Investing.com’s stocks of the week

S&P 500 (SPY)

Stocks snapped their two-day losing streak with the S&P 500 rising by over 1.2% to close around 3,280. The good news is that the index climbed back above the uptrend. However, it isn’t in giving an all-clear signal yet; we still need to clear resistance at 3,300. Resistance is a little bit lower, but 3,330 is the number I am using for resistance.

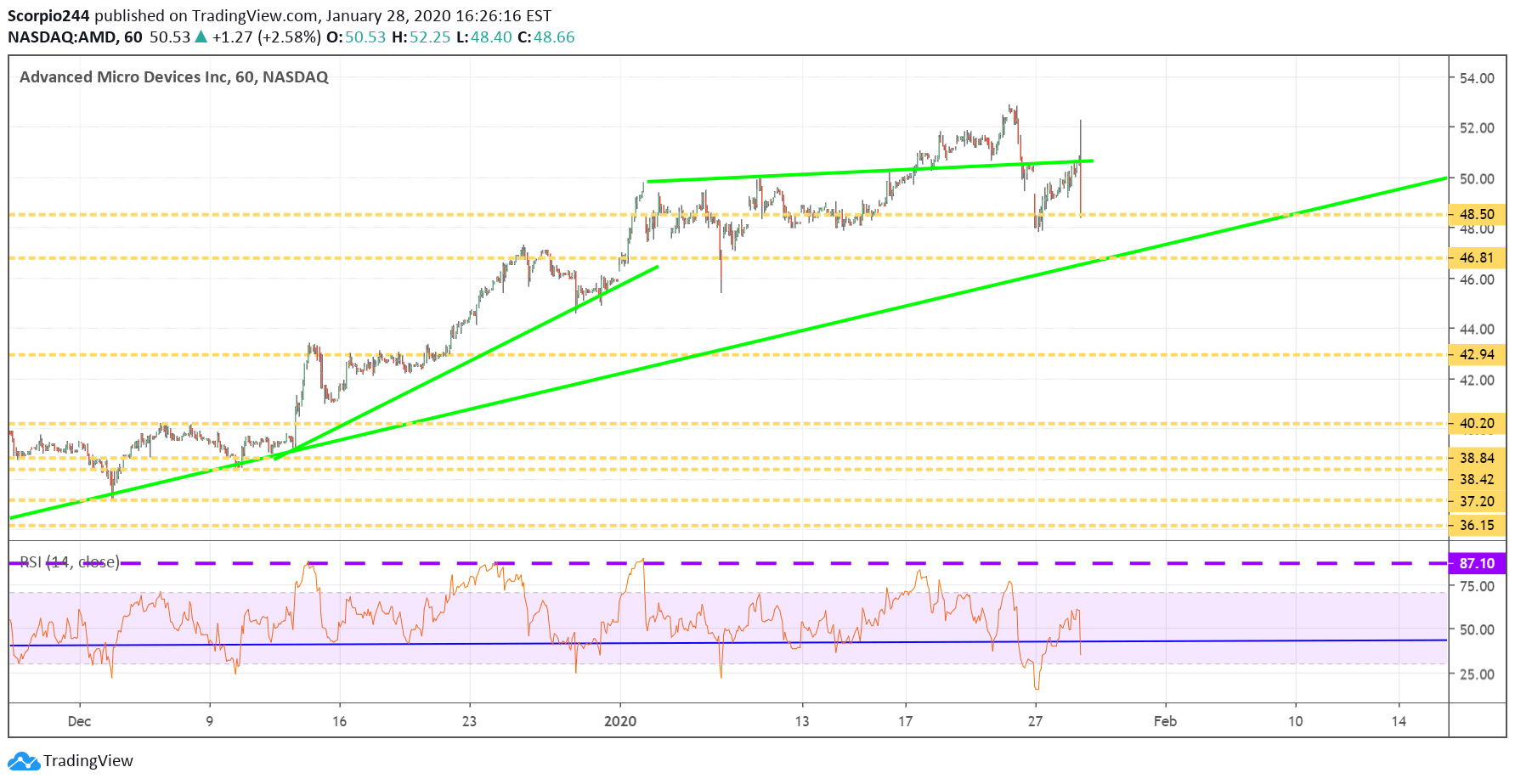

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) reported results that manage to beat on both the top and the bottom lines. But first-quarter guidance was a hair light but gave good full-year guidance. The stock is trading lower following these results and to around $48.90. Support for the stock comes approximately $48.50 and then again at $46.80. We can see what happens when the stock trades today, but for now, the options traders appear to have been wrong and so was I.

