- Markets’ focus entirely on US inflation report after Powell does not comment on rates

- Stocks perk up somewhat as traders pin hopes on another CPI drop

- Dollar selloff aborted for now, aussie lifted by data, gold extends gains

Markets on hold as CPI data awaited for direction

Fed Chair Jerome Powell refrained from commenting on the interest rate outlook when he took part in a panel discussion on Tuesday, much to the relief of investors. Fears that the Fed chief would use the Riksbank event to push back against market expectations of a policy reversal in the second half of the year had undermined the relief rally on the back of Friday’s jobs and ISM data ahead of his appearance.

It was easy to assume that hawkish remarks from the Atlanta Fed’s Bostic and other policymakers this week were paving the way for similarly toned comments from Powell, and thus, the absence of fresh clues was welcomed this time. Sentiment was boosted on Friday from signs that wage pressures in the United States are easing and that the services sector is headed for a sharp slowdown, but the hawkish rhetoric that later followed revived recession worries.

If Thursday’s CPI figures point to further moderation in inflation in December, it’s likely to fuel bets that the Fed’s tightening cycle is nearing the end. Despite very consistent messaging from Fed officials that there is more work to be done on rate hikes, with Governor Michelle Bowman joining the recent chorus of speakers yesterday, traders do not seem to be afraid to go against the mighty Fed.

Market pricing of how high the Fed funds rate will reach has slipped back below 5% post the NFP report, risking the possibility that Powell will again rebuff such expectations. Though, the challenge of convincing the markets is likely to get a lot tougher if tomorrow’s inflation data is softer than forecast.

Equities striving to get on the front foot

On Wall Street, the mood improved somewhat as investors were left to solely focus on the expected drop in the CPI data, while a few outperforming stocks further lifted the broader market. Some of the notable gainers included Amazon.com (NASDAQ:AMZN), whose stock rallied almost 3% as the company’s job-cutting campaign gathered pace, and Warner Bros Discovery (NASDAQ:WBD), which surged by more than 8% on analyst upgrades.

The Nasdaq Composite outshone the S&P 500 and Dow Jones for the second straight day, though futures for all indices are flat today, while shares in Europe are bouncing back from yesterday’s losses.

Dollar subdued, aussie jumps on CPI rise

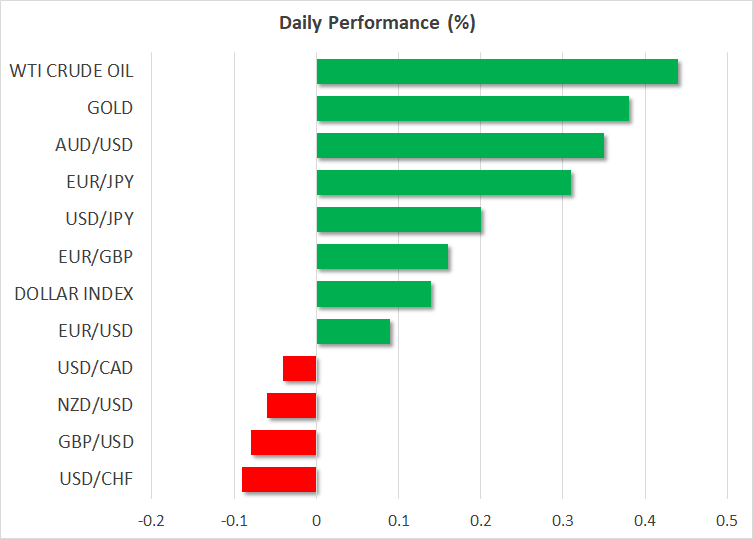

The US dollar continued to consolidate on Wednesday as the sense of caution persisted in the FX market amid a lack of any significant drivers before Thursday’s CPI release. The dollar index has found support in the 103 region, but a downside break is possible from the inflation data and as the euro, which has the largest weighting in the index, keeps tapping the resistance barrier at $1.0760.

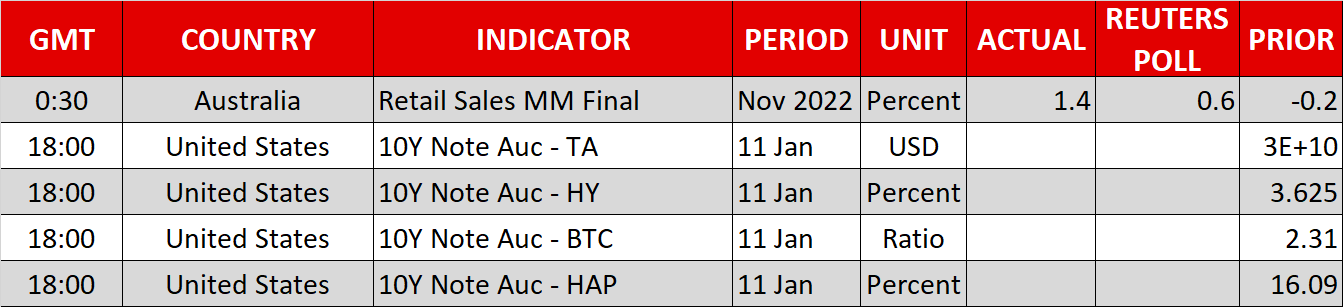

Most other majors were also trading sideways with the exception of the Australian dollar, which advanced by about 0.4% against the greenback following some upbeat domestic data.

After having steadied in recent months, inflation in Australia picked up again in November, climbing to 7.4% y/y to a fresh peak. Retail sales also rose by more than anticipated, dashing hopes that the Reserve Bank of Australia would be in a position soon to pause its rate hikes.

Moreover, China’s swift reopening poses a dilemma for the RBA as commodity prices have rocketed higher on expectations of demand making a full recovery within the next few months.

Metals lead the commodity gainers

Copper futures have jumped about 7% so far this year and an increasing number of analysts are predicting that oil prices will top $100 a barrel again in 2023. In the meantime, though, concerns about a recession and some doubts about how quickly Chinese demand will rebound when Covid infections are so high are putting a lid on any upside in oil.

This is why in spite of the increased optimism, oil futures have lost 6% in the year-to-date. Traders will be looking at the weekly US inventory numbers due later today to see if they will confirm the build in crude stockpiles as indicated by the private API data yesterday.

Gold on the other hand has been on a winning streak lately, aided by the pullback in Treasury yields and the softening inflation picture. The precious metal just hit an eight-month high of $1,886/oz.