Stocks Made Record Closes, Dollar Firm

US stocks surged for another day overnight with the DJIA gained 154.64 pts, or 0.87% to close at 17959.44. S&P 500 rose 7.89 pts or 0.38% to close at 2078.54. Both were all time record closes. Asian equities, however, didn't follow and are stuck in tight range between gain and loss. Crude oil continues to be bounded in tight range above last week's low of 53.60. Gold seems to be giving up on 1200 level and dipped sharply and is now trading below 1180 handle. The dollar index extended recent rise and hit as high as 89.79. In the currency markets, the Japanese USD/JPY extends weakness on risk appetite. Dollar stays firm against euro, Swiss frank and Aussie.

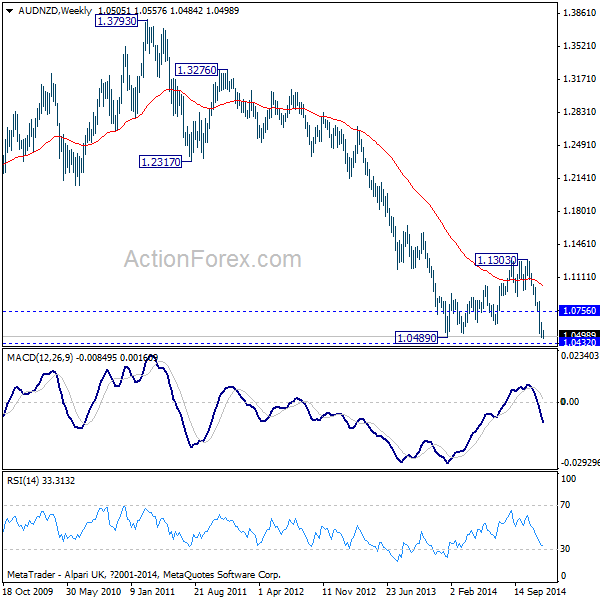

Released from New Zealand, trade deficit narrowed more than expected to NZD/USD -213m in November versus expectation of NZD -550m. Prior month's deficit was revised to NZD -911m. Exports dropped -9.5% yoy to NZD 4.02b while imports dropped -1/3% yoy to NZD 4.24b. AUD/NZD broke this year's low of 1.0489 and reached 1.0484 so far this week. The whole down trend from 1.3793 is resuming and should take out 2005 low of 1.0432 and target 1997 low of 1.0285. Near term outlook will stay bearish as long as 1.0756 resistance holds.

Looking ahead, UK will release Q3 GDP final, current account, index of services and BBA mortgage approvals in European session. From Canada, October GDP will be released. A long list of economic data will be released from US today. That includes Q3 GDP final, durable goods, house price index, U of Michigan confidence, new home sales and personal income and spending.