Stocks fell sharply on Apr. 26, with the S&P 500 down 2.8%, while the Invesco QQQ Trust (NASDAQ:QQQ) dropped by 3.8%. The Qs made a new closing low yesterday when they fell below the Mar. 14 prices.

I will tell you that story around this market is getting more and more complex, with growth fears now creeping into the equation.

If the growth concerns persist, it will become evident through nominal rates falling on the long-end of the curve, breakeven inflation expectations dropping, and the treasury curve flattening and heading back towards inversion.

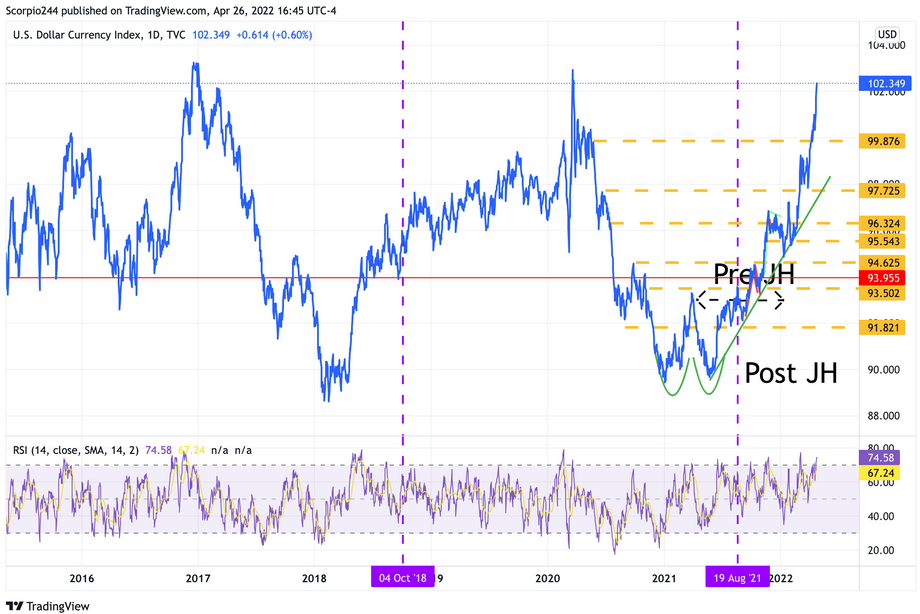

Two days does not make a trend, but clearly, there is evidence mounting, and one does not have to look further than what is happening with the currency market and the dollar index.

The dollar is ripping against every major FX, and the index has cleared the 102 level. With energy and food prices soaring and rates rising, there is only so much the global economy can absorb, not to mention China’s Zero COVID Policy.

It is one reason why I do not believe the Fed will be able to raise rates nearly as much has been indicated. But the Fed needs the market to think it will so that asset prices fall and rates rise and that the markets do all the heavy lifting. It seems the market is finally doing what the Fed wishes.

Financial Conditions

It would be best if you kept an eye on financial conditions; the IEF/LQD ratio works well enough for this. Remember, financial conditions are precisely what the Fed wants to tighten, and as long as those are tightening, this market is going nowhere but lower.

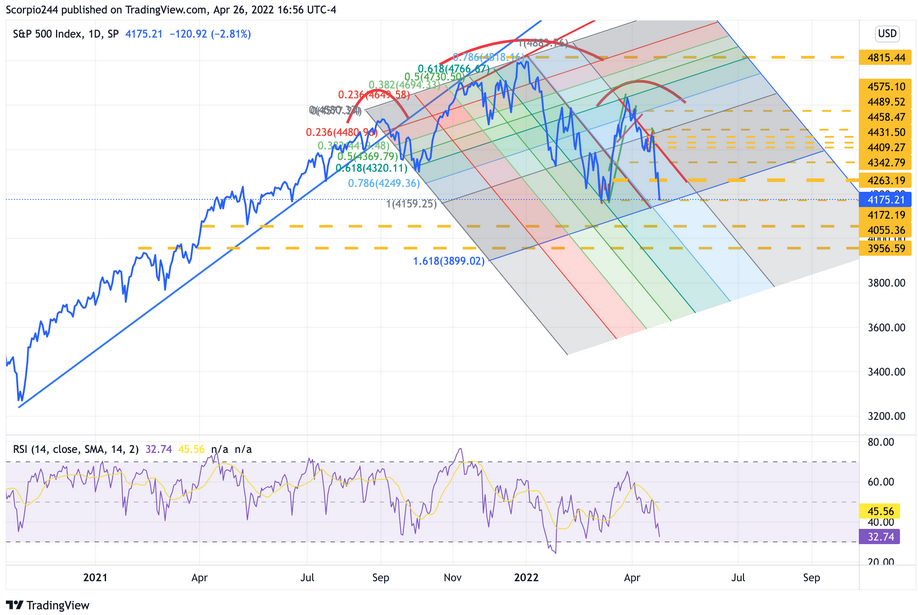

S&P 500

The S&P 500 closed right on support, and given where the market is and the upcoming FOMC meeting, I don’t think the bottom is here yet. If the SPX drops below 4,170, the next likely spot for support will not come until the 4,050 area.

NASDAQ Invesco QQQ Trust ETF

The Qs were trading below support around $317 in the after hours, and there was only minor support around $312. I would look for more meaningful support, around $300. That price was not as far off as it may seem.

Micron

Micron Technology (NASDAQ:MU) fell below support at around $69, and it doesn’t look good for the shares. There is that gap just waiting to be filled, around $58.

Advanced Micro Devices

Advanced Micro Devices (NASDAQ:AMD) continues to drop, and Texas Instruments' (NASDAQ:TXN) weak guidance doesn’t seem to be helping.

The stock is approaching another level of support, around $85, and there is not much between that and $73. You have to think about some of these stocks reaching a bottom, but the question is where.

If you want to play fill the gap, that price may not be until $61.

Alphabet

Alphabet (NASDAQ:GOOGL) missed earnings, and I have not had the time to look through much. But what I noticed was the loss in other income, which appears to be a big part of the miss.

I will have to look closer, but the market was not happy with the results. Believe it or not, there is a gap at $1950 that needs to be filled with this one.