Investing.com’s stocks of the week

Stocks seemed confused at the end of yesterday regarding the latest Fed commentary, and to be honest listening to the press conference, it was easy to get confused.

Ample reserve exceeding excess reserves, and what is considered to be ample, versus what is ample enough to sustain the excess reserve. I’m just rambling here, but that might have well been what Chairman Powell said, and if you weren’t listening with a great deal of concentration, it was impossible to grasp. My main takeaway: the current pace of the balance sheet expansion isn’t going to last, and is likely to end at some point in the second quarter. However, it will likely continue, just a slower pace, more in line with the demands of the economy and monetary base.

Additionally, they made some minor changes to language:

The Committee judges that the current stance of monetary policy is appropriate to support sustained expansion of economic activity, strong labor market conditions, and inflation nearthe Committee’s symmetric 2 percent objective.

The Fed wants to make it clear that inflation below 2% is something that is not acceptable and is looking for a return above 2%. It would tell me that the outlook for interest rates policy is likely to be lower for even longer.

It should provide a smooth path for the equity market longer-term and higher one.

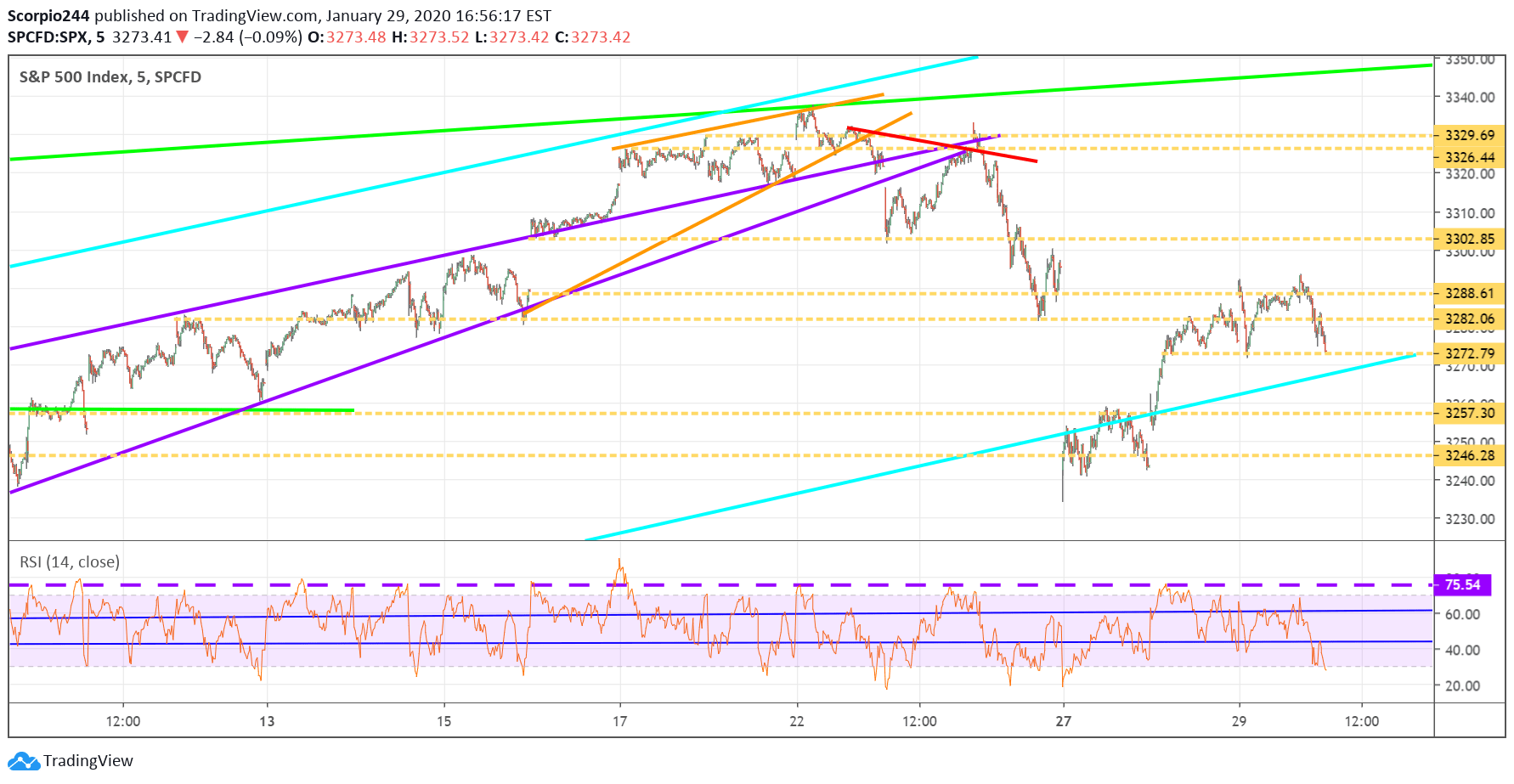

S&P 500 (SPY)

