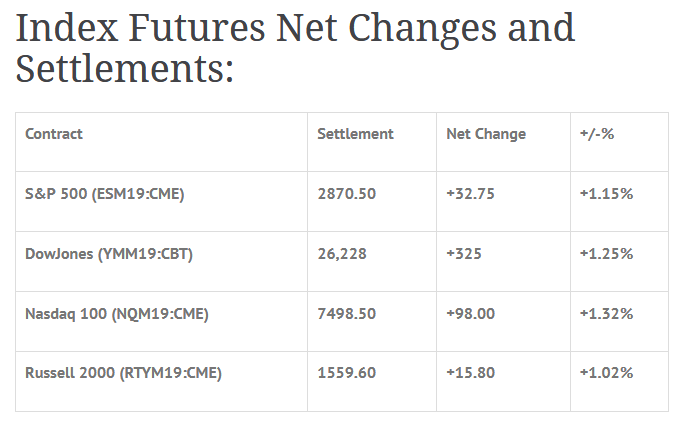

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 10 out of 11 markets closed higher: Shanghai Comp +0.20%, Hang Seng +0.21%, Nikkei -0.02%

- In Europe 13 out of 13 markets are trading higher: CAC +0.42%, DAX +0.59%, FTSE +0.93%

- Fair Value: S&P +4.23, NASDAQ +25.35, Dow +5.73

- Total Volume: 1.24mil ESM & 176 SPM traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, the 8-Week Bill Settlement, Durable Goods Orders 8:30 AM ET, and Redbook 8:55 AM ET.

S&P 500 Futures: Welcome To Mutual Fund Monday And The First Trading Day Of April

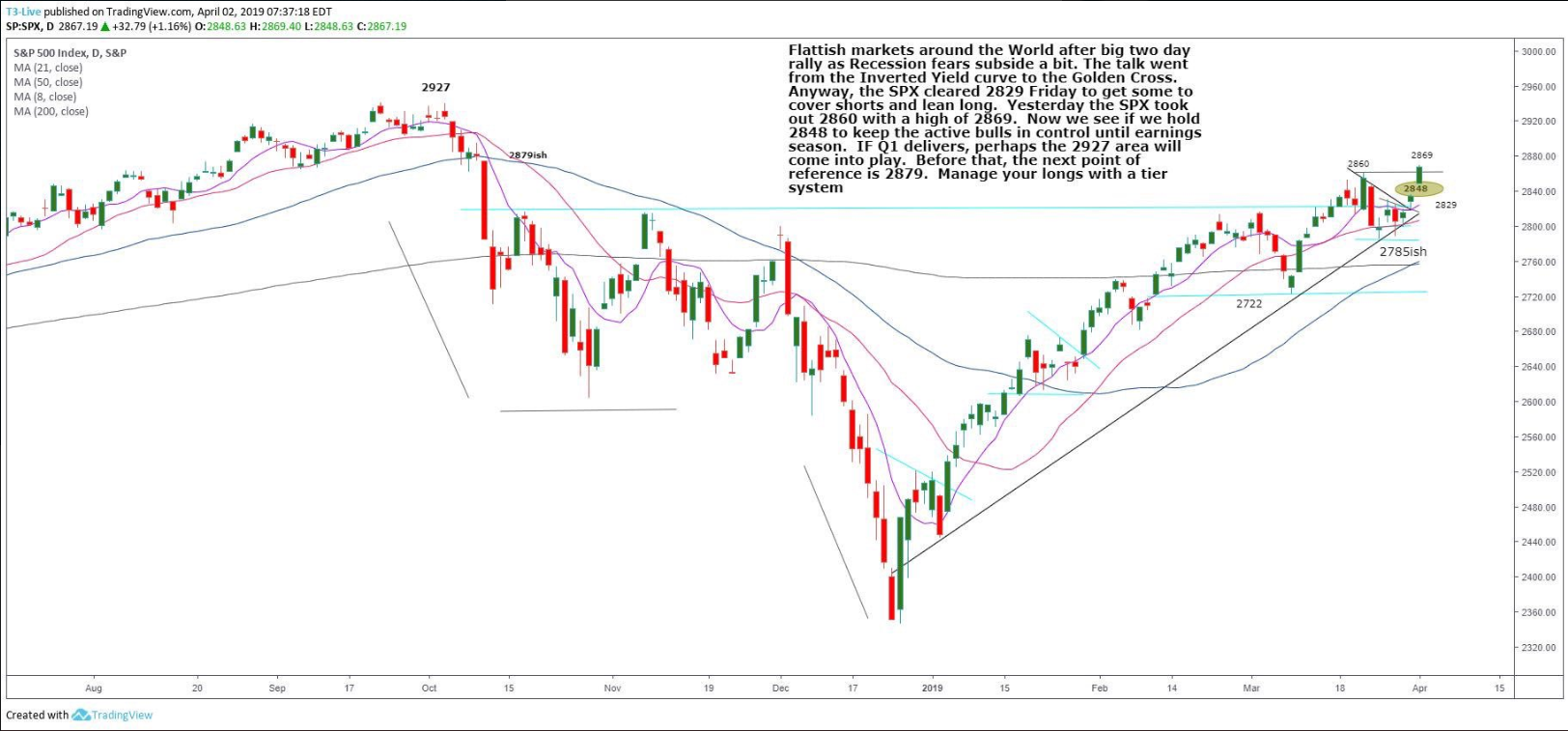

Chart courtesy of Scott Redler @RedDogT3 – $spx futures flattish as World markets digest a big multi-day move.

I knew it was a game changer when the EU started printing money again and the U.S. Federal Reserve decided to back off its rate increases. If memory serves me, these actions were the driving force behind all the stock buybacks, and the big stock market rally that started in March of 2009. While there maybe some selloffs in the future, it’s my guess the S&P’s keep charging higher.

During Sunday nights Globex session, the S&P 500 futures (ESM19:CME) gapped higher to open at 2844.50, up +6.25 handles from Friday’s settlement, and would remain the low for the day. From there, it went on to print a high of 2861.25, and opened Monday’s regular trading hours at 2859.00.

The ES was quiet after the 8:30 CT bell, and traded in a 4 handle range for the first half hour. At 9:00 a ‘top of the hour buy program’ was triggered, and the futures popped up to a new high at 2863.50. After that, the markets found some balance, and started to trade sideways for the next hour.

A little after 10:00 the ES began to slowly creep higher for the rest of the morning. By noon the futures had traded up to 2866.50, and it wasn’t done there. The slow grind continued well into the afternoon, eventually topping out at 2870.00.

On the 2:45 cash imbalance reveal the ES rallied 2871.50 as the MIM came out showing over $250M to buy, then traded up to a new high at 2773.50 on the 3:00 cash close, before settling the day at 2871.00, up +33.25, or +1.17%, on the 3:15 futures close.

At the end of the day, the bulls took over the tape. In terms of the ES’s the overall tone, it was firm all day. In terms of the days overall trade, total volume was steady, with 1.21 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.