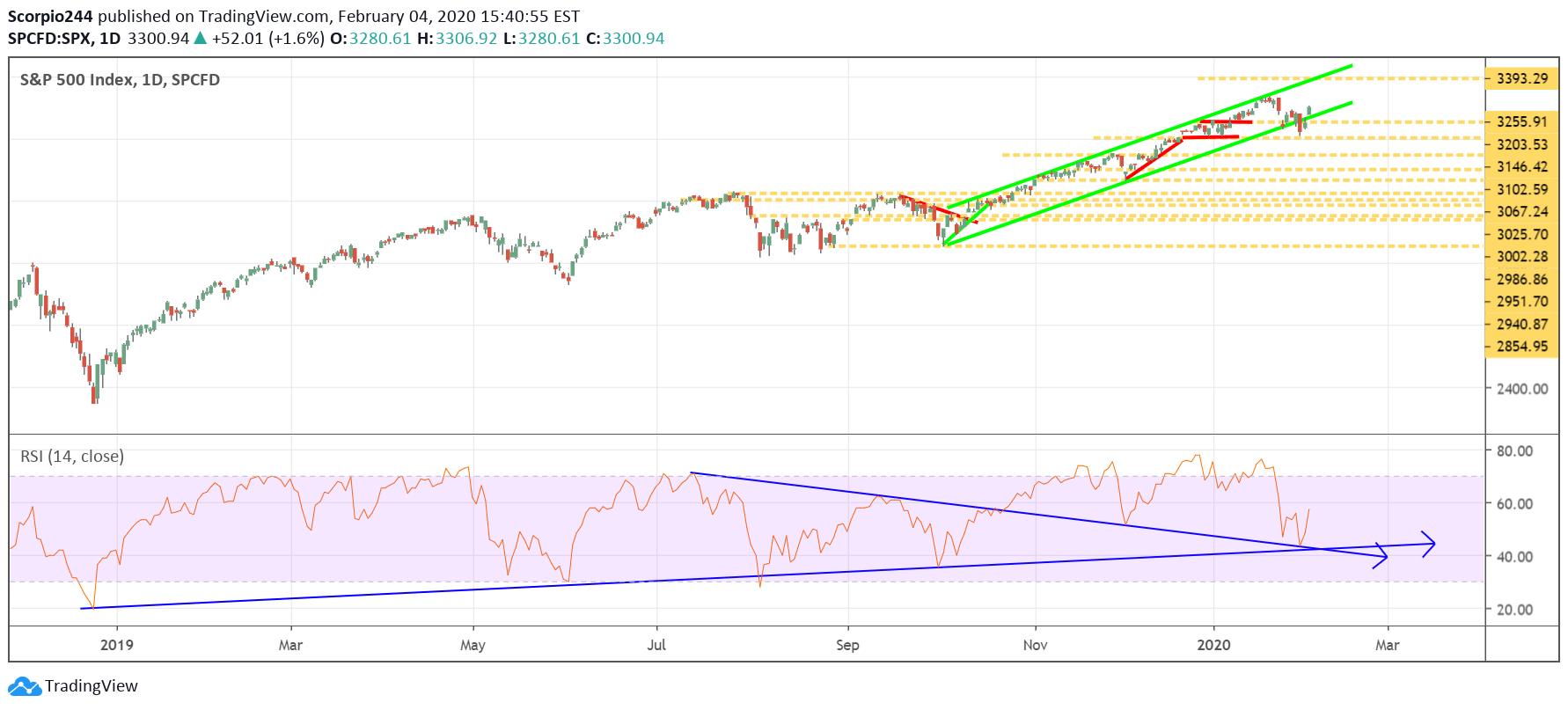

Stocks had a strong rally yesterday rising by around 1.5% to 3,298. The market has recovered all the losses from Friday and then some. The 3,305 level appears to be a bit of a challenge for the S&P 500, but I am guessing that the market continues to push higher back to its all-time highs.

The index managed to bounce right off the RSI uptrend, keeping the long-term uptrend in the S&P 500 in place.

