Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

For most people the flu would be enough to sideline them, but even with a 102 fever the Monster Market Commentary gets pushed out because the market waits for no one.

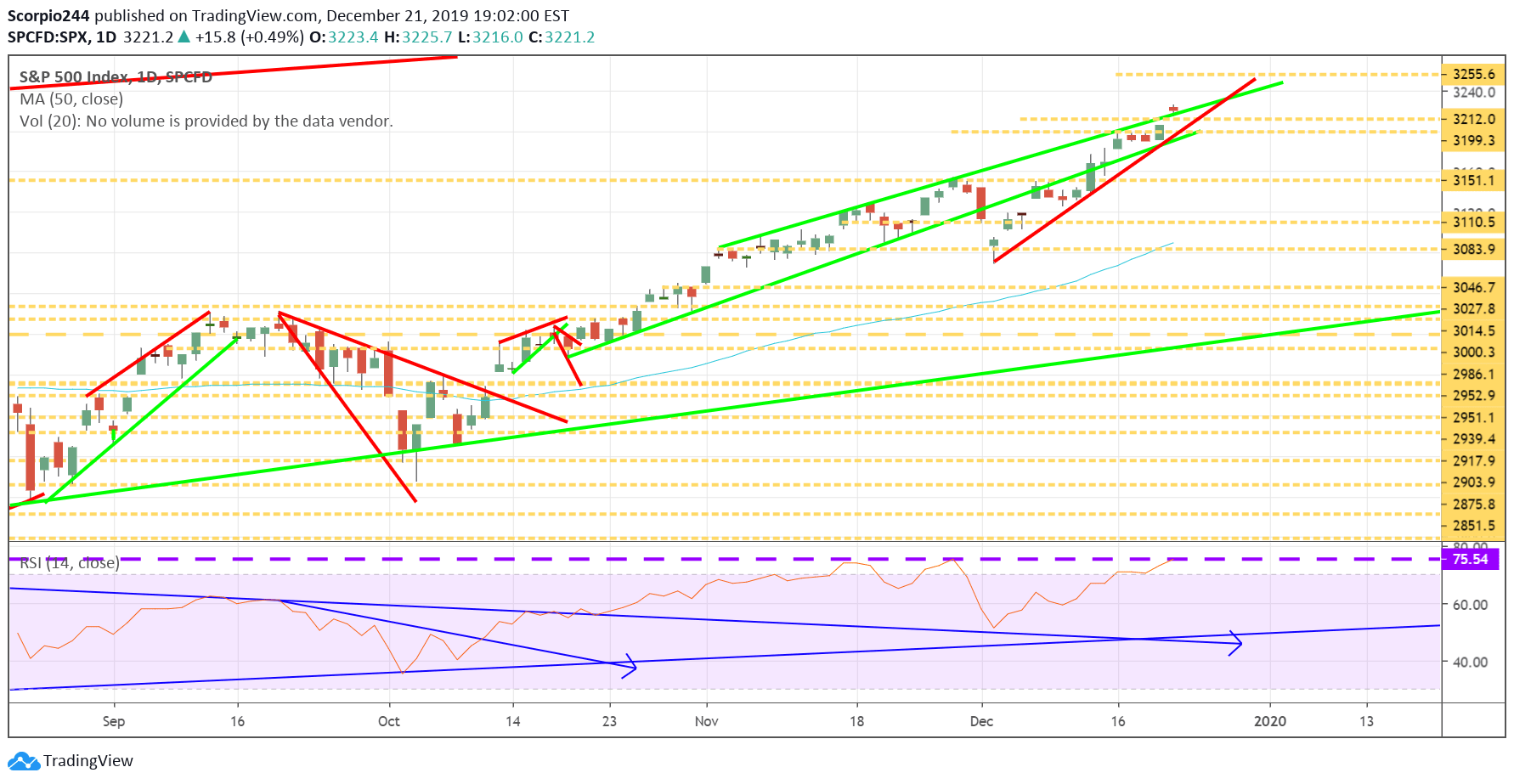

S&P 500 (SPY)

Stocks continued to push higher this past week, with the S&P 500 rising to 3,220. The index managed to avoid the potential rising wedge pattern; I was watching, and instead pushed higher above the upper end of the trading channel that formed on November 4. The good news is that stocks are likely to continue to rise this week with the potential for the S&P 500 to rise to around 3,255.

