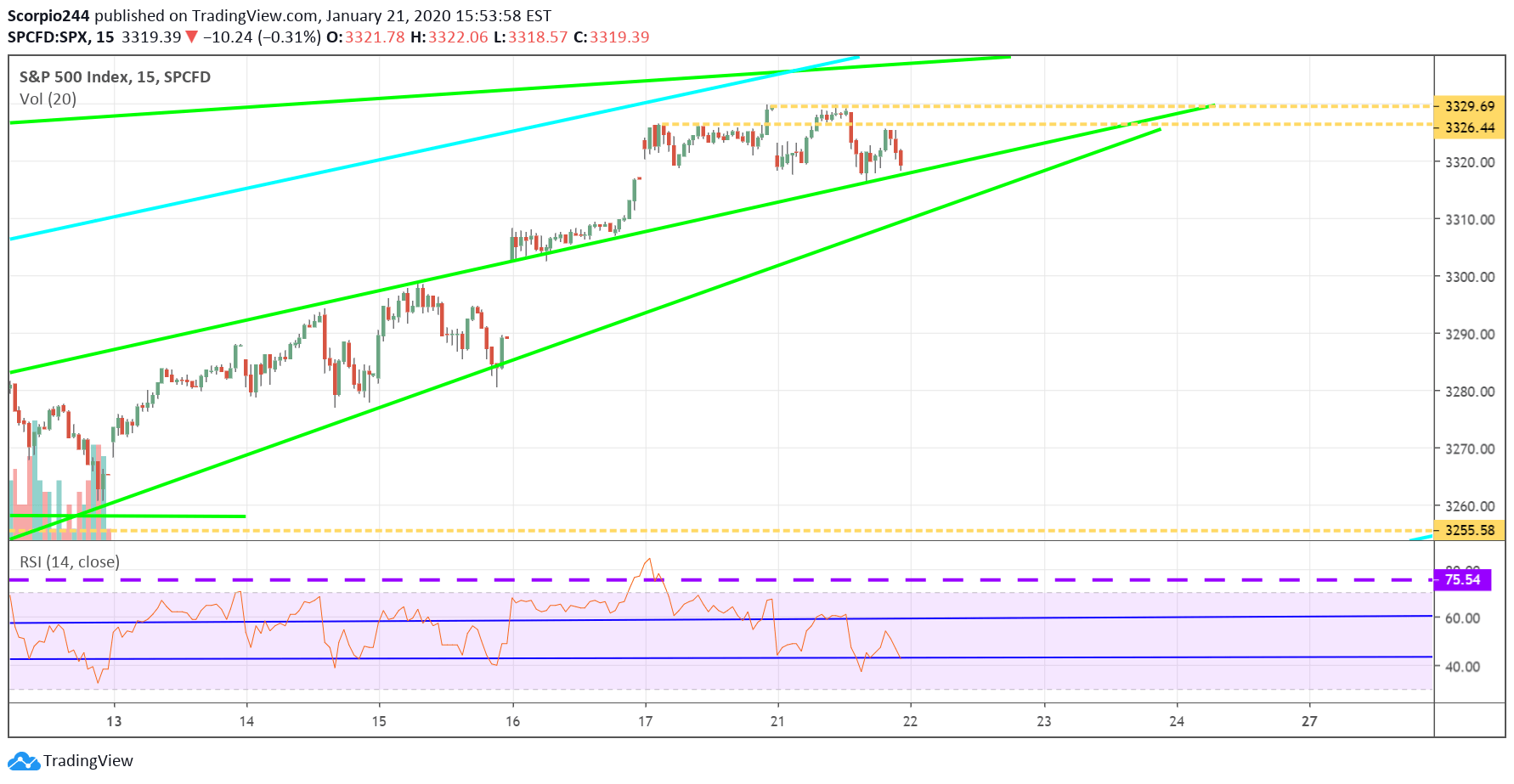

S&P 500 (SPY)

Stocks had a down day with the S&P 500 falling by roughly 25 bps, and closing around 3,320. But more important is how the index managed to struggle around resistance in the 3,325 to 3,330 region. The big question will be what happens at the uptrend, also known as the upper side of the rising wedge, with the potential for the first test of support around 3,300.