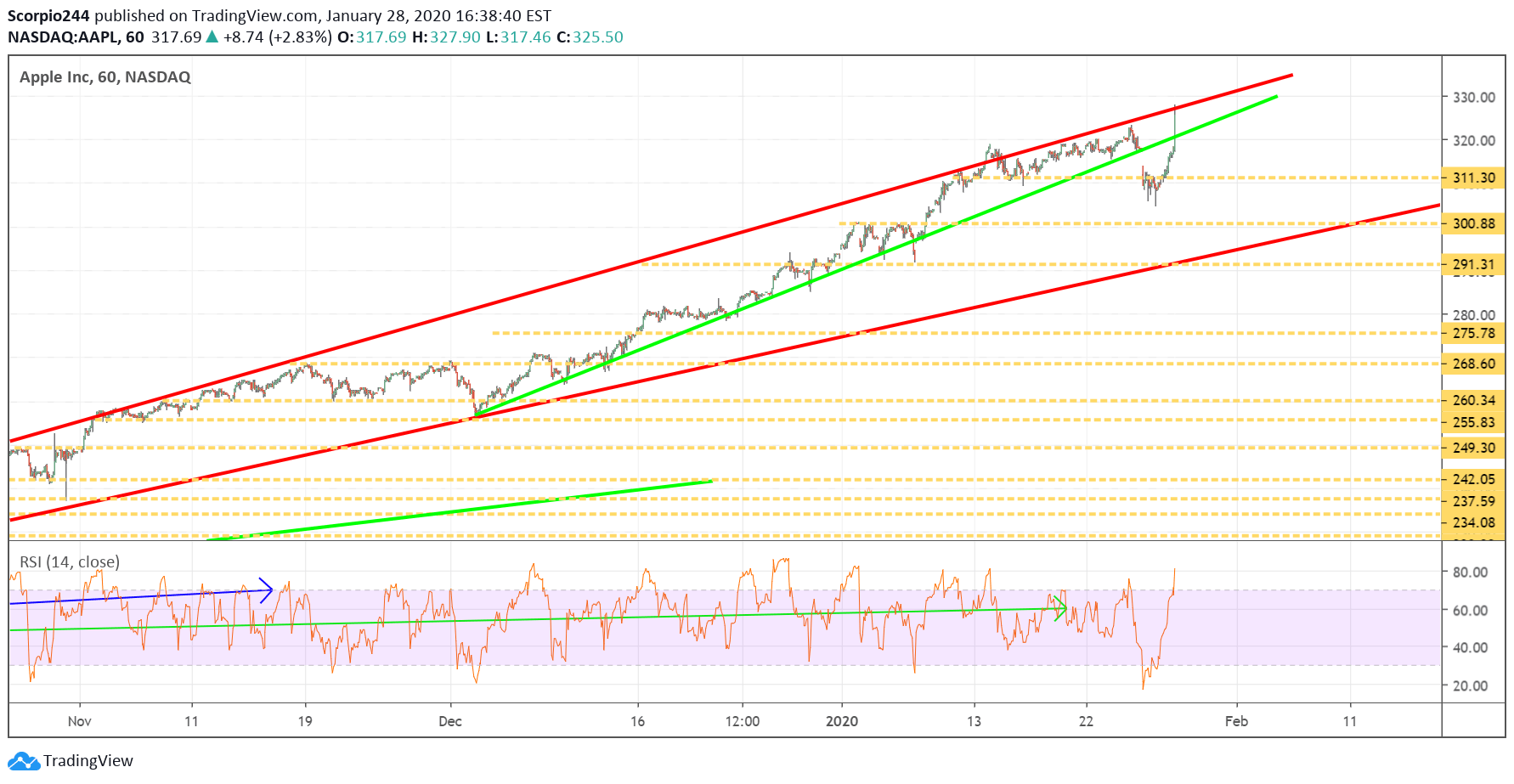

AAPL (AAPL)

Apple (NASDAQ:AAPL) crushed it, with fantastic revenue and earnings, and even more impressive revenue guidance. The company had to come through in a big way, and they did. Shares are rising to an all-time high after earnings. I will have more coverage later.