The chart shows that the S&P 500 got to resistance in that 3,290 region and just gave back all the gains to finish flat to finish at 3,272. This 3,272 region has become a level of support for the S&P 500 and should provide a place for stocks to rise from. Again, the S&P 500 seems placed well above the uptrend at the moment.

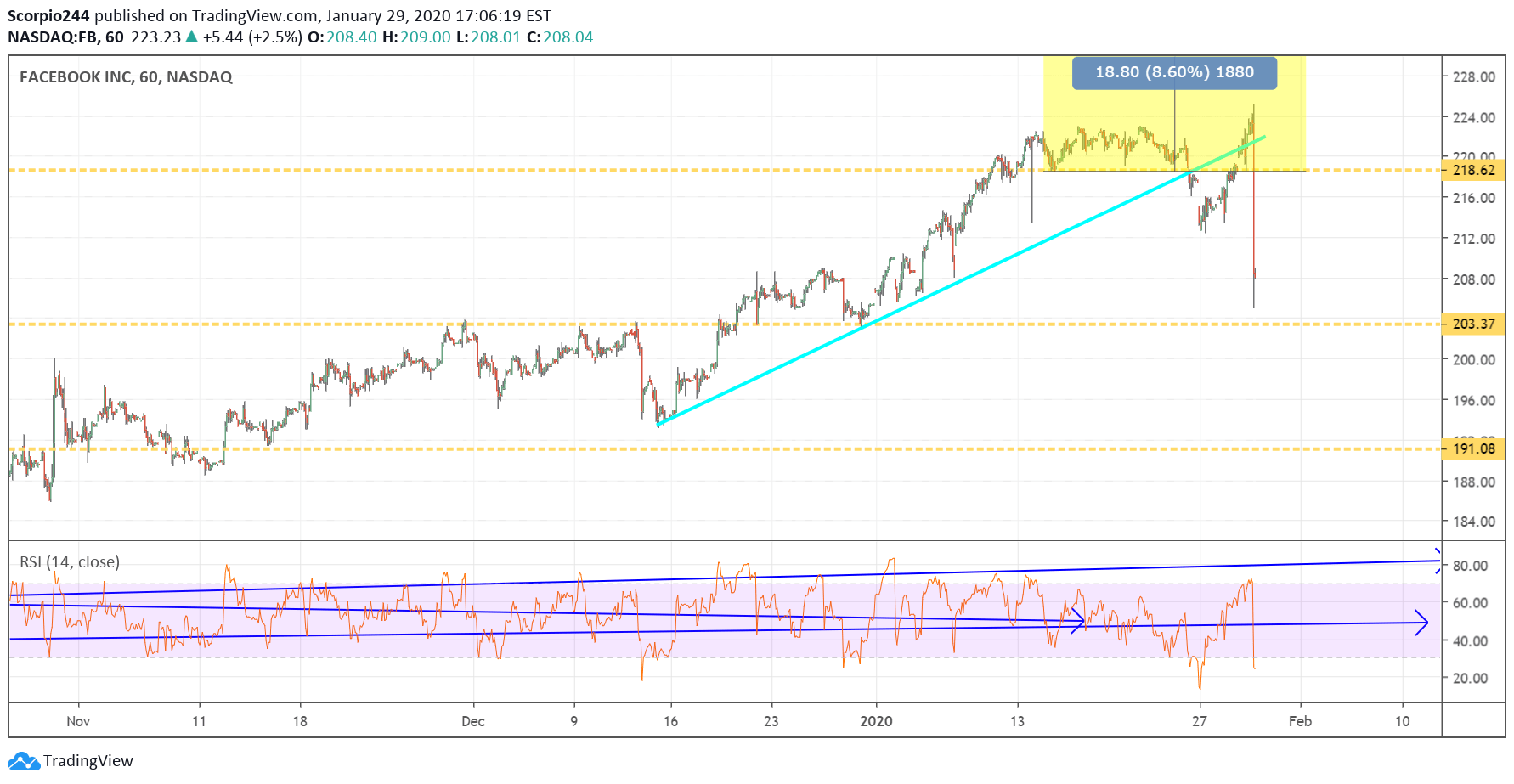

Facebook (FB)

Facebook (NASDAQ:FB) is dropping after reporting better than expected earnings and inline revenue. The revenue guidance I think it is not very pleasant, with the company looking for decelerating growth and no relief from their rising costs. Earnings growth doesn't look as if it will be getting better anytime soon. We will see what comes out of the earnings call. It seems like $203 is the next level to watch for. It looks like the options traders, and I got this one wrong.

