- Risk appetite to be tested after Friday’s stock rally.

- US retail sales report could reignite US recession fears.

- Tuesday’s Trump-Putin call could seal the ceasefire.

- Both gold and oil markets prepare for risk-positive headlines.

Stocks Are Trying to Maintain Friday’s Improved Mood

Following a tumultuous period, which had all the ingredients of a full-blown market crash, there has been slightly more positive sentiment among market participants since Friday. Thursday’s bill approval, which will keep the US government funded until September 30, and Friday’s agreement between German parties on the jumbo fiscal package resulted in a positive reaction from US stock indices.

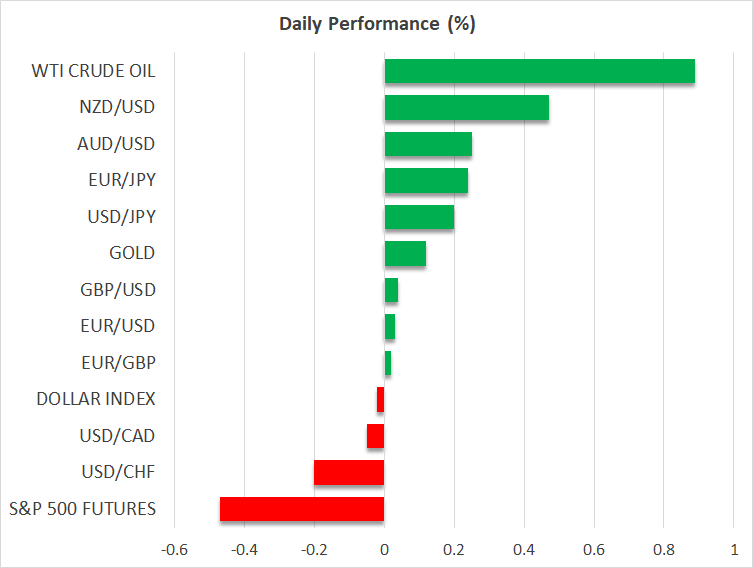

However, this was not enough to turn the week green, with the Nasdaq 100 index recording its fourth consecutive negative week and accumulating around 11% losses over the past four weeks. Interestingly, the US dollar managed to minimize its mid-week losses and only slightly underperformed against most major currencies.

The announcement of another set of Chinese stimuli over the weekend, focusing on boosting wages and employment, is supporting the improved risk appetite, with Asian equities trading higher today. Western-based investors, though, are unlikely to be equally thrilled, as, despite the numerous support programs announced over the past few years, the impact on the Chinese economy can be characterized as inadequate.

Therefore, coupled with the US launching a wave of air strikes on Houthi rebels over the weekend, US and European stocks might not be as cheerful today as they were on Friday.

