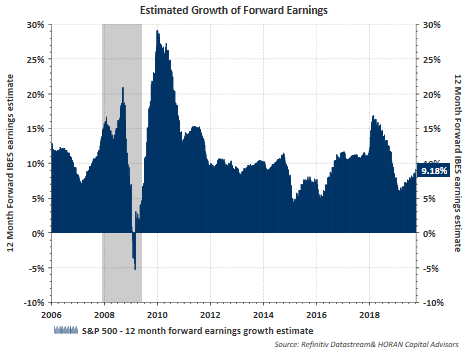

Earnings growth expectations for S&P 500 companies continue to improve with the 12-month forward earnings growth estimate equaling 9.18%. This improving trend has been in place since February and is one tailwind supporting higher stock prices so far this year.

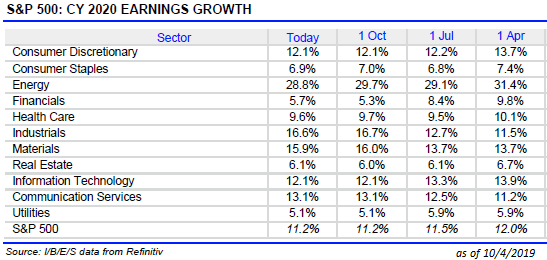

Although expected earnings growth estimates experience revisions up to the actual earnings report date, a favorable trend is in place. Looking out to year end 2020, expectations are S&P 500 earnings will increase 11.2%. A portion of the improving growth picture is attributable to lapping the earnings spike that resulted from the Tax Cut and Jobs Act as noted in an earlier post.

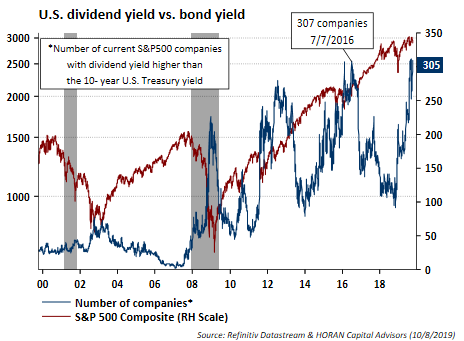

Another favorable aspect of the market is the fact over 60% of S&P 500 companies (305) have dividend yields greater than the yield on a United States 10-Year. Treasury. As the below chart shows, in the past this excess yield on stocks versus bonds has signaled a favorable environment for equities. The last time this many S&P 500 stocks traded with dividend yields greater than the 10-year Treasury was in mid-2016. Subsequent to that time in 2016, equities were a pretty favorable investment for investors as seen below.

The current earnings growth recession is similar to that which occurred in the 2015/2016 time period. Although the causes were different over the two time periods, the consequences on stock prices are often similar. With expectations for earnings growth improving, and in spite of many negative recession headlines, this just might be a favorable time for stock investors.