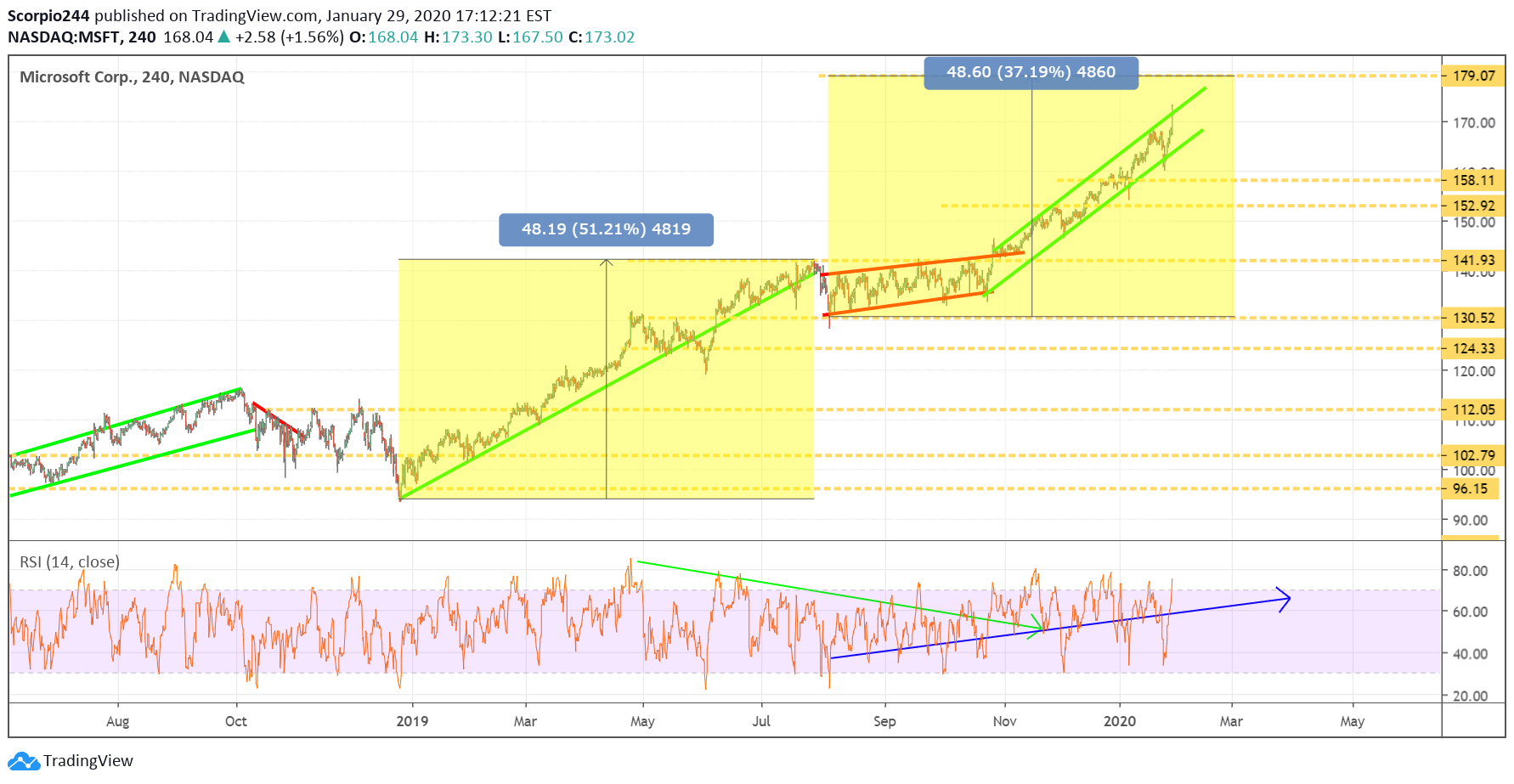

Microsoft (MSFT)

