March Madness is officially underway, with Round 1 games kicking off today. While many of us here at Schaeffer's are rooting for our hometown teams Xavier and University of Cincinnati, stock market bulls may want to root for a 5 seed this year, if history is any indicator.

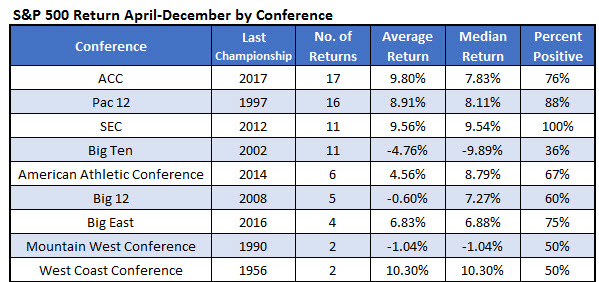

Below are S&P 500 Index returns from April through December, depending on the winning mens' NCAA conference, courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Only conferences that have won the tournament twice are shown.

As you can see, the ACC leads the pack, with 17 wins. In fact, in the past three years, teams from the Atlantic Coast Conference have won the dance twice, and came within one buzzer beater of winning three times. In years when an ACC team wins the NCAA mens' tournament, the SPX has gone on to generate a healthy 9.8% return, on average, from April through December. There are nine ACC teams in the tournament this year, led by No. 1-seeded Virginia, and No. 2 seeds Duke and North Carolina.

Meanwhile, SEC teams have won the tourney 11 times, and the SPX has been positive from April through December 100% of the time afterwards. It's the only conference with more than one NCAA win and a 100% win rate. Further, the index has generated an average gain of 9.56% after an SEC win. The SEC has six teams in the dance, led by No.3-seeded Tennessee and No. 5 seed Kentucky.

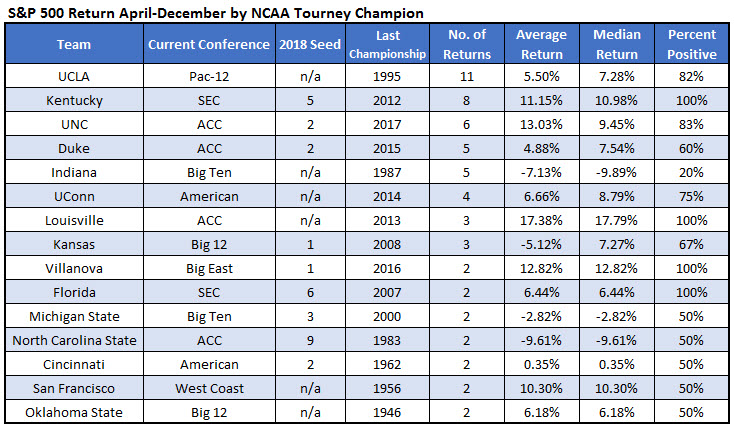

So, which team should stock market bulls root for this year? Below are SPX returns from April through December, depending on the winner. Only teams with at least two wins are shown.

The SEC's Kentucky Wildcats have won the whole thing eight times, and the S&P was higher from April through December every single time, enjoying an average return of 11.15%. That's the only team with more than four wins and a 100% positive rate for the SPX.

However, a win by the ACC's North Carolina could also precede a big year for the stock market, if past is prologue. The Tar Heels have won the tournament six times, and the SPX was higher through the rest of the year five of those times, generating an average gain of 13.03%.

In conclusion, as with the Super Bowl, the results above are simply due to randomness -- like many stock market indicators -- and should be taken with a grain of salt. Instead, stock and options traders should base their positions on our Expectational Analysis methodology, which takes into account fundamental, technical, and sentiment indicators.