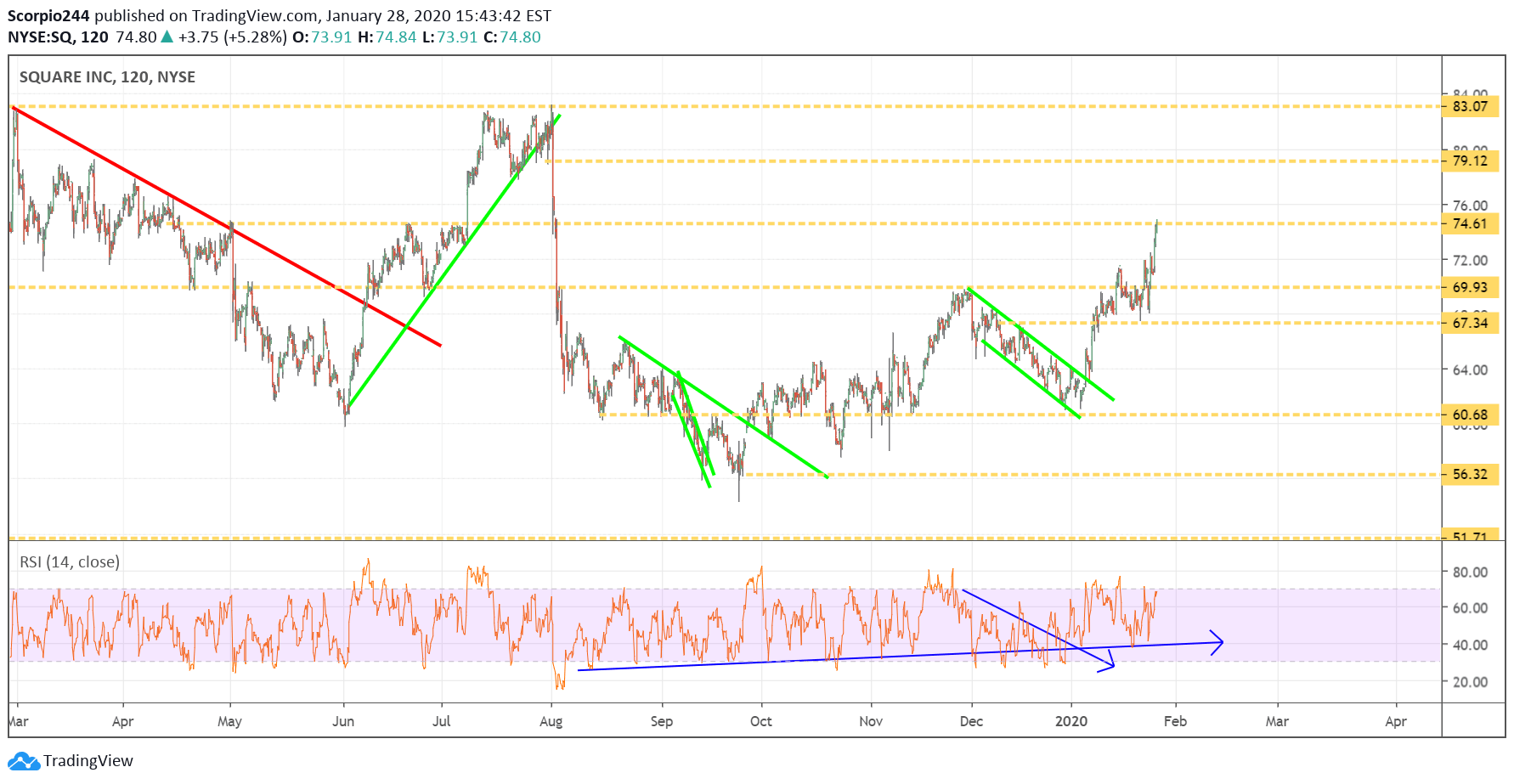

Square (SQ)

Square (NYSE:SQ) had a great day rising by over 5% to our target of around $75. Remember we were seeing call buying in this one at the end of last week. The stock back to an area of resistance. If it can clear this level, the next region comes around $79.