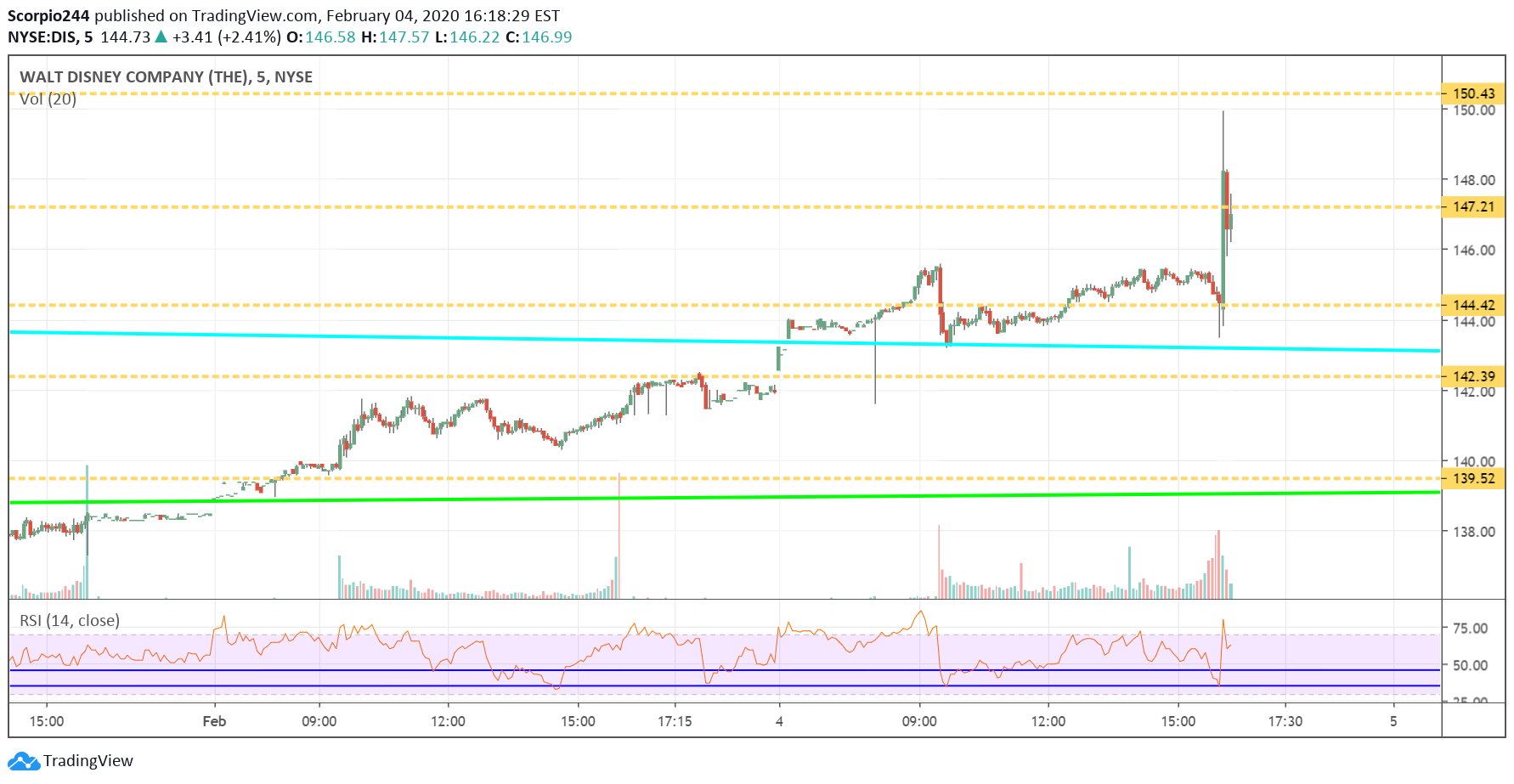

Disney (DIS)

Disney was popping after beating results on both the top and bottom lines and posted better than expected subscribers with 26.5 million for Disney+. Good, for the options guys, they seemed to nail it again. The stock was at $143, and then again at $137 when they were active. The next level of resistance comes around $147 and then at $150.