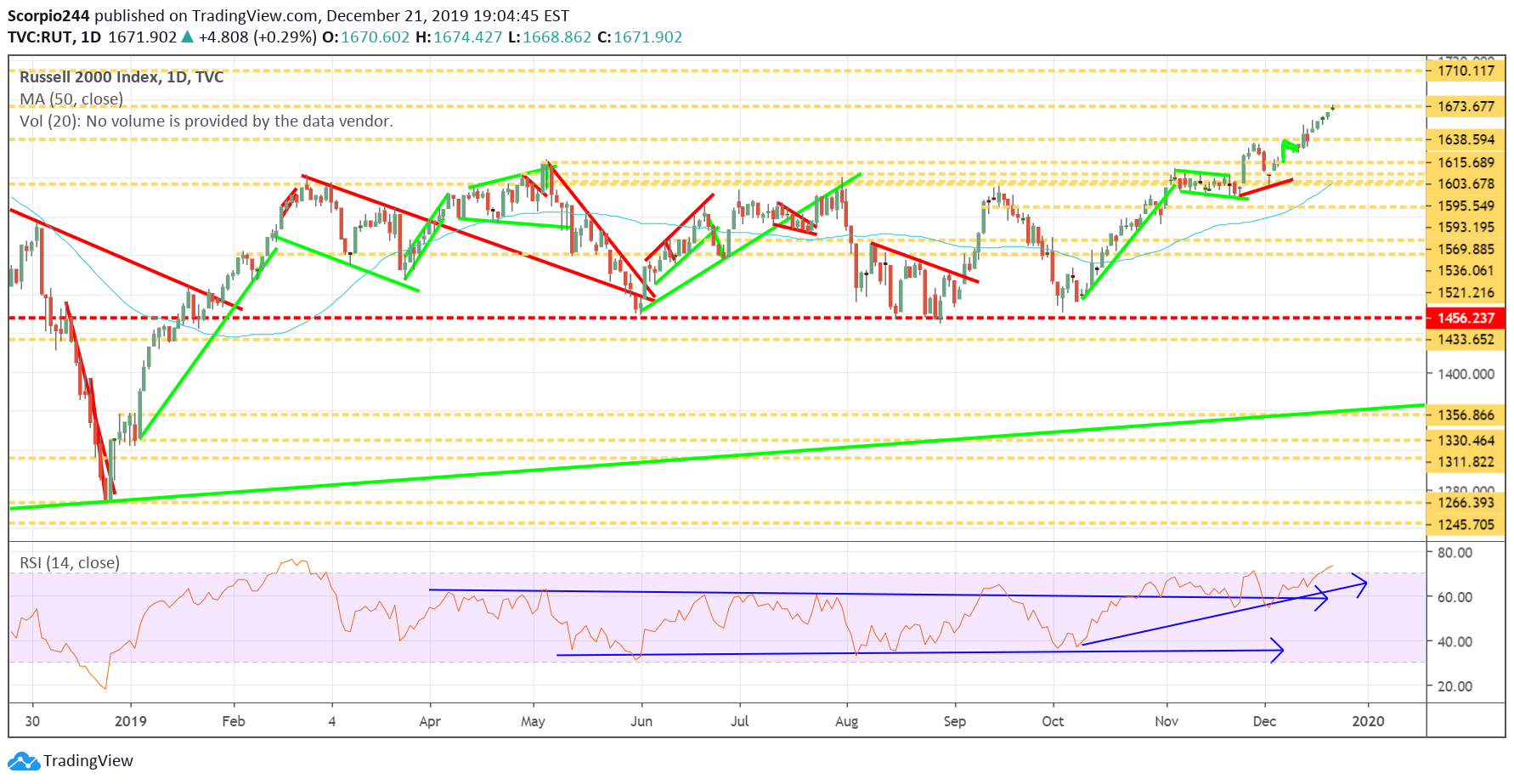

Russell (IWM)

The Russell also finished the week off higher, closing right at resistance at 1673. I continue to prefer the Russell over the S&P 500 into year-end. I think Russell can rise to around 1710, and it has more ground it needs to cover. That is likely one reason why I have held on to my January $166 IWM calls.

