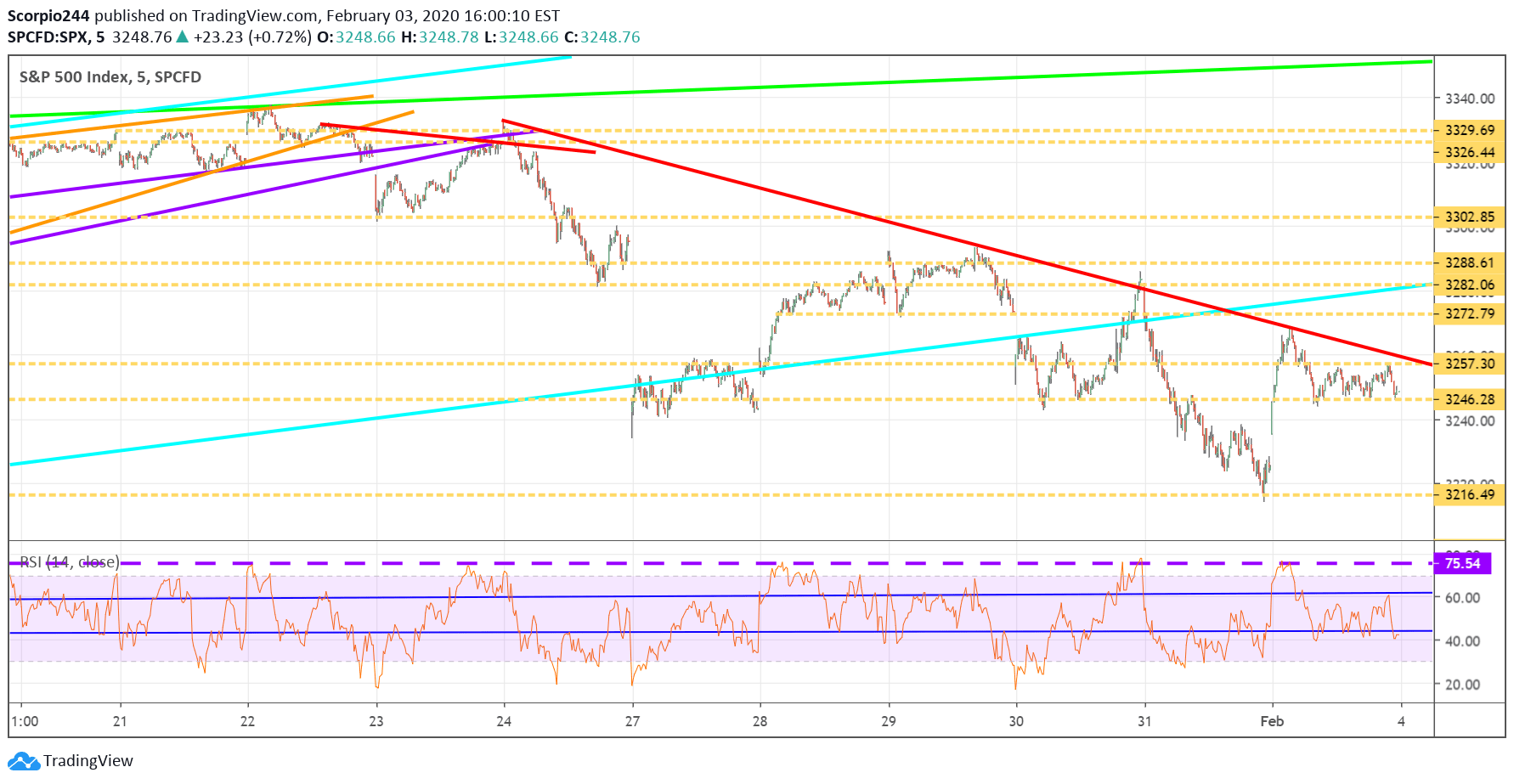

S&P 500 (SPY)

Stocks moved higher on February 3, with the S&P 500 rising by around 70 basis points back to 3,246. But not all is good news because it would appear that a bearish downtrend has formed.

It will be essential to see what happens from here, do we fail at the trend line or break higher. My suspicion is that we know more tomorrow, one way or another.

