer demand. If we see oil prices get worse, key support may come from the $45 a barrel level.

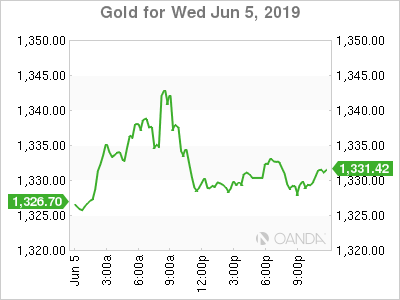

Gold

Gold prices quickly reversed after forming a double-top pattern and US stocks continue to build off their recent gains. Gold prices were ripe for a pullback after the last several sessions saw the best rally since 2016. The softest private payroll reading in the nine years saw gold surge to the $1,348.90 high before reversing backing down towards the $1,333.00 region. Trade tensions remain high and fluid, thus providing enough uncertainty to keep demand in place for the safe-haven. The dollar reversal appears to be taking a break, with the greenback up slightly on the day. If dollar weakness is sustainable, the precious metal should not have any difficulty targeting the 2018 high region of $1,369 an ounce.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.