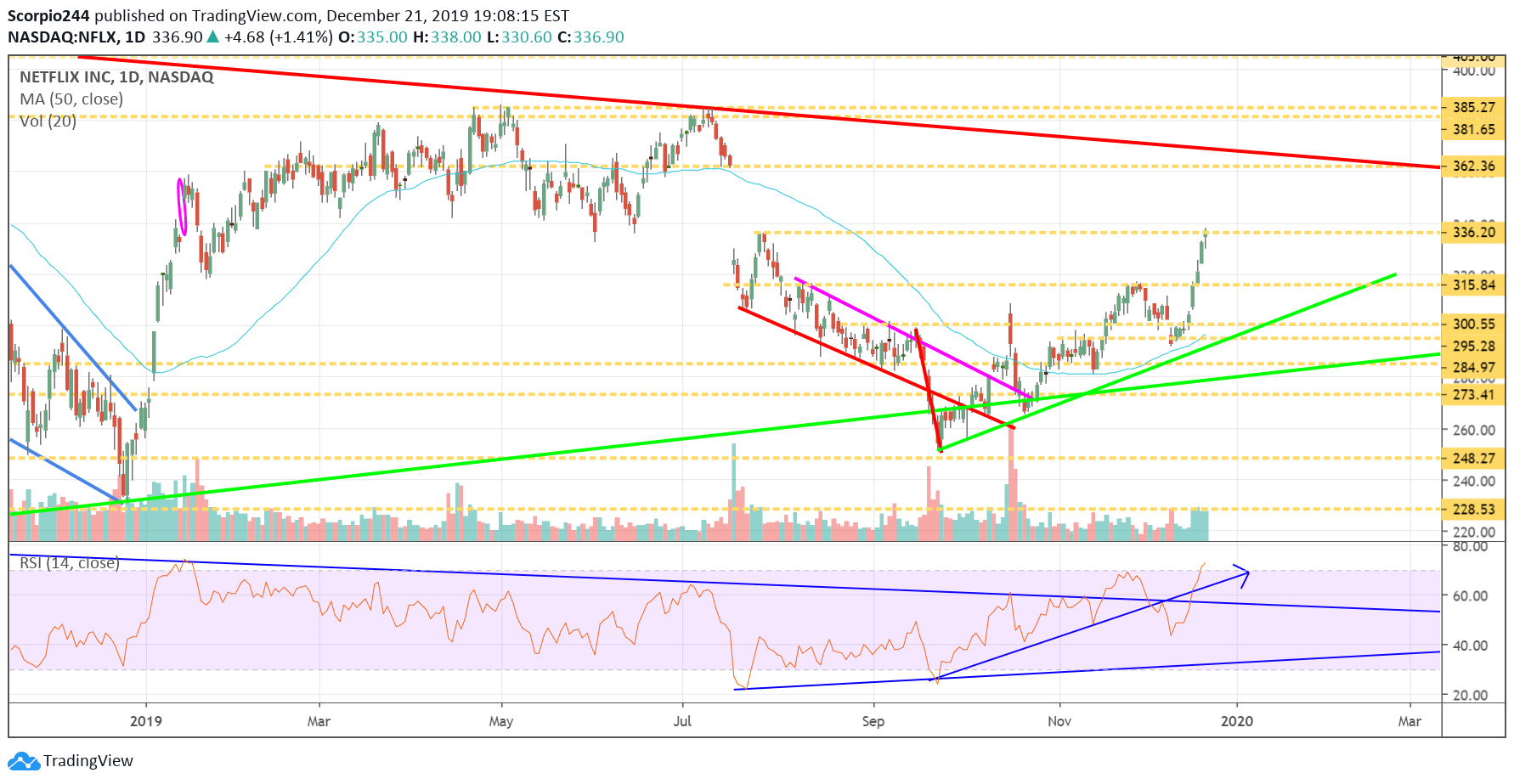

Netflix (NFLX)

Netflix (NASDAQ:NFLX) had a great week rising back to resistance at $336. I had noted earlier this week in a mid-day commentary that I thought if the stock could get over $336, it could look to fill the gap up to $362.