ISM Report

The ISM manufacturing report came in yesterday, and it showed an improvement in the sector with a better than expected reading of 50.9%. More critical is that it corresponds to a GDP growth rate of 2.4%. Additionally, GDPNow is forecasting first-quarter GDP growth of 2.9%.

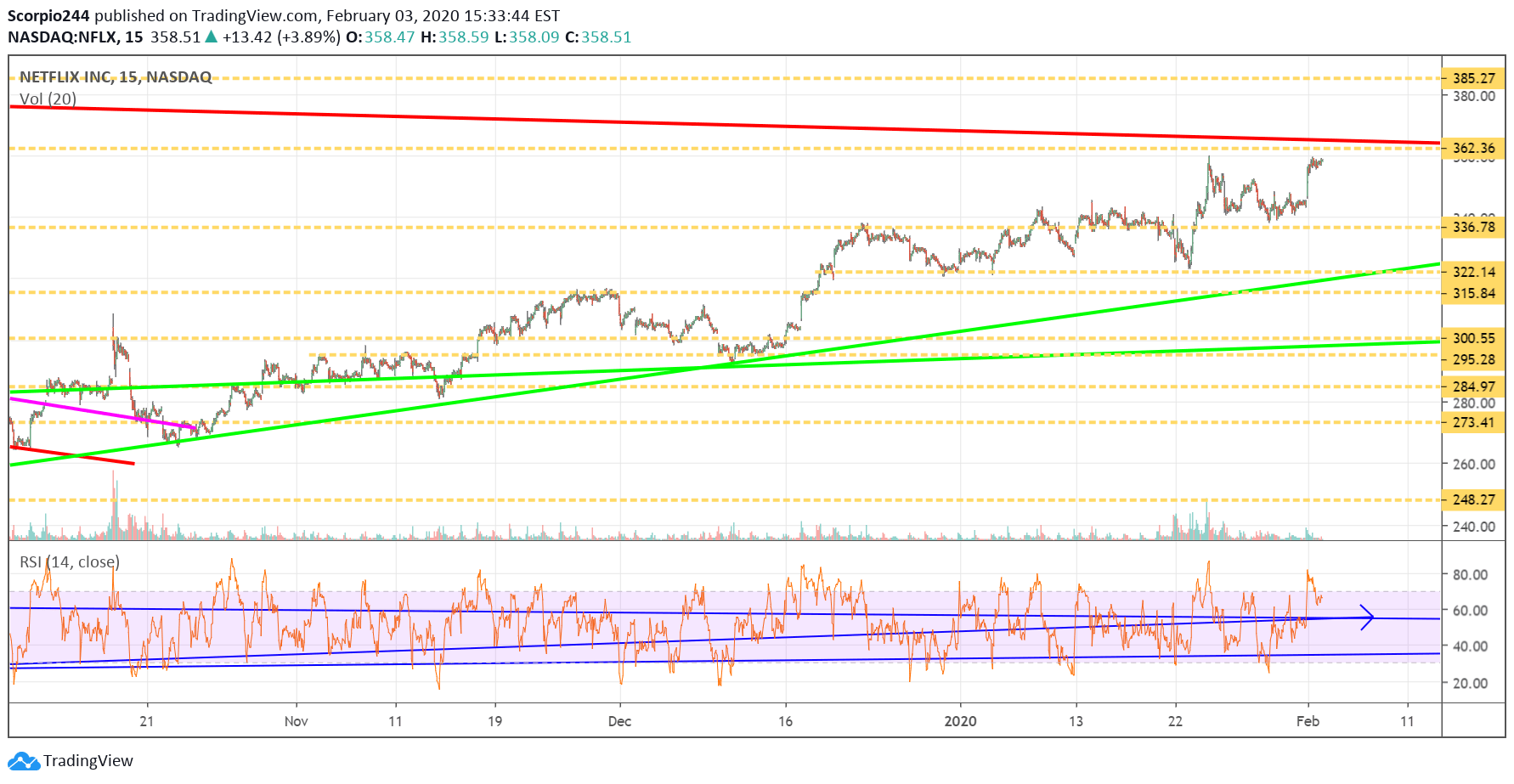

Netflix (NFLX)

Netflix (NASDAQ:NFLX) was higher yesterday and is very close to $362 now. That is the big level of resistance we have been waiting for. It is simple, breakout, and we go to $385. Remember, we saw the bullish betting in this one last week, and the stock has performed very well during this whole market downturn.