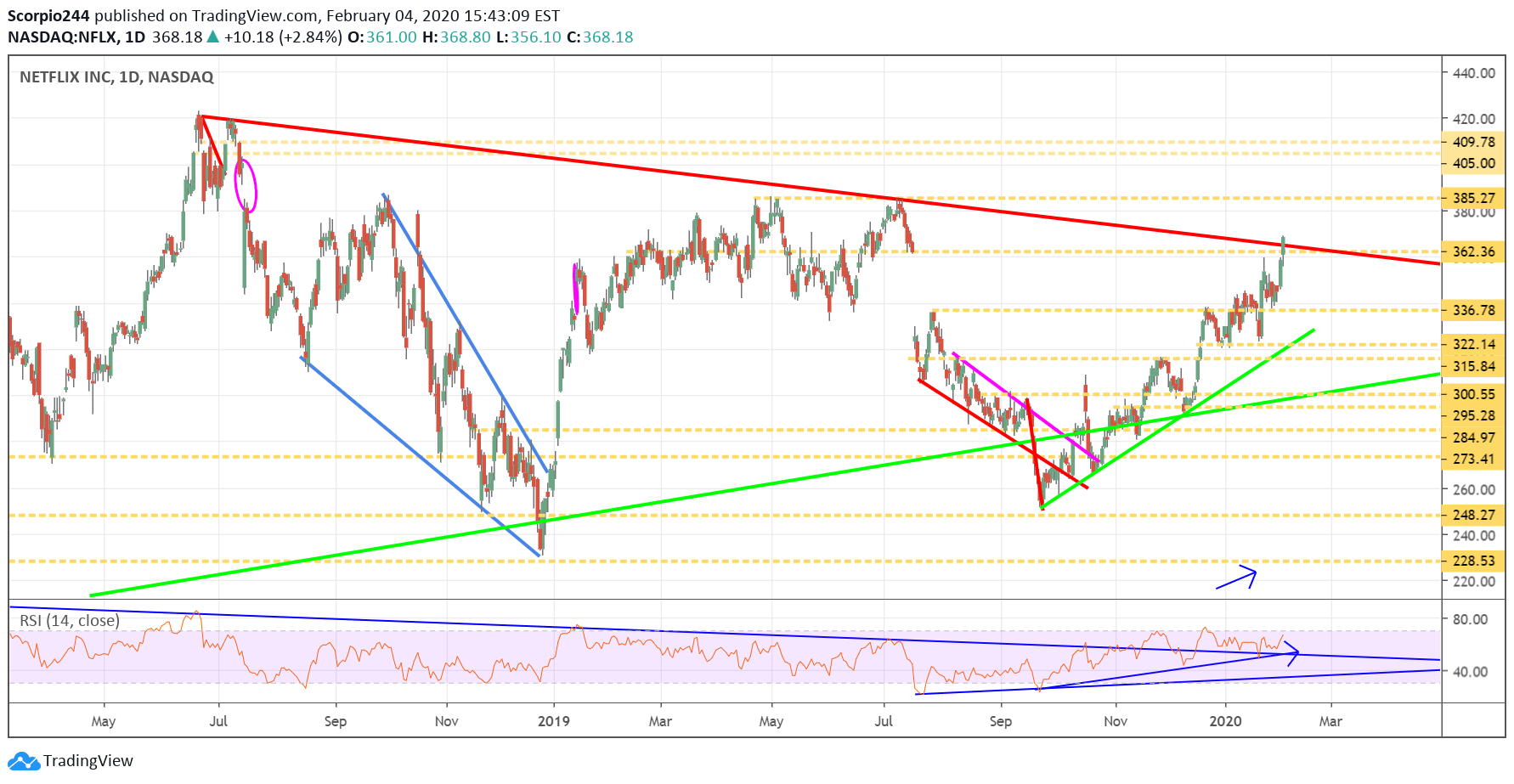

Netflix (NFLX)

Netflix (NASDAQ:NFLX) had a big day, and again, I saw more bullish betting in this name, while it broke above a significant downtrend.