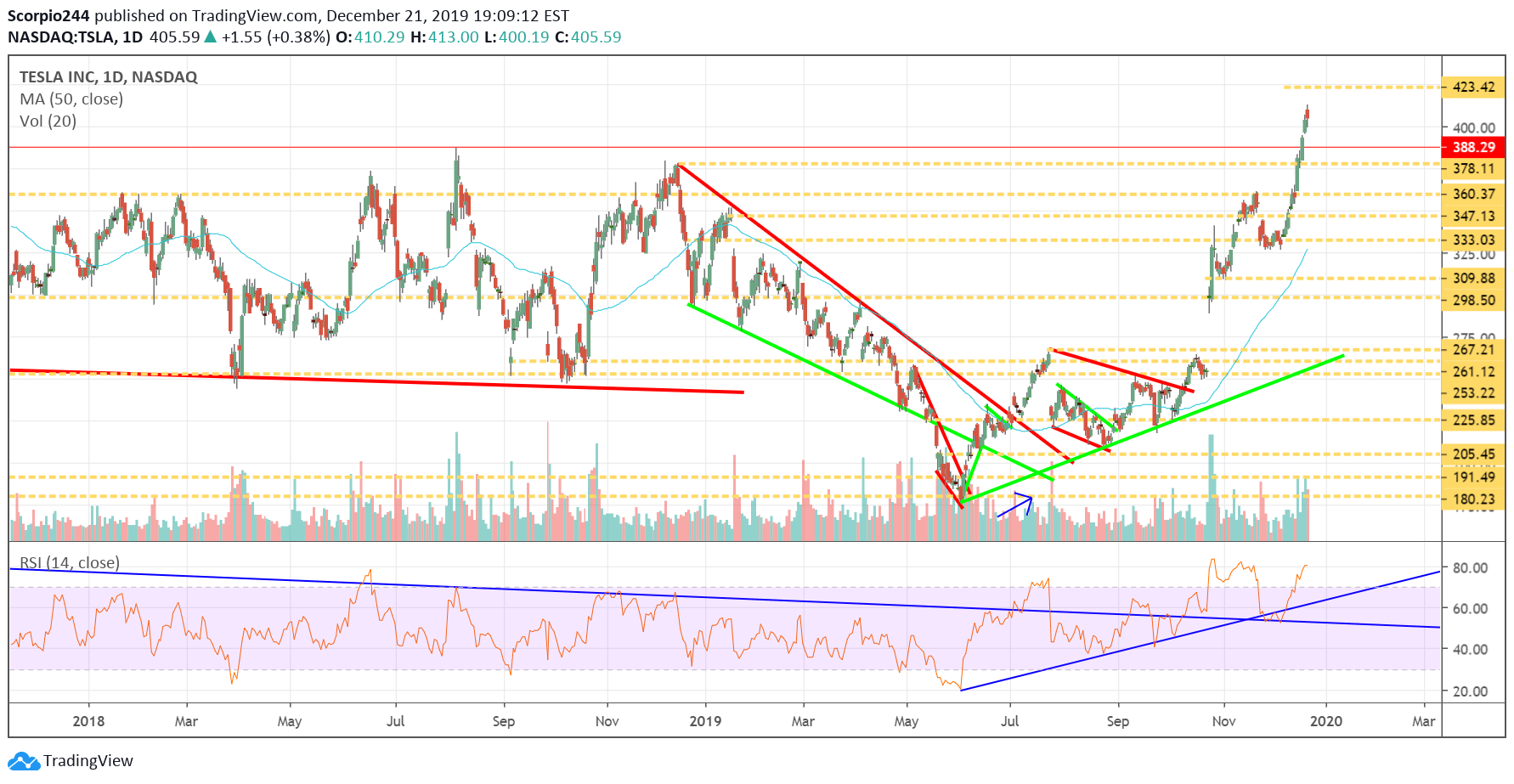

Tesla (TSLA)

Tesla (NASDAQ:TSLA) is also rocketing higher, and based on some bullish options activity and the chart, I think there is a chance to increase to $423.