I noted on the mid-day update to be careful that it appeared the market was merely filling gaps, and it looks that is what happened yesterday. So we need to be cautious because there are several signs that suggest a change of trend may be occurring.

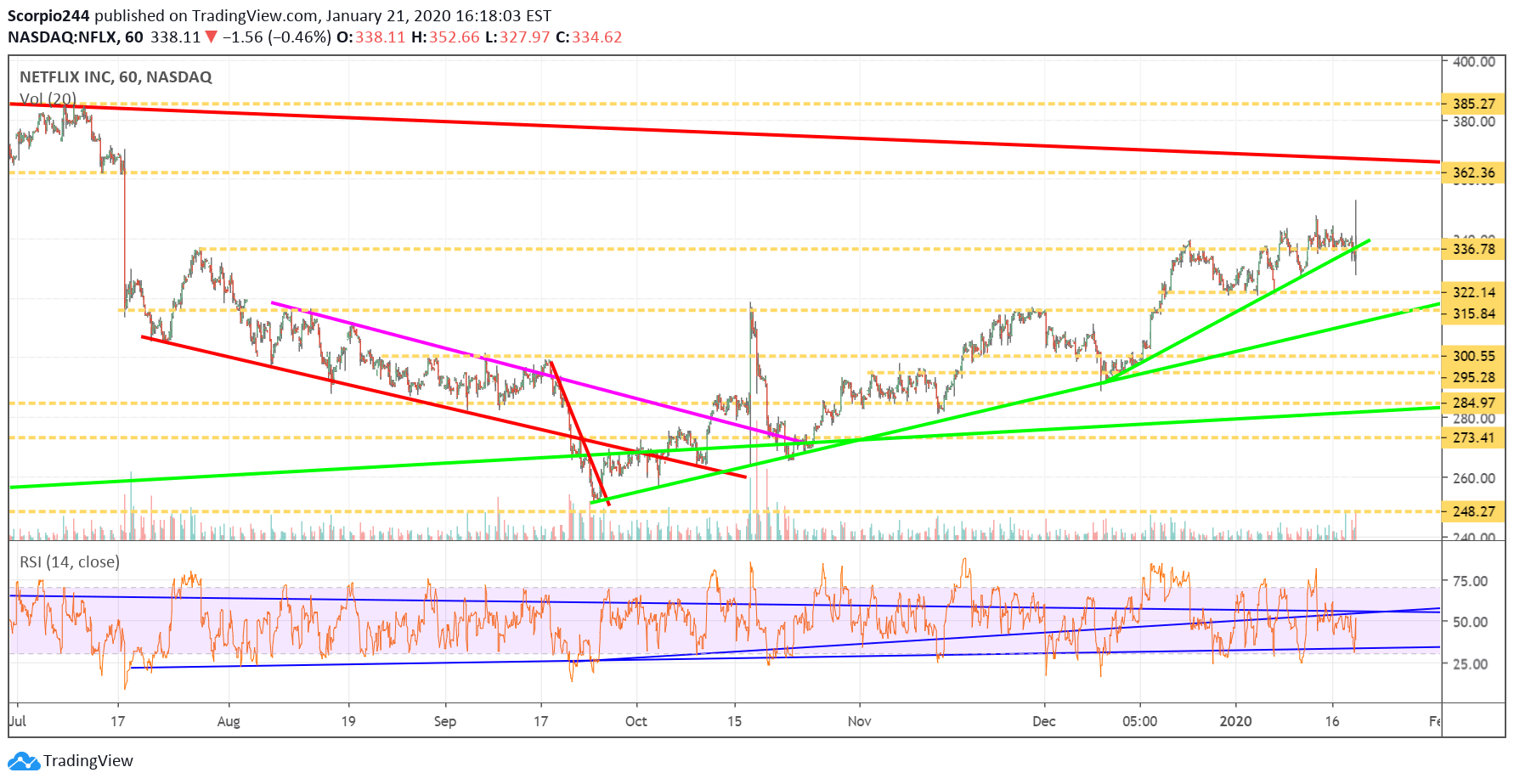

Netflix (NFLX)

If the competition of streaming media services is hurting Netflix (NASDAQ:NFLX), they sure didn’t show up in the results with net additions of 8.7 million. The only reason I think the stock is trading slightly lower is that the guidance for the first quarter came in lower at 7 million. But the first quarter historically is the best quarter of the year for the company, so we will have to wait to see if they are low balling their guidance. Anyway, I thought the results were good, and the company is projecting, easing negative free cash flow for 2020. Nevertheless, the stock seems to be hardly responding. These results certainly didn’t make me grow more bearish so my view of its rising to $360 hasn’t changed.

