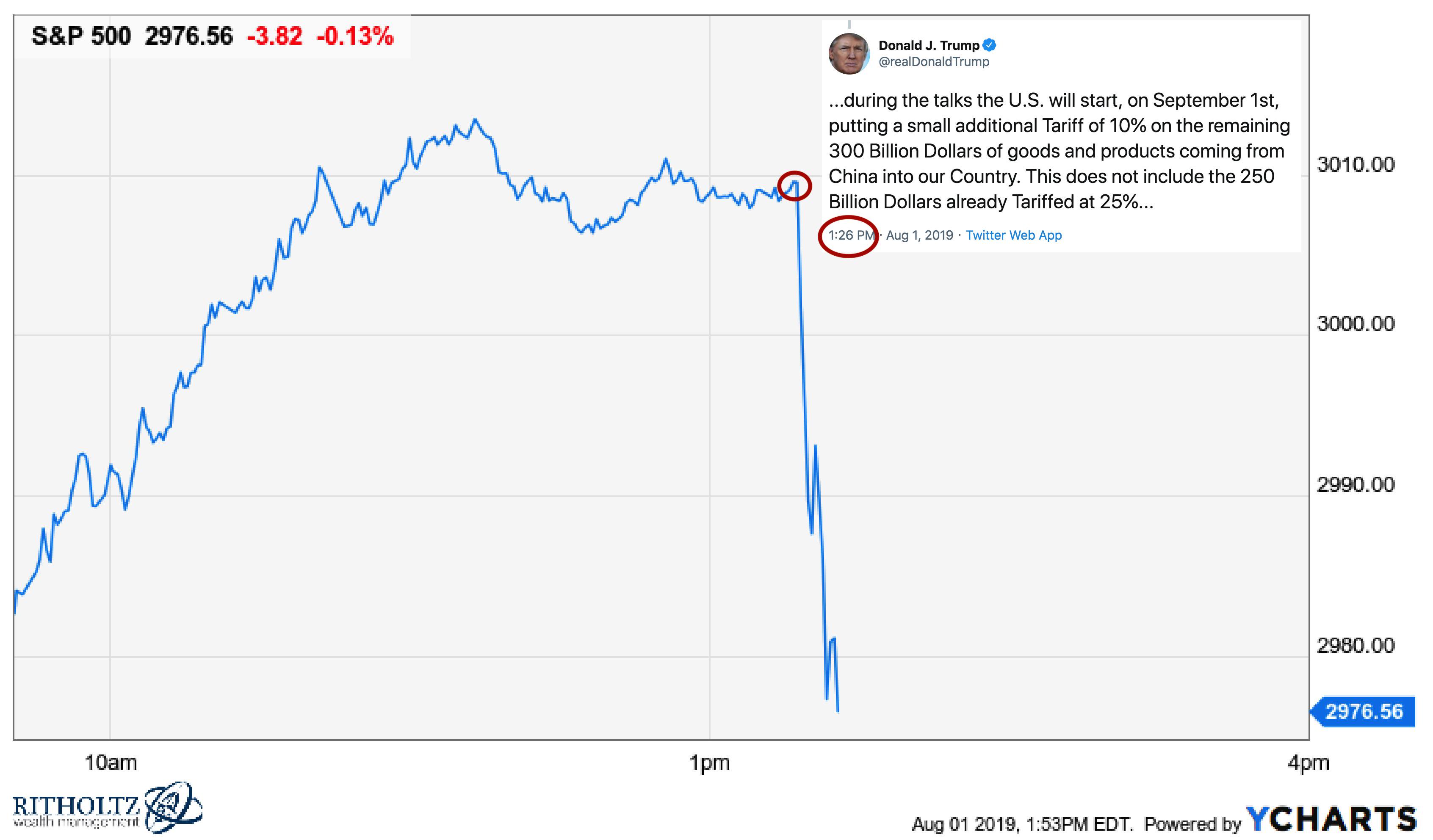

And the machines go wild!

How much the sell-off was a machine-driven algo’s gone wild sell-off versus true China trade war concerns we will never know. But what I do know is that the market moves faster than ever and what used to takes weeks and months, now takes hours and days. While it may be hard to believe the S&P 500 was around 3,020 just last Monday, yesterday it touched almost 2,820. That is nearly a 6.2% decline in a week.

For as beautiful as ETF and index investing is, yesterday’s wild move lower can be the result. It is a vicious negative cycle: the ETF’s NAV goes lower; therefore the ETF sells stocks; then stocks fall, then the NAV of the ETF falls, then the ETF sells stocks, and so on. Not to mention that Algo’s rule the land, and they all follow some kind model, so if the model says to sell, that is what happens. I guess you have to ask yourself if you agree or disagree with the “model.”

The good news is that the S&P finished the day down about 3%, and that means we need to fall about 4.25% more to see a 10% correction. Which at this pace could be by mid-week. Not outside of the realm of possibility. I had noted earlier yesterday in a mid-day update that a close below 2,880 likely sets up a retest of the June lows of around 2,730.

S&P 500 (SPY)

At the moment, 2,730 seems possible. Hey, it gets us to 9.7% off the July high.

VIX

The VIX broke above resistance yesterday at 22, and that likely means it goes higher towards 26. It means more downside risk for equities

Apple (AAPL)

AAPL fell yesterday, as it should. Now that AAPLfell below $194, we need to think that perhaps $182 is possible.

AMD (AMD)

Under normal circumstances, AMD appears it has formed a double or even triple top. The stock fell below support at $28.50, and it could be ready to move much lower, perhaps to $25.70.

My one hesitation is that yesterday doesn’t seem as if it was normal.

Amazon (AMZN)

AMZN did fall below support at $1,770, and that means $1,700 could be coming.

Alibaba (BABA)

Alibaba (NYSE:BABA) needs to hold $151, or it could fall to around $141. I don’t see how it will hold $151, but you never know.

Boeing (BA)

Boeing (NYSE:BA) uptrend appears broken, and now $317 is coming.