Meanwhile, Microsoft (NASDAQ:MSFT) posted some strong results, with a big beat on the top and bottom. Azure continues to have fantastic growth, climbing 62% in the quarter. The options traders saw this one rising to around $176 following results, and it seems to be on the way there, currently at $175.50. I had mapped out an increase to about $179. It looks revenue guidance for the second quarter is better than expected at the mid-point as well

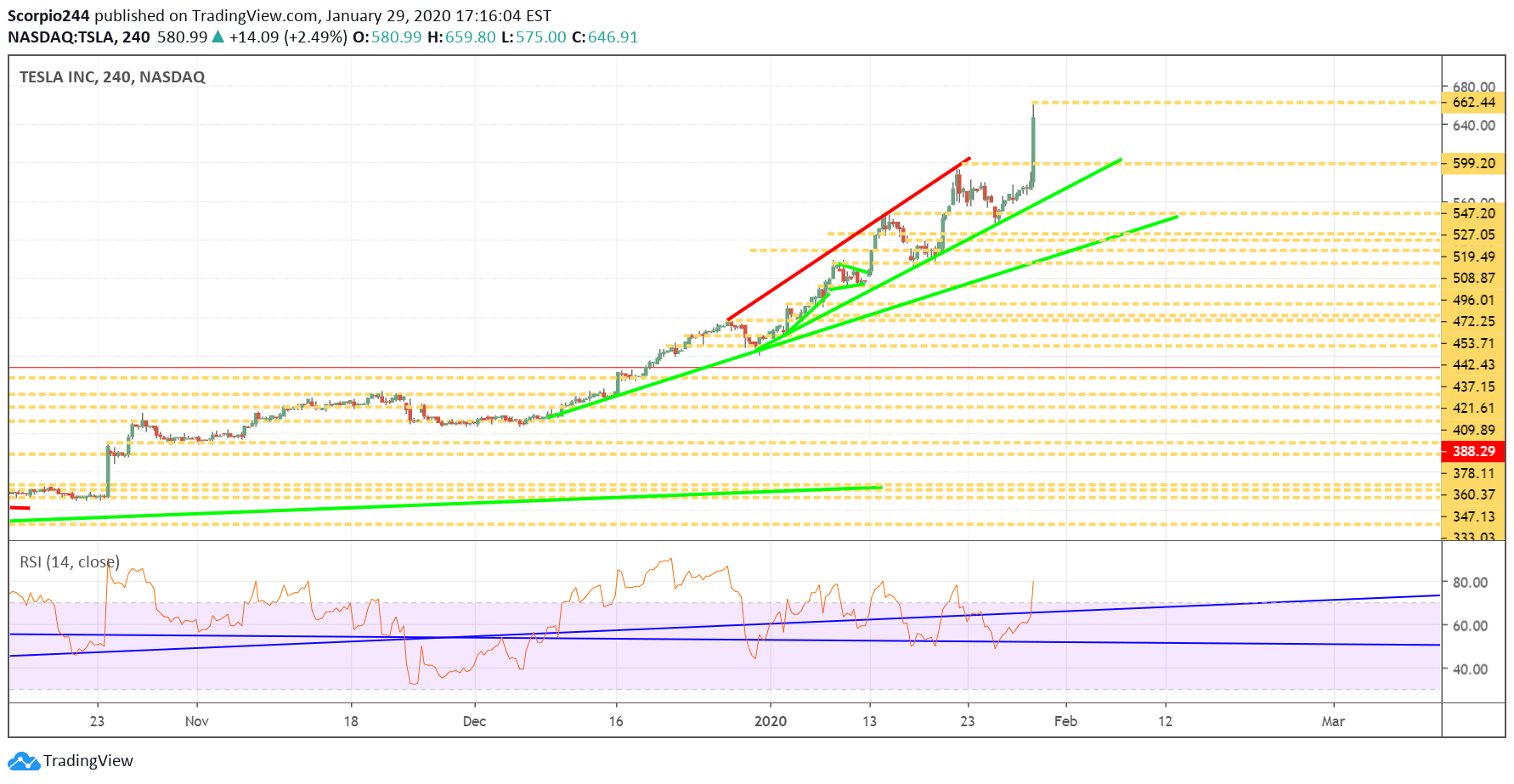

Tesla (TSLA)

Tesla (NASDAQ:TSLA) is up too after blowing out earnings and guiding to more than 500,000 deliveries in 2020. The stock is currently trading at $650 in the after hours, and this is likely a case where analysts are going to have to raise their earnings and revenue estimates significantly following these results. So I’m going to need a few days to figure out a fundamental valuation. For now, I marked $662 as resistance because that its the highest price on the day.

