Don’t worry about the horrible jobs report because that will ensure that even more stimulus will come. But the market has gone to extremes; the S&P 500 is now trading at its highest valuation since the 2000 bubble on a PE multiple. The daily chart shows that it has an RSI over 70, the monthly chart shows it’s now trading outside of its upper Bollinger Band for the third month in a row.

Even more bizarre is the market could rise to even higher levels. Why, because the S&P 500 multiple peaked around 23 in 2000, which would equate to about 4500 on the index. So can the mania grow, sure!?

Housing

The housing sector (HGX) seems to be the only group not surging to new highs, perhaps because interest rates are moving higher.

Lumber

It could also be because lumber prices have soared, but the market is telling you the prices won’t stay this high.

Yields

The yield curve has exploded higher, with the 10-year minus 2-year now almost at 1%, its highest level since July 2017.

That’s why the banks are soaring. In a “should” be free story, I noted that Wells Fargo (NYSE:WFC) could rise to around $36.

Lemonade

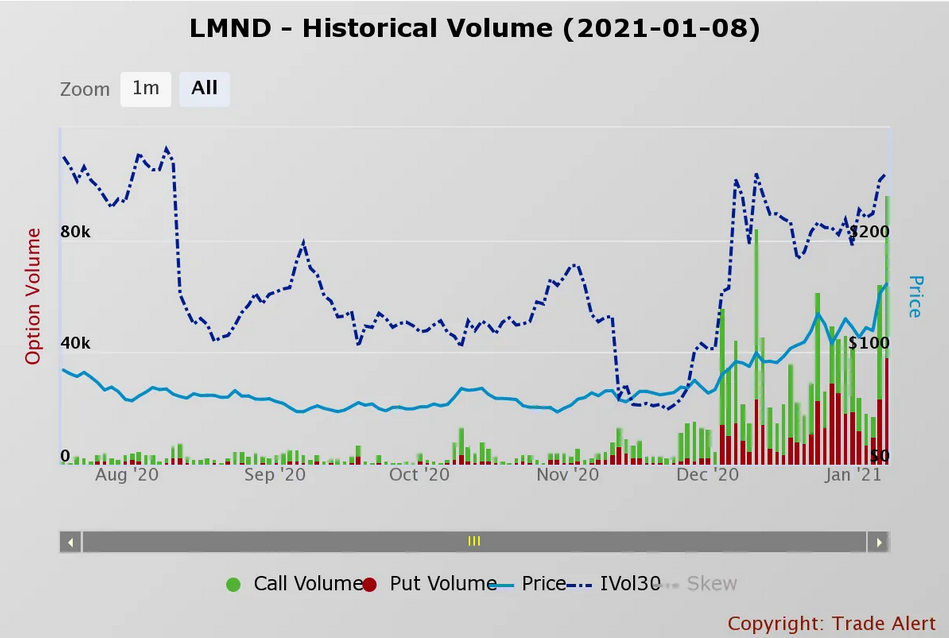

Meanwhile, Lemonade (NYSE:LMND) jumped again. Do you know why? Probably not. Just look at the options volume that traded on Friday. LoL. Look at the implied volatility spike; it’s only at 115%. It is called a squeeze, no, not a short-squeeze, a gamma squeeze, or a convexity squeeze.

Dealers are getting long the stock to hedge themselves against all those call options being traded. No, there isn’t a buyer for every seller; it doesn’t work like that in the options markets. The seller is the market maker, looking to make the spread.

See Fubotv (NYSE:FUBO) if you don’t believe me.

But what do I know?

Plug Power

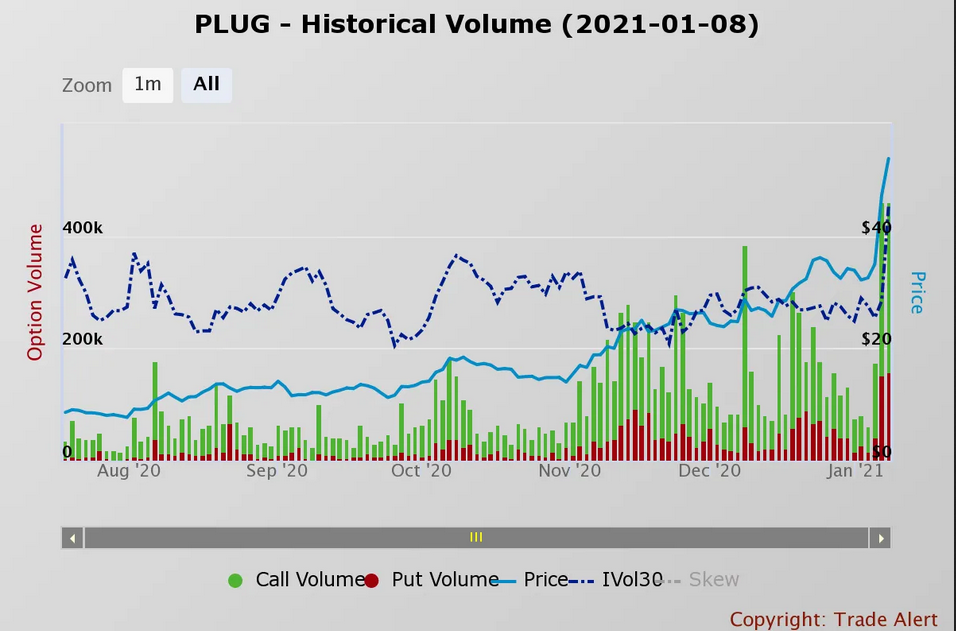

Or maybe like Plug Power Inc (NASDAQ:PLUG), with a soaring IV of 130%

Good luck!