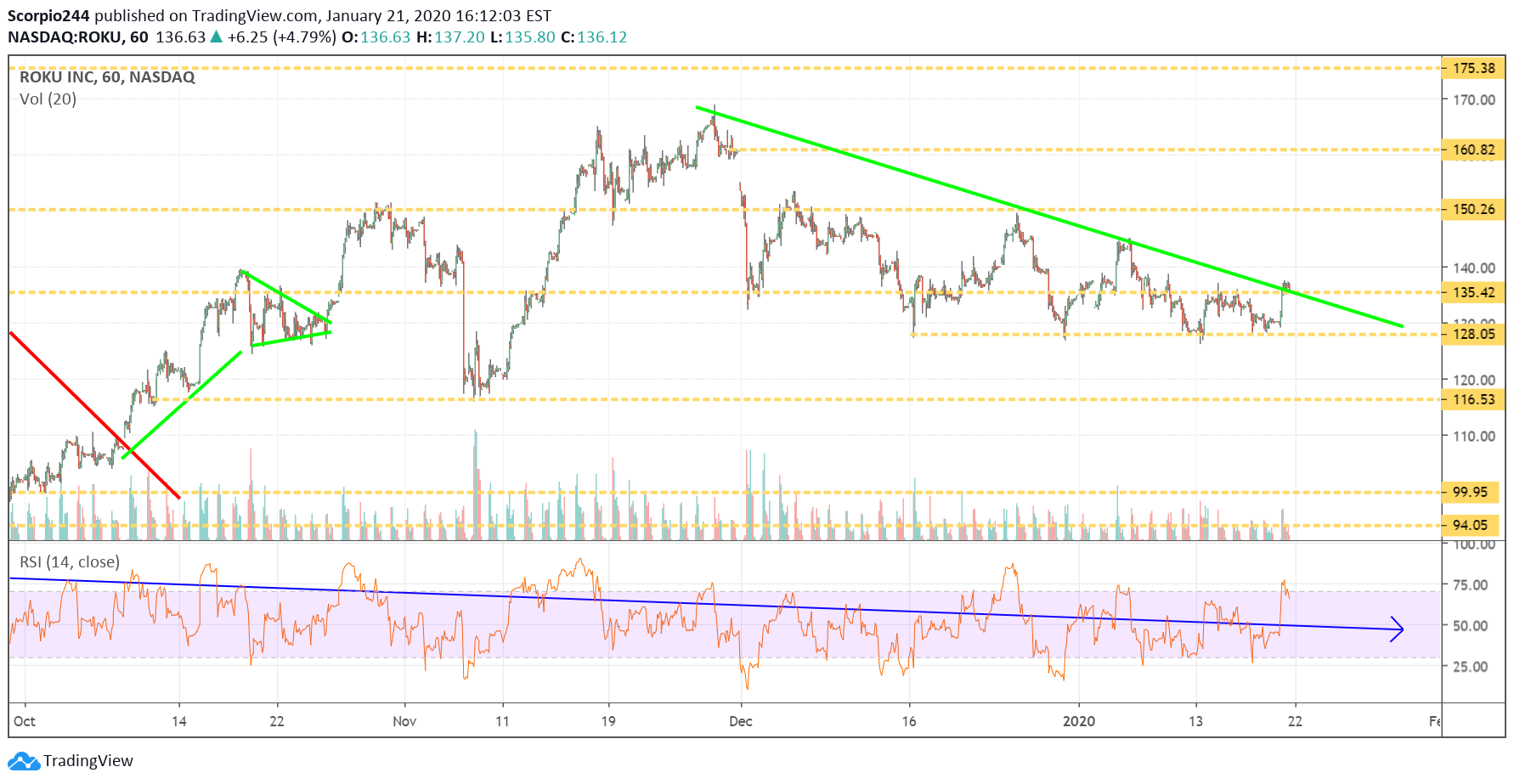

Roku (ROKU)

Roku (NASDAQ:ROKU) increased by about 5% to finish yesterday around $136.75. My problem is now the stock is right on that trend line, and that doesn’t make me feel too great. It tells me we find out a lot today, in terms of what is next.