Netflix (NFLX)

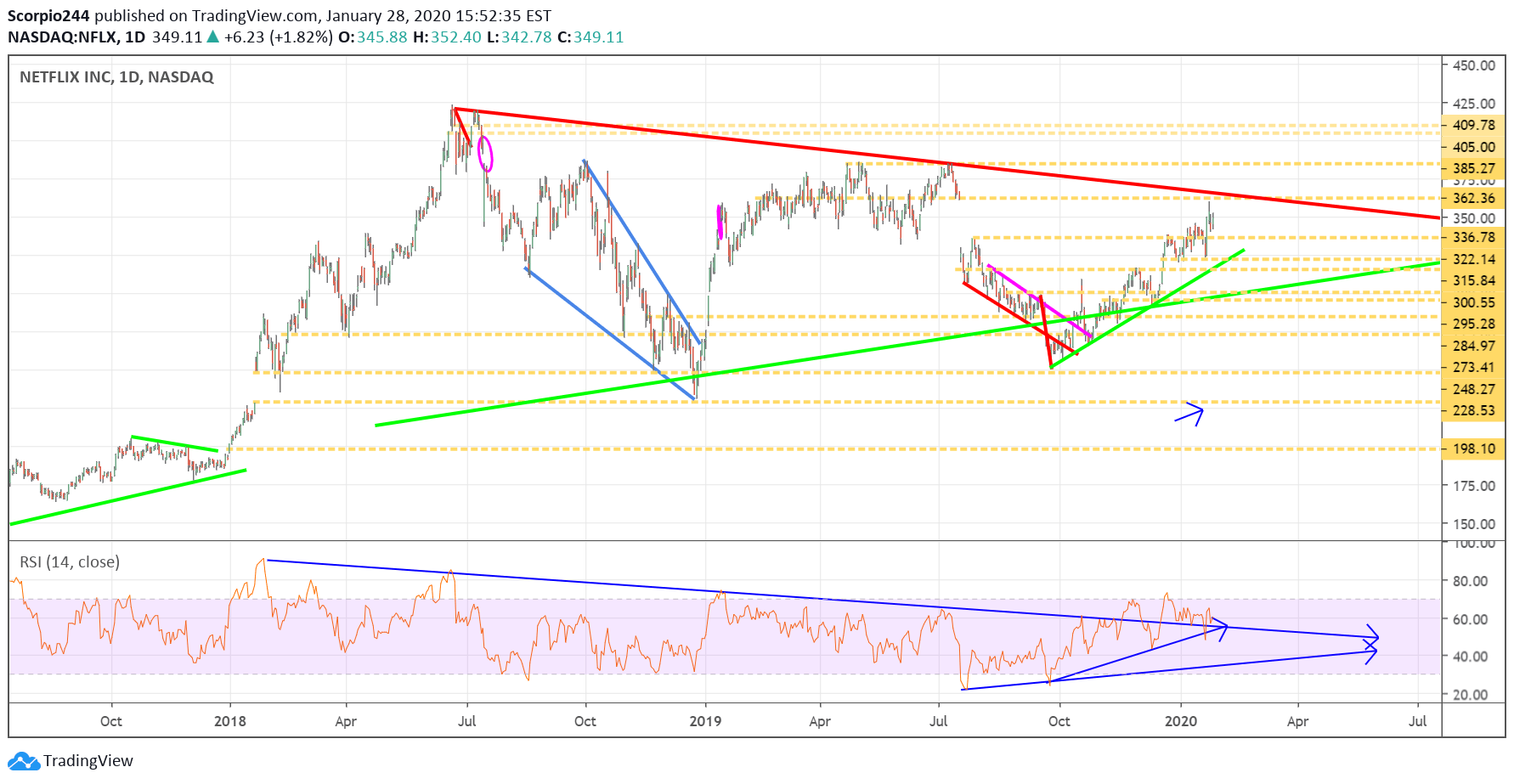

Netflix (NASDAQ:NFLX) continues to trend higher, and I don’t see that changing anytime soon. The RSI is still trending higher, and the only thing standing in the way is the massive level of resistance at $362. If it can ever get through that region, the next level of resistance comes at $385.