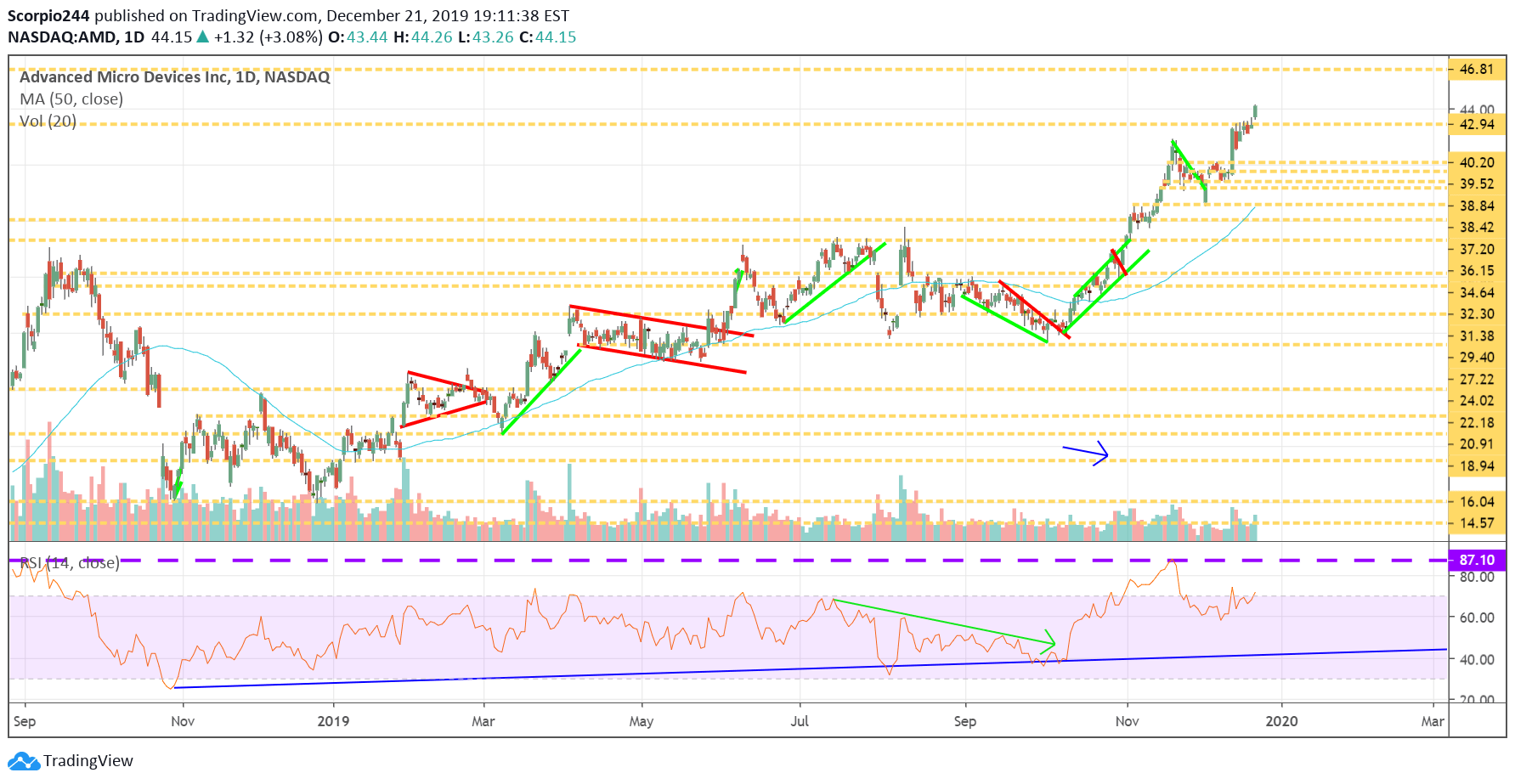

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) rose above $43 this past week, and now it stands a chance to push higher to $46.80.