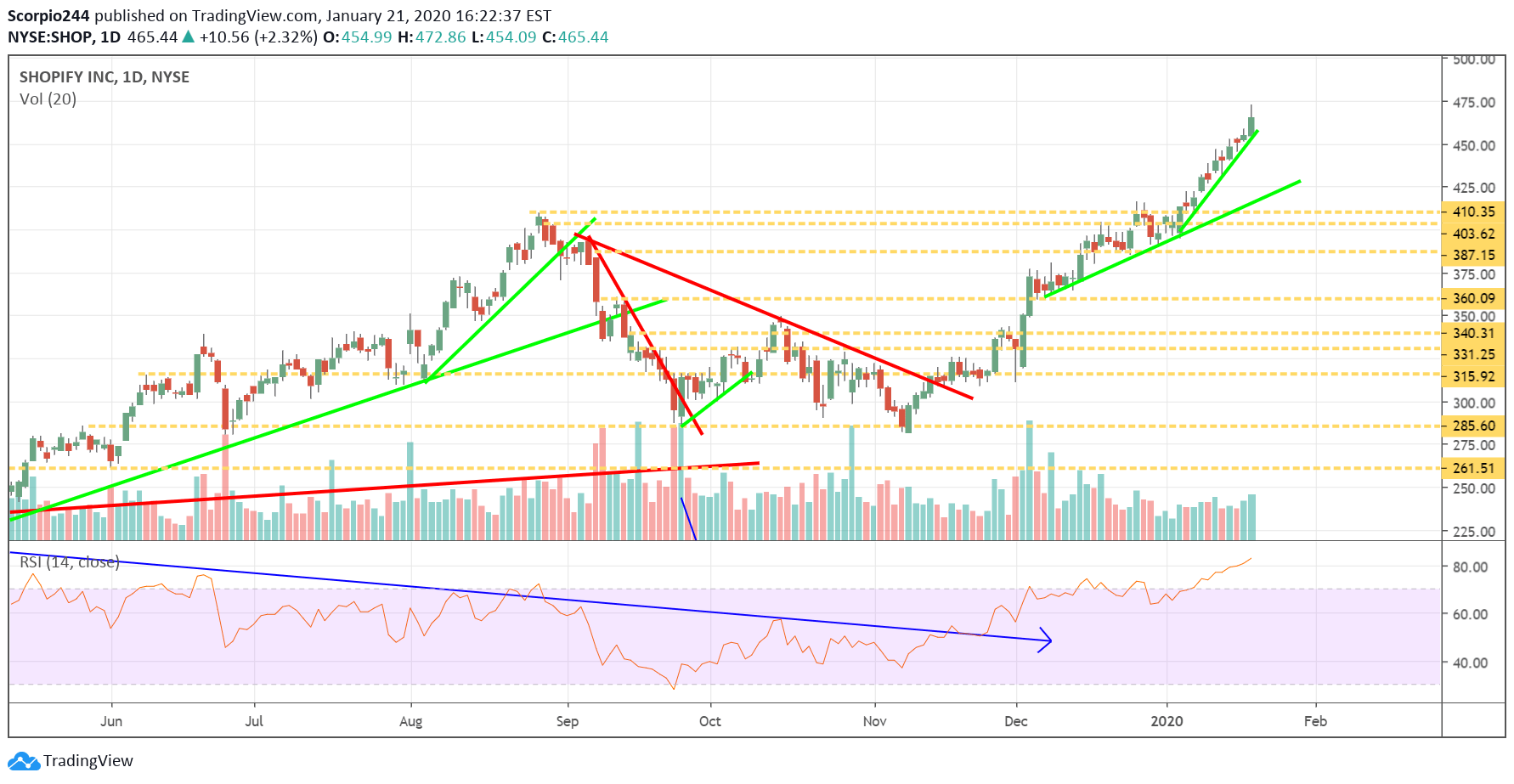

Shopify (SHOP)

Shopify (NYSE:SHOP) was up sharply rising by around 2.5%. However, the stock looks like it may be ahead of itself, and I noted on the midday commentary yesterday that I thought the stock was likely heading lower to around $420.