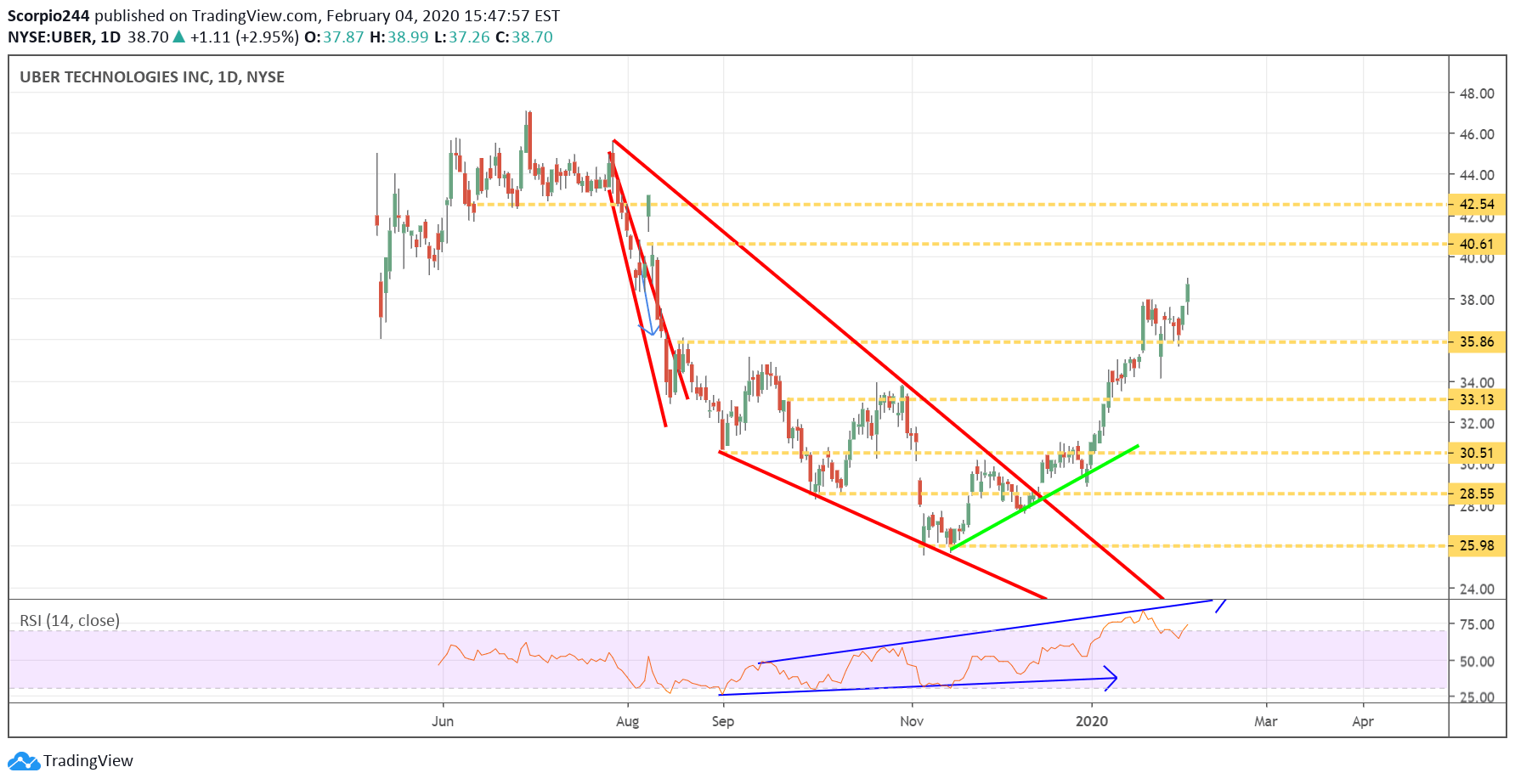

Uber (UBER)

Meanwhile, Uber (NYSE:UBER) continues to see some strength heading into results, with the stock approaching resistance around $40.60. I have also been seeing some bullish betting that suggests the stock rises above $41 following results.