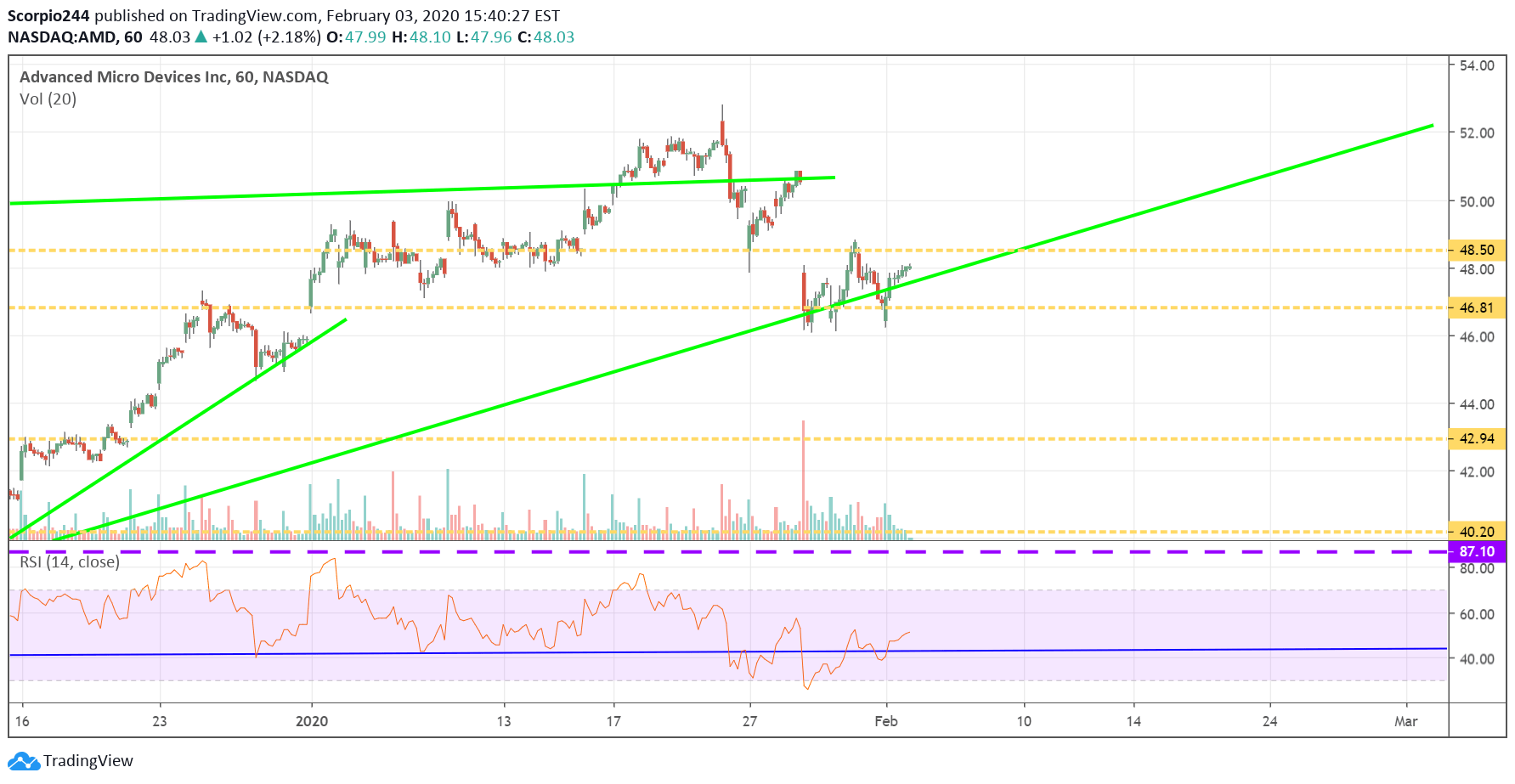

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) looks solid and was bounding back yesterday, rising over $48. The stock has done a fantastic job holding the trend line and support around $46.80. Going back to $50.50 seems feasible at this point.