GE (GE)

GE had a huge move higher, rising above resistance and is likely on its way to $13.30.

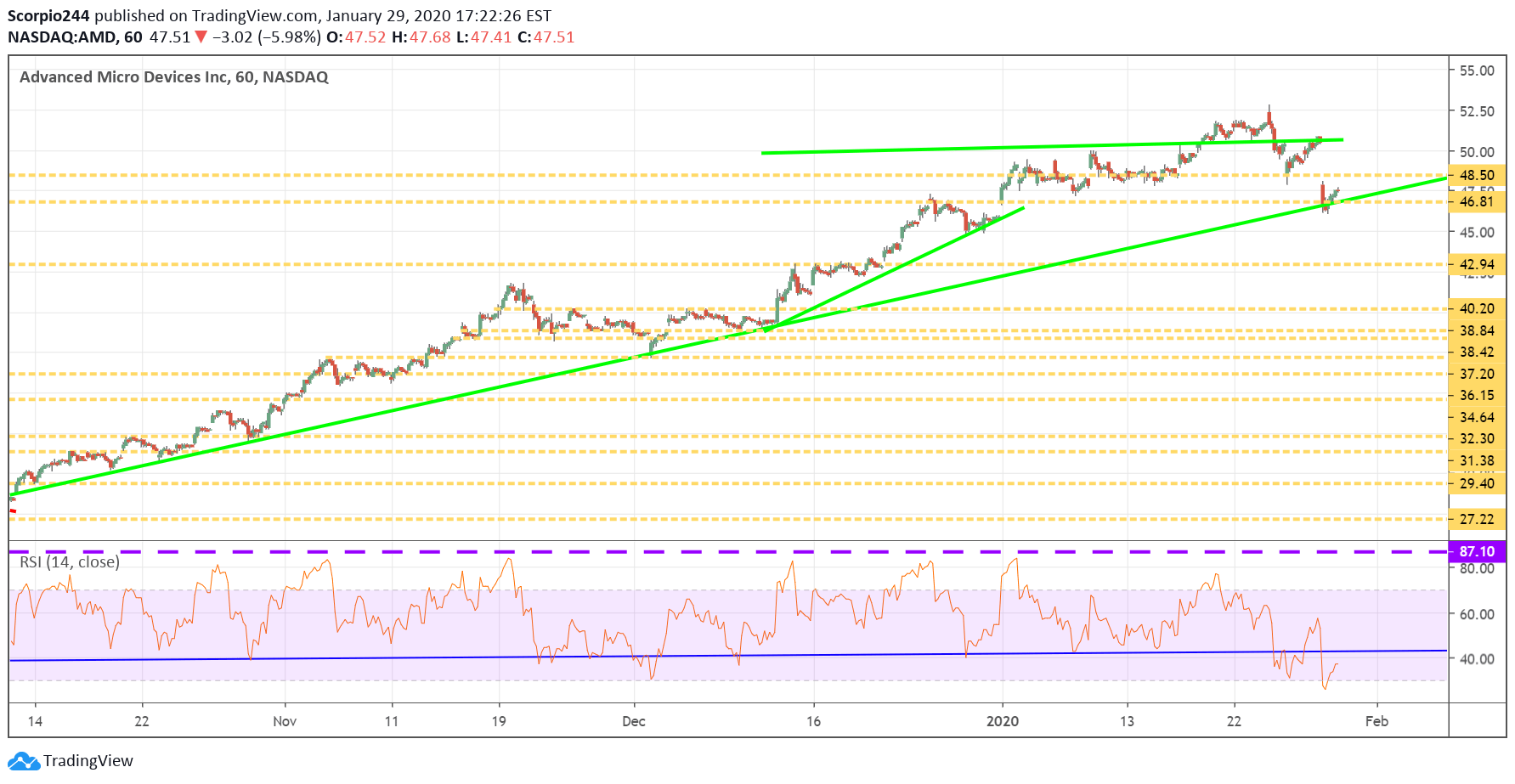

AMD (AMD)

AMD fell sharply yesterday, but as I noted multiple times that $46.80 was the line in the sand and as long as that level held, it would be a win. Well, it held, so I think we see a gap fill back up to $51.