Stocks had a good day on Monday, and there isn’t much to find in yesterday's trading action that is “bearish.” The setup appears to be more bullish at this point. Sometimes markets can stray from the underlying fundamentals, and some time markets can lead fundamentals. I still happen to be in the camp that the market is getting ahead of itself here, but who am I to judge?

The index is attempting to break the trading range we have been in since the start of April, and with earnings quickly approaching from the most significant companies, things could easily move one way or the other. Interestingly, the S&P 500 managed to close below 2,880, which isn’t anything magical, but it was from the prior high on April 17. Mostly, we continue to just move sideways within this range.

Risks

The broader market continues to ignore many of the risks that other parts of the market are reflecting, but what do I know? I am only a mere mortal.

I guess all that fiscal stimulus and QE can only be reinvested into equities; maybe there was clause hidden in the underwriting agreements. Does anyone else find it odd that other risk assets like oil and copper don’t rally? If the economy was thought to be improving, I would have assumed these two risk assets would rise too. Right, I get it, there is just too much supply and nowhere to store it. So, why would the price be rising? It has nothing to do with a lack of demand.

Copper has been looking pretty weak too.

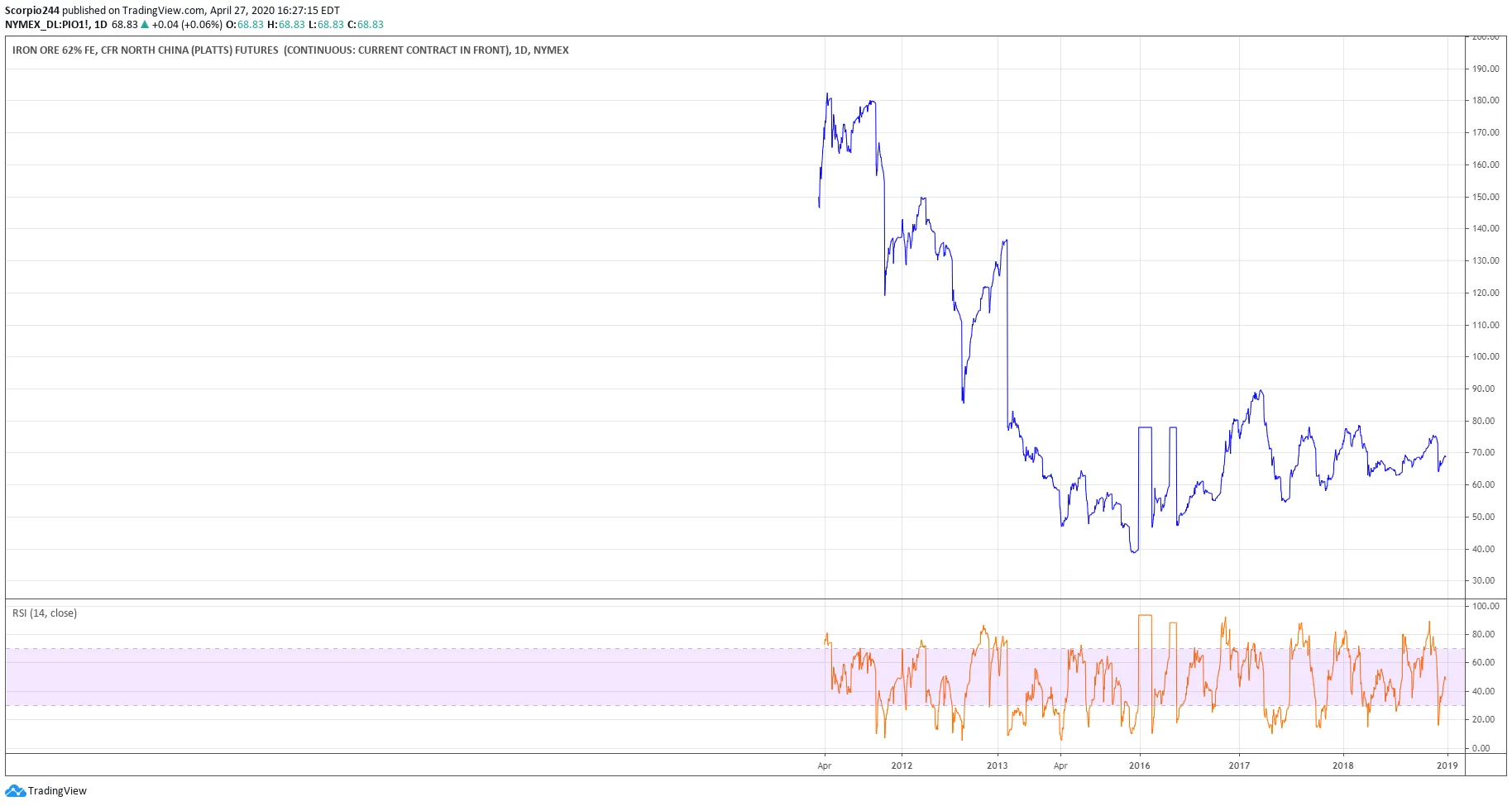

Iron ore, we certainly don’t use that in anything.

Tesla (TSLA)

Moving on, Tesla (NASDAQ:TSLA) rose sharply yesterday ahead of results later this week. It still seems possible for it to get to $850. Remember the phrasing that was used in the fourth quarter letter around deliveries. It said it should "comfortably exceed" 500k units. So does that mean 500k units or 505k units? It could be 700k units, for all we know. Remember last year, when the stock fell to $180 because everyone was sure that Musk would cut delivery guidance and didn’t? Ok, well, I do. Don’t be surprised if he doesn’t cut guidance again.

It is kind of strange for a guy (me) to be negative on the economy, but positive on a luxury car company. But, people still need to buy cars, and Tesla can continue to take share. The lease on my car is due soon, and you’d be surprised how hard it is to do that right now. I really would get a Model Y; my only problem is that I need something sooner than when the Model Y will likely be released.

Amazon (AMZN)

Amazon.com (NASDAQ:AMZN)’s stock did not rally Monday, failing again at $2376. The RSI just continues to trend lower, $2180 still seems possible. Imagine the irony if the company reports a weaker than expected EPS because they decided to spend more. As long revenue is better, that’s all that matters, right?

Netflix (NFLX)

Netflix (NASDAQ:NFLX) is forming a descending triangle, and that seems pretty clear now. Watch for that drop to $386.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) is now trending lower. Even worse, I saw a bunch of bearish put buying yesterday. Ugh! The RSI is trending lower now too. Did I mention the gap is filled too?

Advanced Micro Devices (AMD)

(NASDAQ:AMD) has that same negative trend line on the RSI that all the other stocks seem to face. It also has a strong level of resistance at $59.