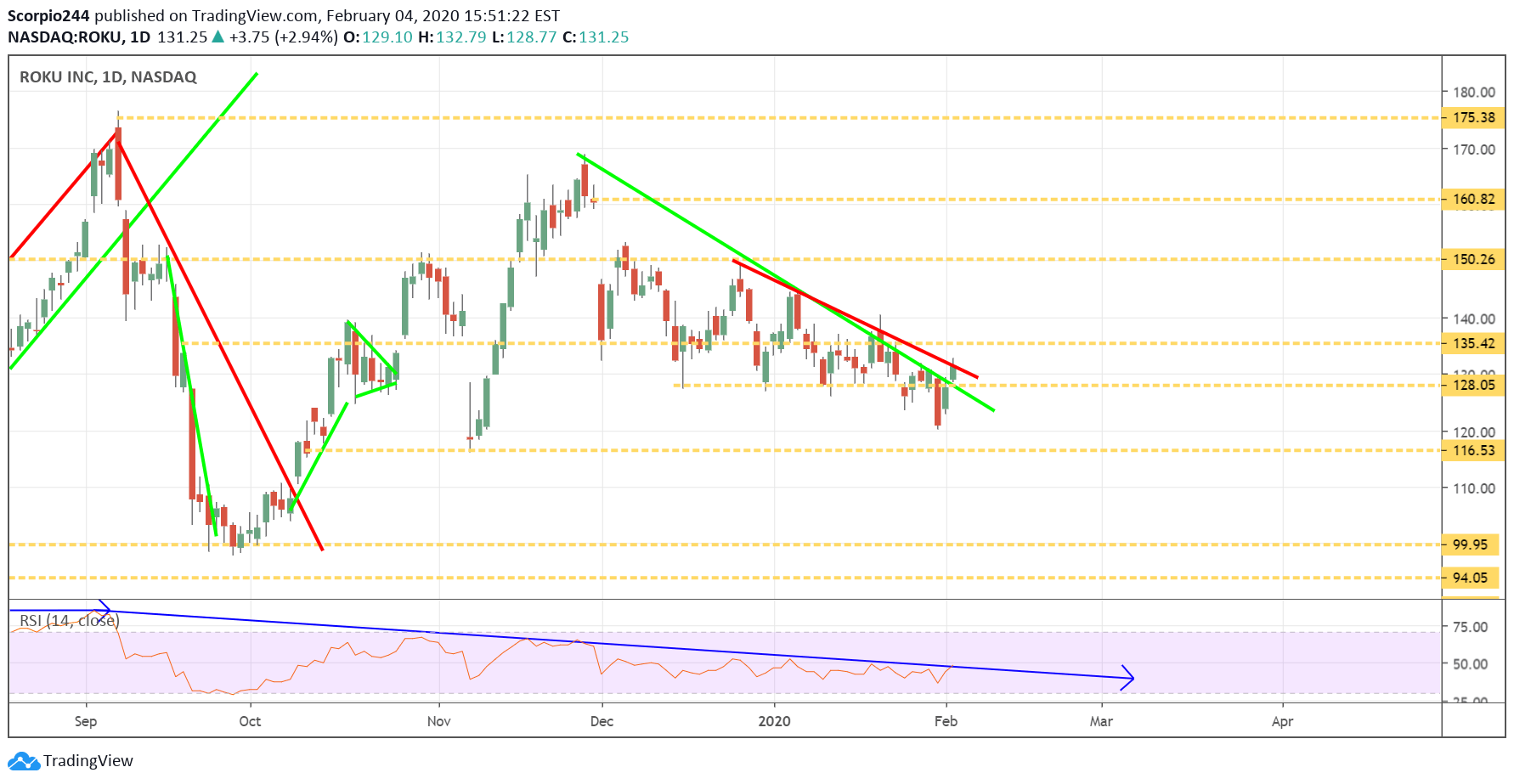

Roku (ROKU)

I know people are probably cheering Roku's (NASDAQ:ROKU) move higher yesterday. But it isn’t time to celebrate yet, notice how the stock continues to fail at the downtrend.

