Stocks jumped on Nov. 29 as volatility came down sharply. I noted this was highly likely on Sunday, but the S&P 500 wasn’t able to get up to 4700. Instead, it stalled at 4,675.

The VIX jumped too much on Friday, and this snapback was obvious once we didn’t get a significant drop at the open.

S&P 500

The IV crush pushed the S&P 500 higher to 4675, which was a resistance level, and that is where it stopped rising. It was also the 61.8% retracement of what I believe was wave three down; therefore, today’s up move could be the completion of wave 4. Thus, we should start wave five today in the futures, resulting in that drop to support I have looked for at 4530. Let’s see what happens first before we think further out.

NASDAQ

There is a broadening wedge right now in the Invesco QQQ Trust (NASDAQ:QQQ)s, and these broadening wedges have been breaking in the direction of the previous move. The broadening wedge going into October was preceded by a rising trend, which led to a breakout. This wedge was proceeded by a down move and should result in a move down to around $383.

High Yield

All the recent gaps in the iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) have now been filled, except for the lower one. That corresponds nicely to the predicted moves more down in the SPX and QQQ.

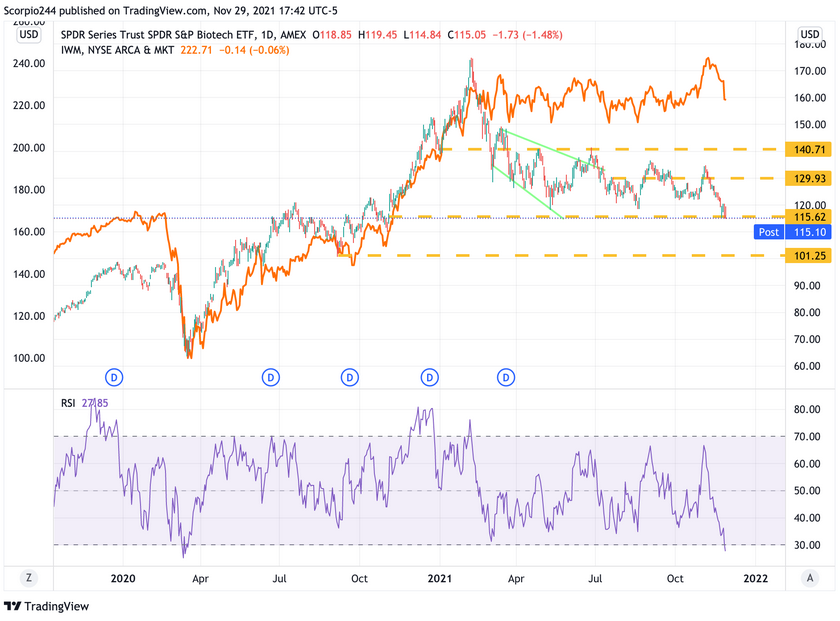

Biotech

The SPDR® S&P Biotech ETF (NYSE:XBI) is close to breaking a significant support level here, $115. It could set up a drop back to $100 over time. It is terrible news for those Russell 2000 fans, too, because many biotech stocks help move the Russell around.

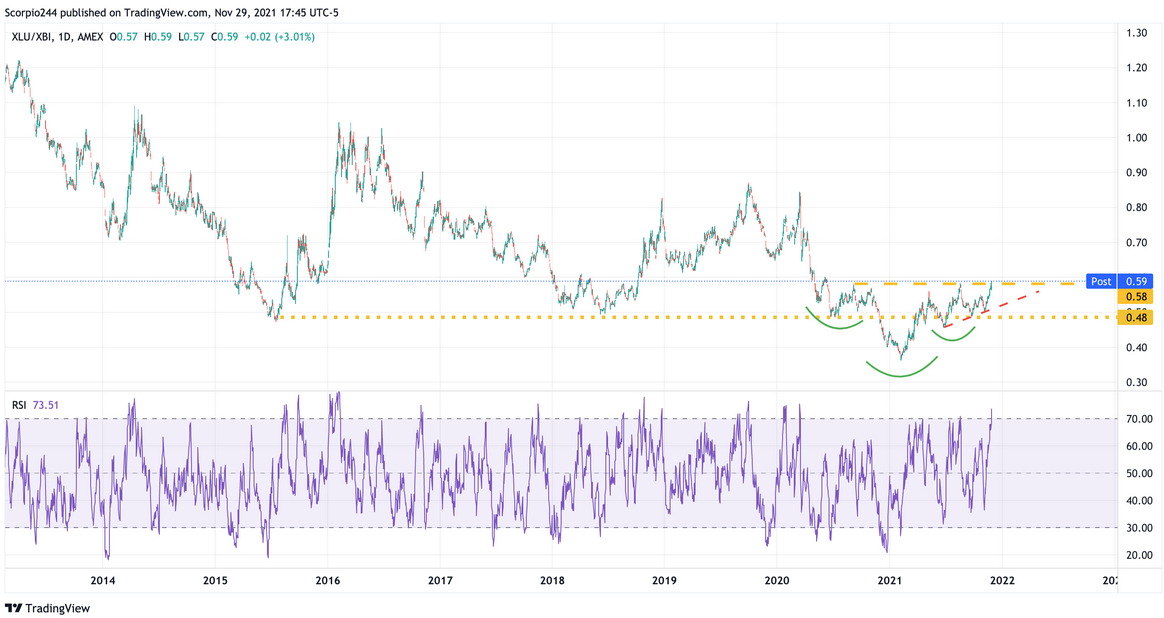

RISK

Meanwhile, the risk appetite in the market may be ready to take a turn for the worse, based on the ultimate risk-on/risk-off gauge. The biotech (XBI)/Utility (XLU) ratio has a giant reverse Head and Shoulder pattern present and is about to break the neckline, up. It would mean the XBI underperforms XLU; it is probably not a good sign of what’s to come anytime that happens.