S&P 500 (SPY)

Stocks finished the day higher with the S&P 500 climbing by nearly 40 basis point to 2,833. At this point, there is very standing in the way between the S&P 500 and its eventual rise to 2,875. In fact, at this point, we aren’t even talking about a 2% move.

Russell (IWM)

The iShares Russell 2000 (NYSE:IWM) had a perfect day closing above key resistance at 1,563. The chart still appears to be bullish, and I would not be surprised to see the index trading above 1,592 soon.

Further to Go

I know I have said this over and over again, but the S&P 500 is simple trading at a valuation that is too low. It is currently trading at just about 15 times 2020 earnings, and estimates would have to fall a lot to get the S&P 500 back to a historical average one-year forward PE of 17.7. At its current value of 2,833, the S&P earnings estimates for 2020 would need to fall too by roughly 15% to $160.06 to have the PE rise that high. Now I’m not saying that can’t happen, but there would need to be a recession to trigger that kind of decline in earnings growth, and at this point, I don’t see that happening.

Yields To Fall More

10-year yields appear as if they are going to take another leg lower and fall to around 2.54%.

Declining yields are not a function of anything more than the spreads between US and International bonds being very wide. The spread between US bonds and Germans Bunds are near historic highs and is now contracting.

How many people thought I was crazy when in my ten predictions for 2019 I said 10-year yields would drop to 2.3%. Doesn’t seem so crazy now? Oh, and by the way, I wrote on that prediction on December 10. I also wrote on December 1 that the Fed would not raise interest in 2019.

Amazon (AMZN)

Moving on Amazon.com Inc (NASDAQ:AMZN) continues its rise, and the big test will come at $1,770. Should the stock rise above that level the next area of resistance comes around $1,850. But notice how the RSI is now breaking out of the downtrend. It would suggest to me that the stock continues up and through $1,770.

Facebook (FB)

Facebook (NASDAQ:FB) continues to have a problem falling over 3% today. The stock is nearing a massive break down should it drop below $157. The RSI for Facebook suggests that it does continue to fall and $148 is coming.

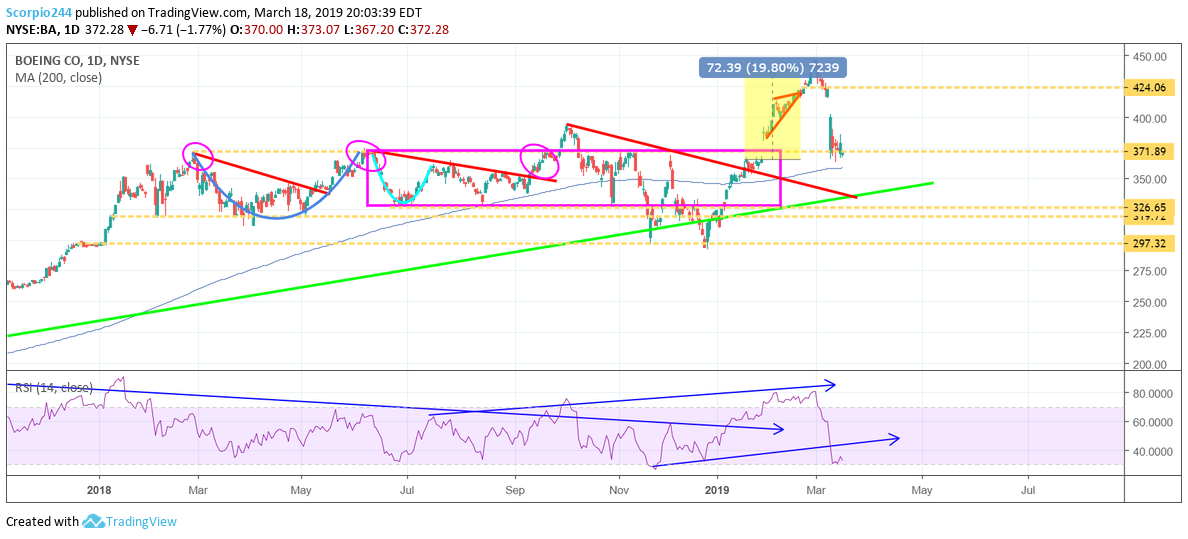

Boeing (BA)

Boeing Co (NYSE:BA) continues to hang on to support at around $370, for how much longer is the big question. I’m not sure that it can, and that means $330 is on the way.

Celgene (CELG) and Bristol-Meyers (BMY)

What does it mean when a stock is getting taken over at purpose price of $102, yet the stock is trading at $88, a nearly 14% discount heading into a big shareholder vote? Probably not a good sign, right? That’s how I would see it. Good Luck Bristol-Myers (NYSE:BMY). The market doesn’t seem very confident in this deal.

Copper

Watch for a Copper break out and move up to $3.05 or higher in the coming days.