Stocks advanced yesterday, with the S&P 500’s last minutes pushing higher to close at 3,915. The index was fairly well-contained, trading below 3,910 all day with buyers stepping in for the final 30 minutes of trading, but with a powerful move right at the close.

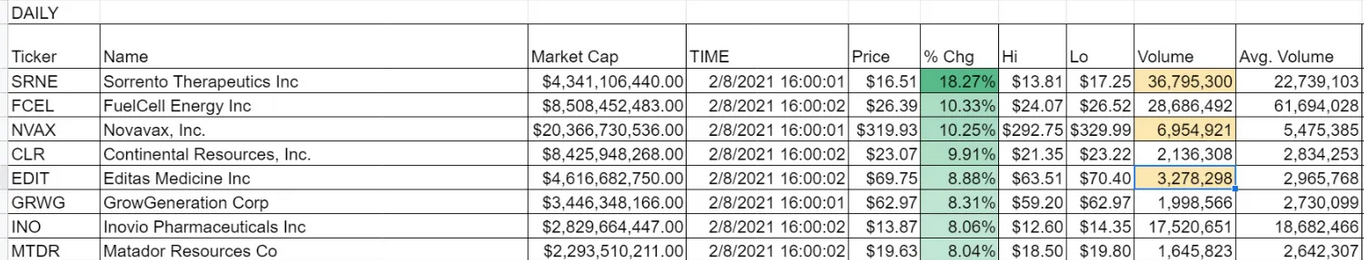

The most shorted indexed did manage to push higher by over 4%, and the Russell pushed higher by more than 2%. The move higher continues to be a short-squeeze of epic proportion with stocks like Sorrento (NASDAQ:SRNE), Fuel Cell (NASDAQ: OMX, and Novavax (NASDAQ:NVAX) leading the way. These are, of course, also in the Russell.

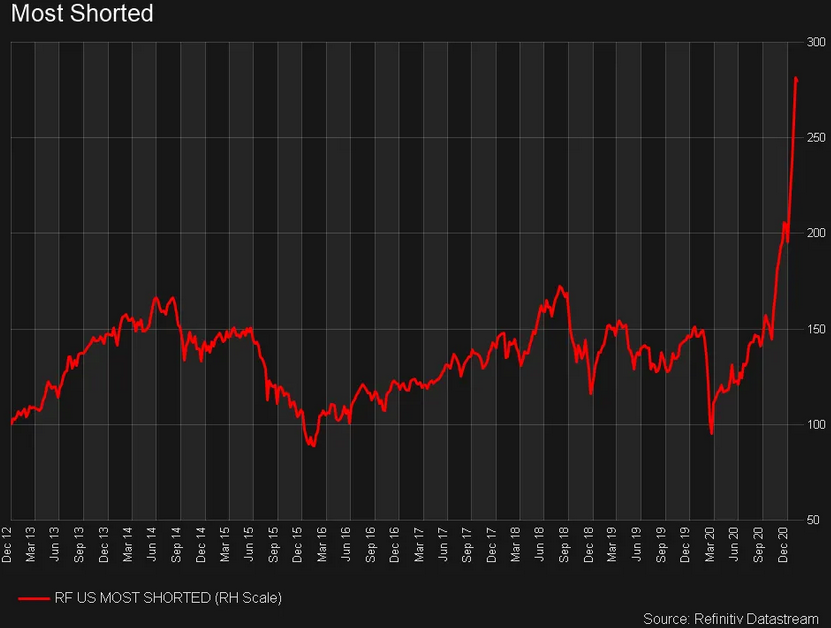

I showed this chart in my weekend video for members of Reading The Markets, and it is stunning.

VIX

The VIX was also up yesterday, rising by around 2% to finish at 21.2. Again, one of the warning signs I like to track—rising volatility and rising stock prices—typically an indication of a market that is overheating as market makers jack up the pricing on options.

This, for now, remains the name of the market game, because if this is indeed the bottom of the range for the VIX, which I believe it is, and implied volatility starts to rise again, then the S&P 500 should be ready to take another dip lower. Whether it is of the 3-5% variety as we saw 2 weeks ago, or something more, I can’t tell right now.

The technical chart would suggest that 3,780 is the next spot on the S&P 500 we will soon see.

Square

Square (NYSE:SQ) broke out on Monday, rising above $250. The stock is likely to rise slightly more, perhaps to around $280, and the top trend line.

Lemonade

Lemonade (NYSE:LMND) is just flirting right now with a potential break of support at $140. If it t should fall below that support level, it'll most likely quickly return to around $120.

Exxon

Oil probably has a couple of more bucks to rise, which will probably be good news for Exxon (NYSE:XOM). The stock broke free of resistance on Monday around $51, and that will probably give it some more room to rise, perhaps to around $54.

I don’t know, that’s all I have.