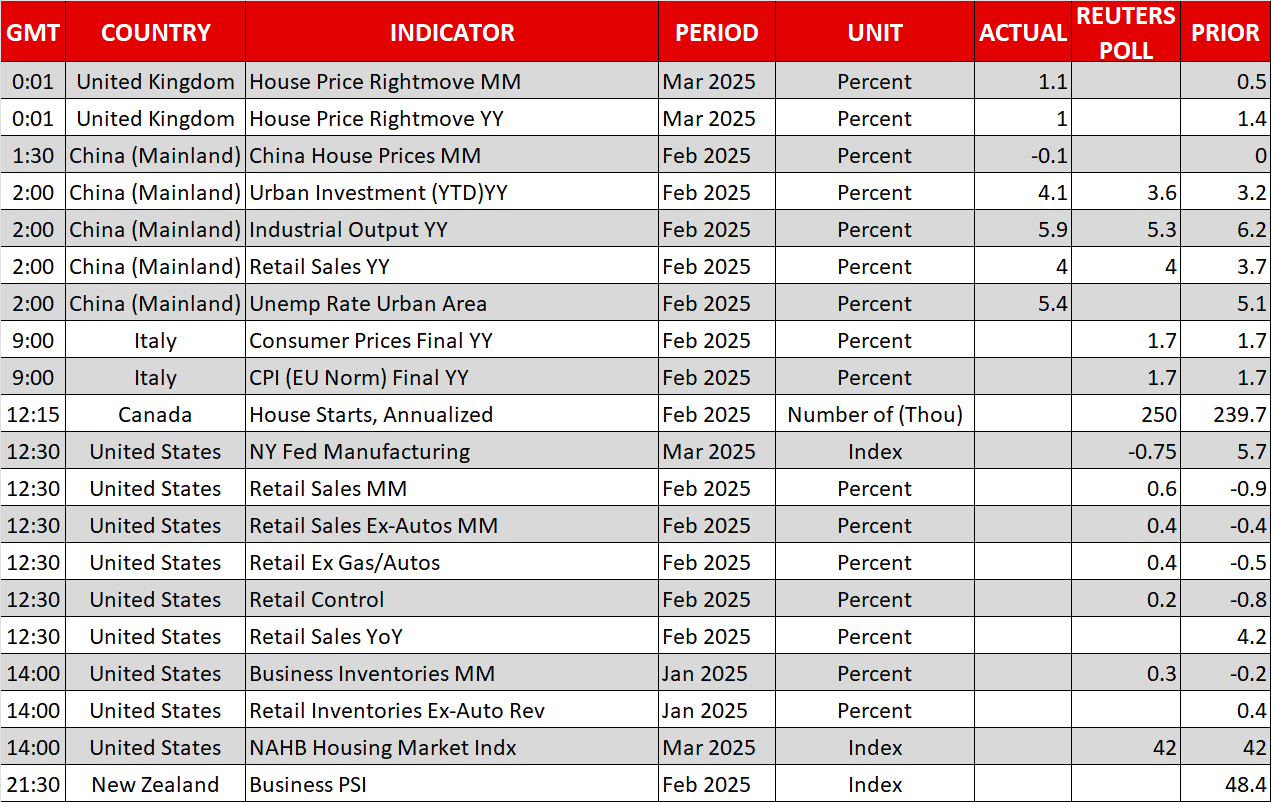

Key US Data Today; Fed Meeting on Wednesday

With the tariff talk easing during the weekend, partly because US President Trump is preparing for April 2, when the reciprocal tariffs will be announced, market participants remain concerned about the likelihood of a US recession. Crucially, Friday’s University of Michigan Consumer (UoM) Sentiment Index result, and particularly the 1-year inflation expectation jumping to 4.9%, which is the highest level since November 2022, was a harsh reminder that the average US consumer might actually be very worried about the outlook.

This hypothesis will be further tested today, as the February US retail sales report will be published. Economists expect a good bounce higher across the various metrics examined, following an abysmal January report. Confirmation of these forecasts could further support risk appetite, but the real risk is another soft report.

Such an outcome would make Wednesday’s Fed meeting even more challenging for Chairman Powell et al. and draw extra attention to the published dot plot, particularly as US Treasury Secretary Bessent commented on Sunday evening that there are “no guarantees” that a recession can be avoided.

Gold and Oil Could Suffer From Positive Geopolitical Headlines

Despite the initial negative reaction from Russian President Putin about a Russia-Ukraine ceasefire, following a plethora of meetings between US and Russian officials over the weekend, decent progress appears to have been made. As such, there is a strong possibility that Tuesday’s call between Trump and Putin could seal a 30-day ceasefire, after three years of fighting.

In this case, both gold and oil could weaken, although their reaction could be of a smaller magnitude than widely expected. Specifically, gold is currently hovering around the $2,985 area, and hence such an announcement could lead to a small profit-taking. However, the uncertain global economic outlook and the sizeable chances of the Ukraine-Russia ceasefire quickly falling apart might limit the precious metal’s losses.

Similarly, oil is already trading a tad above the key $66.95 level. The aforementioned ceasefire could push it slightly lower, but it will probably be a while before Russian oil is allowed to freely flow around the world. Therefore, no major impact on supply is expected in the short-term, with the markets mostly focused on the weakened demand side.