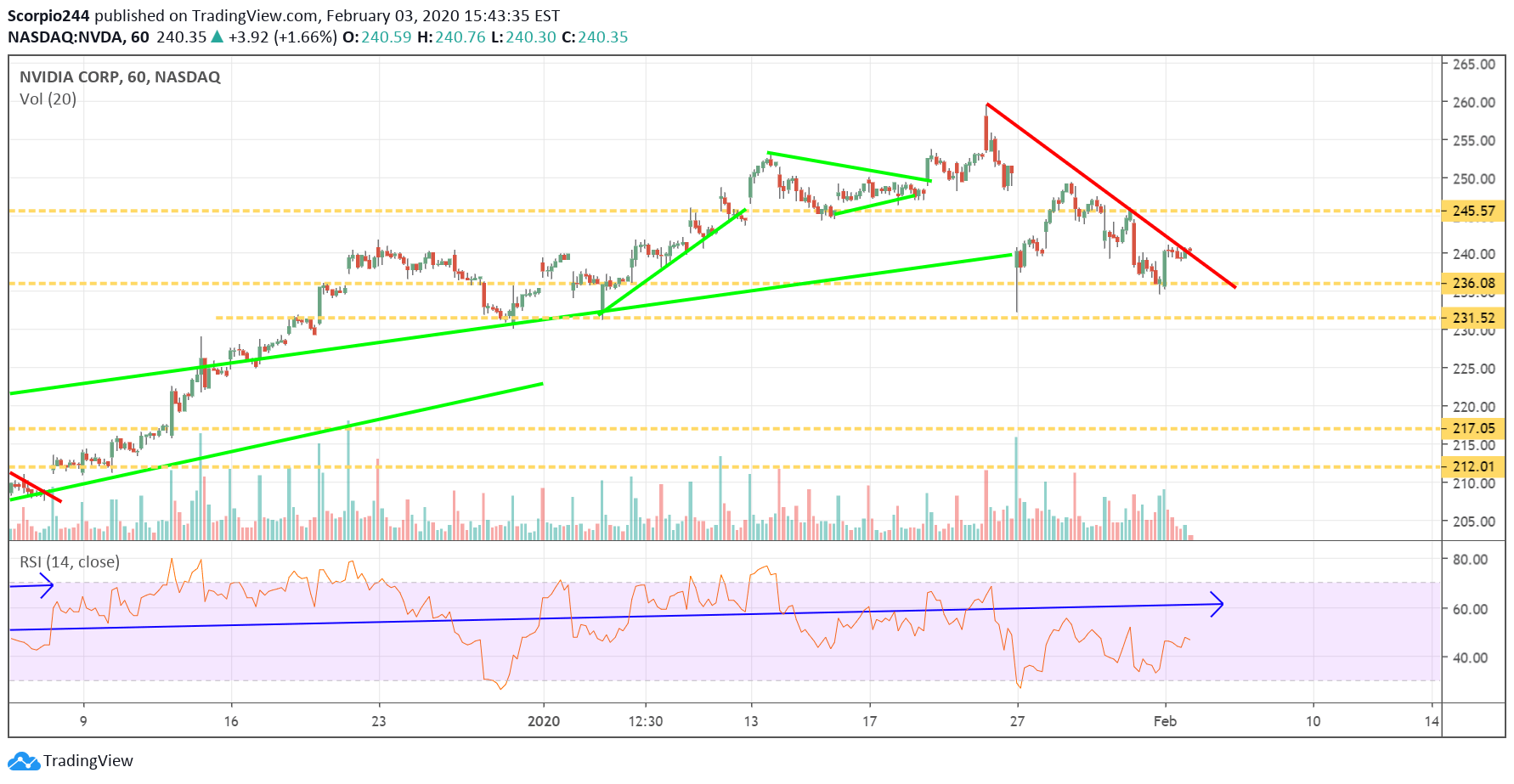

Nvidia (NVDA)

NVIDIA (NASDAQ:NVDA) is looking reasonably strong, too, and is breaking a downtrend at the moment. It could result in the stock rebounding to around $246.