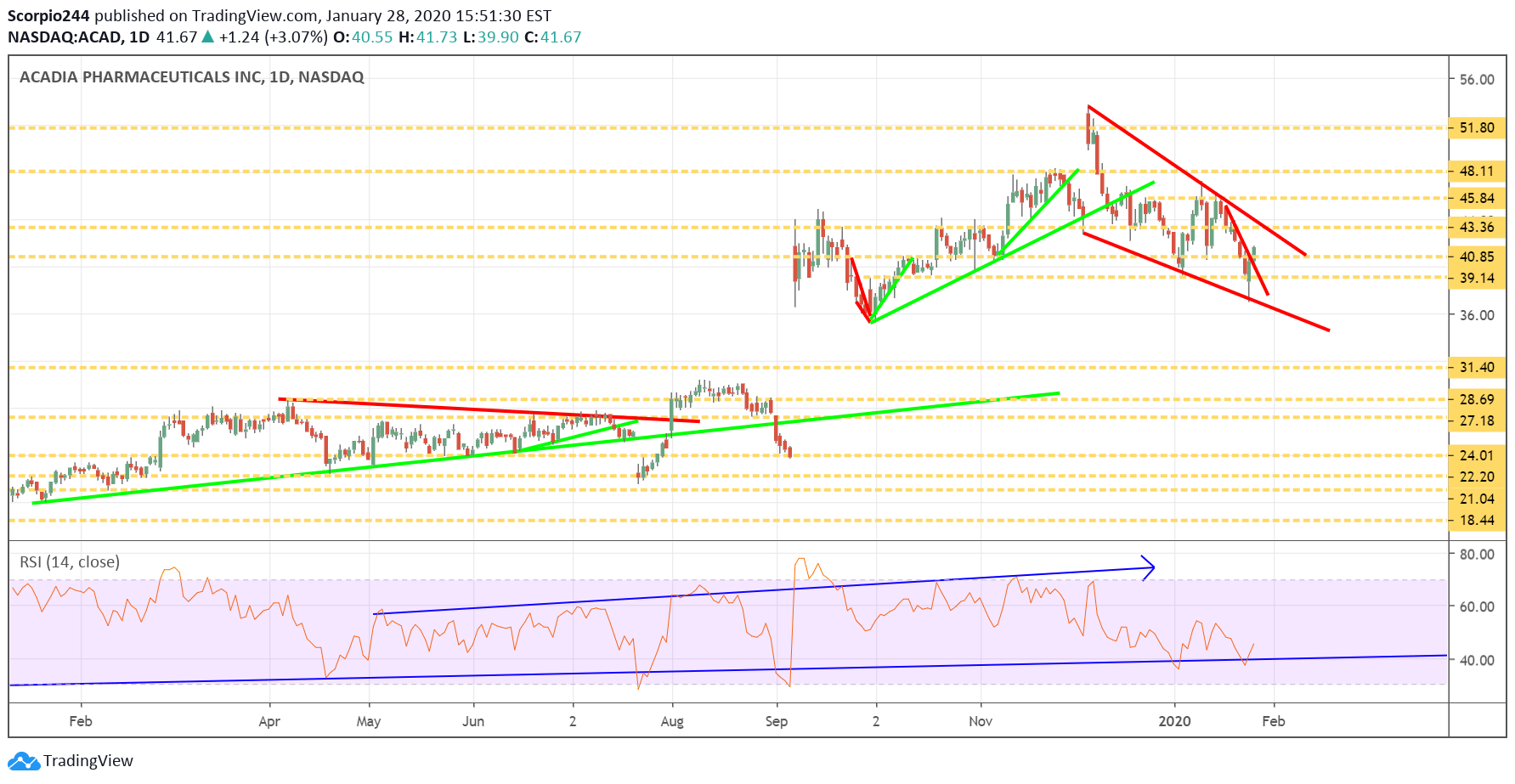

Acadia (ACAD)

Acadia rose yesterday, back to around $41.70. I have owned this stock for four years, I still don’t understand how it trades, and I was a buy-side trader for more than ten years. Maybe one I’ll get it.