AT&T (T)

AT&T (NYSE:T) has been steadily trending higher, and if it can clear $39.25, then perhaps it pushes to $41.80.

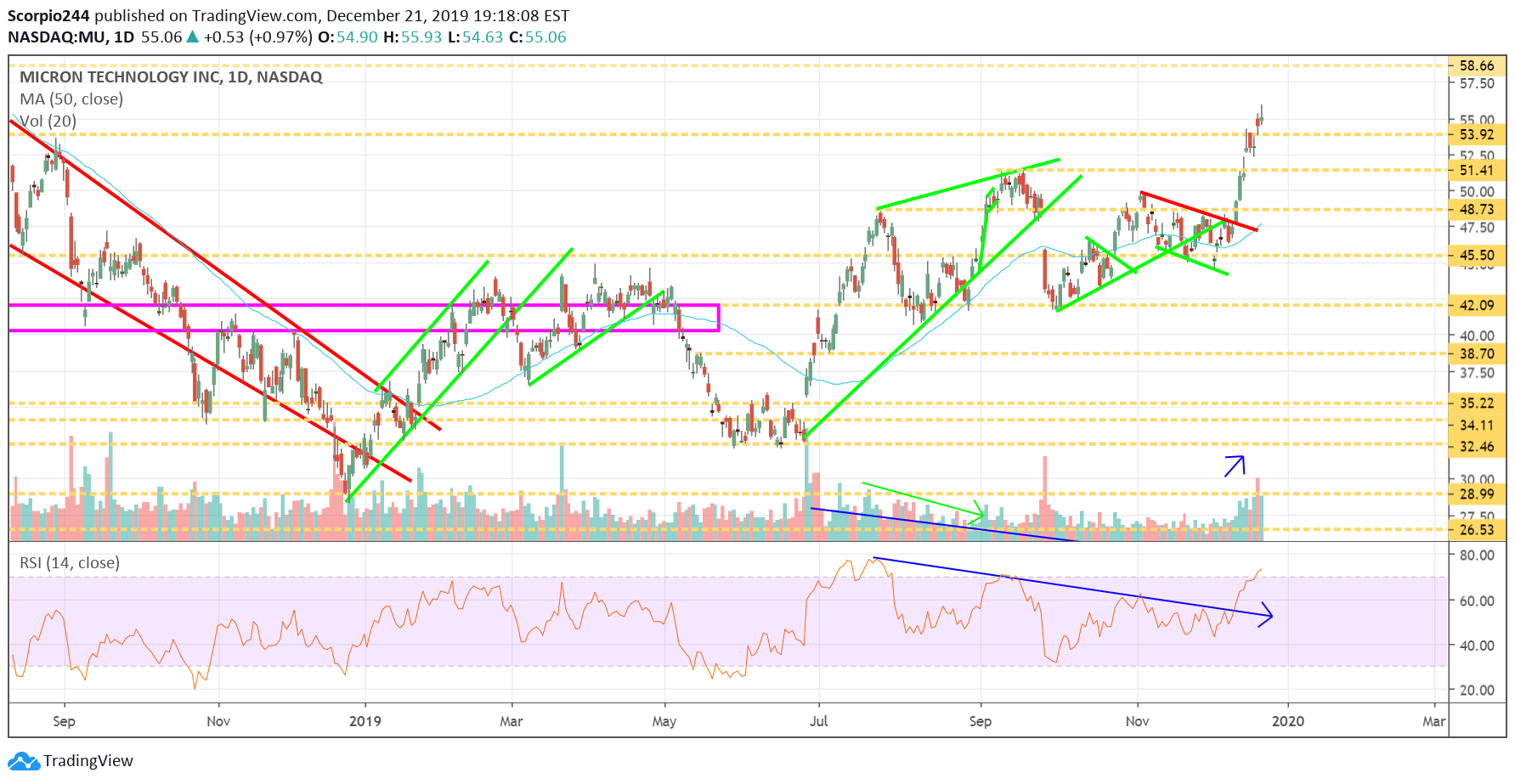

Micron (MU)

Micron (NASDAQ:MU) also had a good week, after its quarterly results and like the options traders were betting, the stock climbed. Now, $58.65 is the next level to watch for.