Intel (INTC)

Intel (NASDAQ:INTC) options buyers are back? It seems possible. The stock filled the post-earnings gap and held support, and it looks like it is going to turn higher.

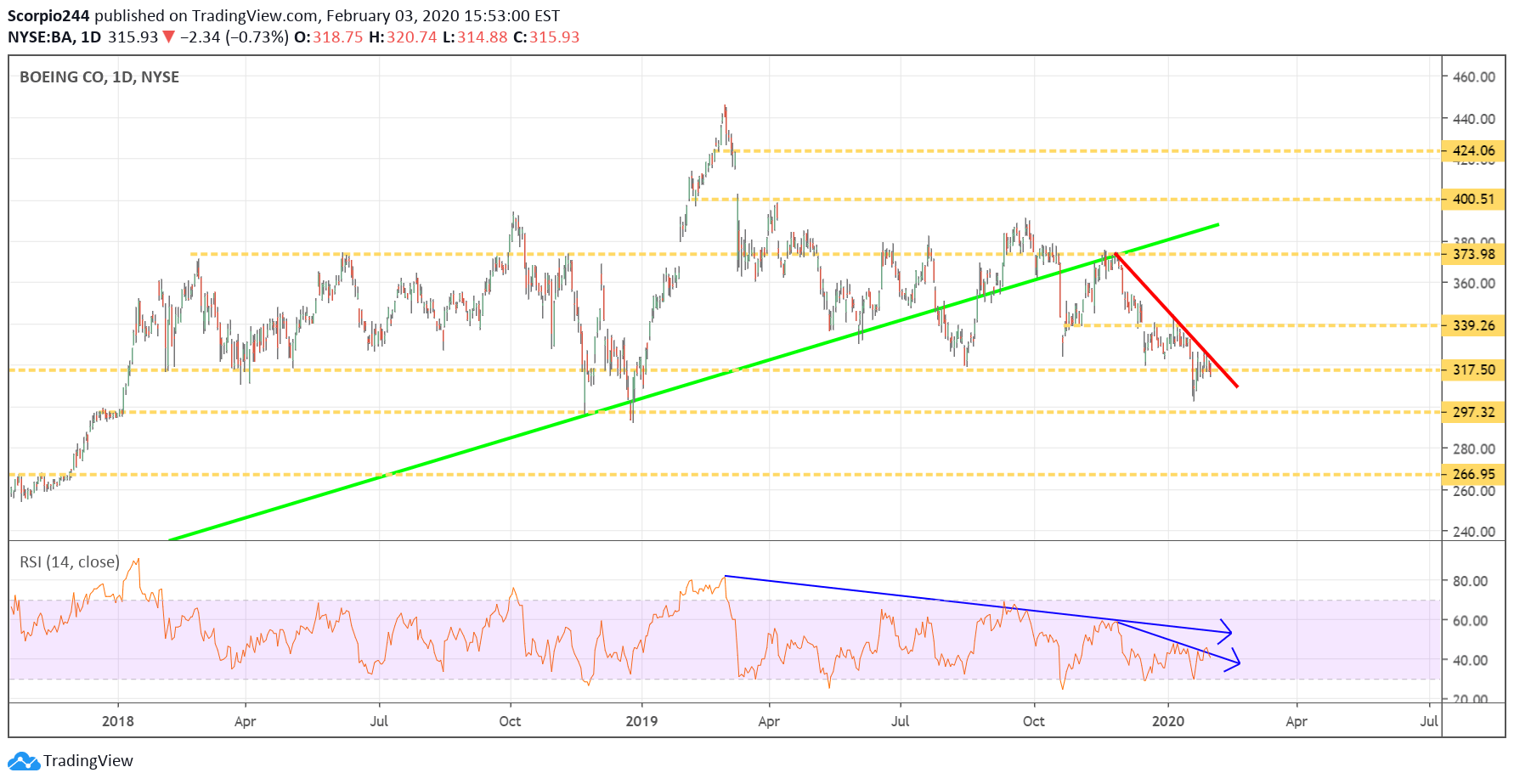

Boeing (BA)

Boeing (NYSE:BA) continues to trend lower, and all the signs suggest it falls back to $297 to $300.