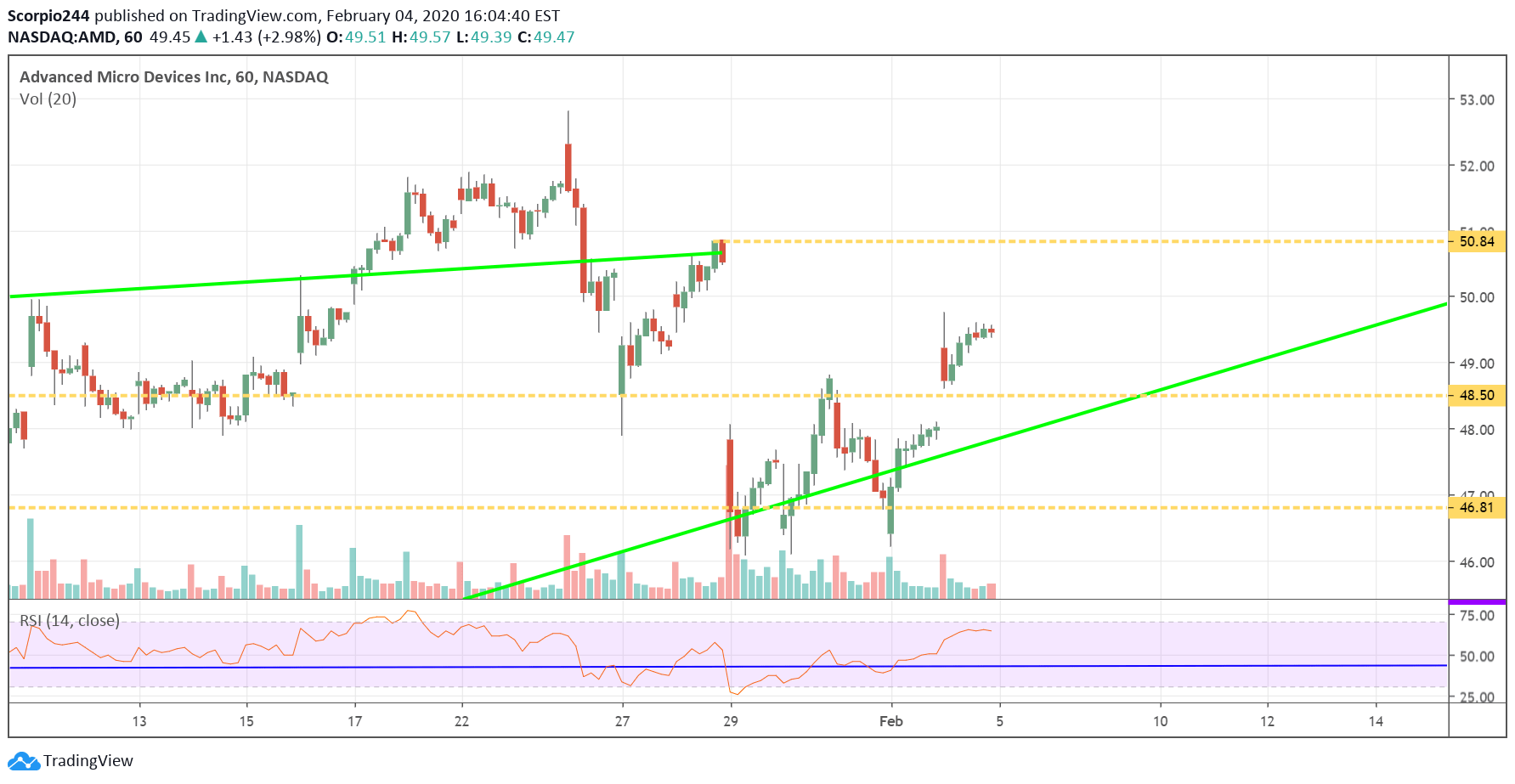

AMD (AMD)

Advanced Micro Devices (NASDAQ:AMD) is moving higher and appears to be working towards to fill that gap up at $51.