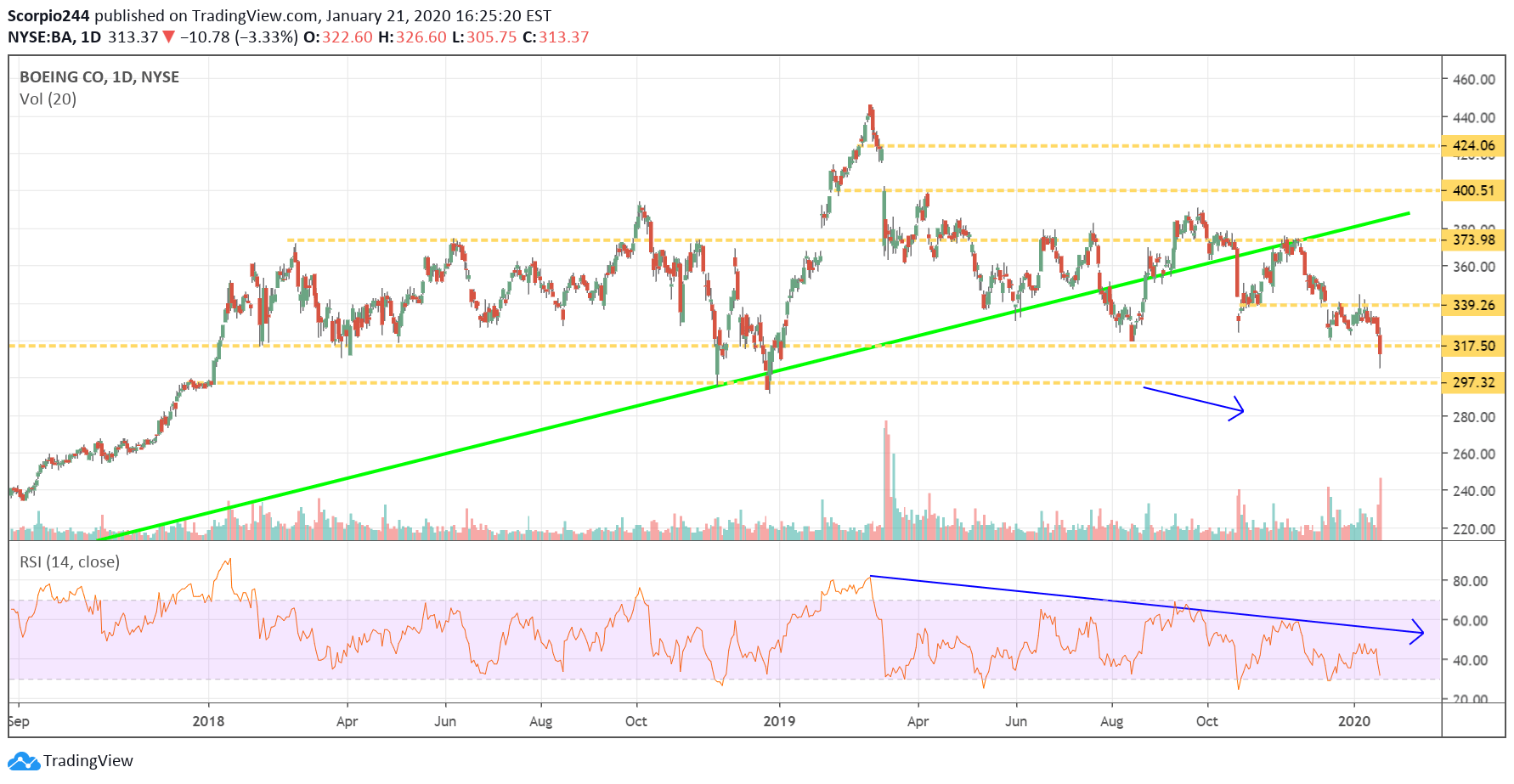

Boeing (BA)

Boeing (NYSE:BA) finished Tuesday below $317.50, and that has been an important level of support in the past, and now it is broken. The trends appear to suggests that the stock continues to move lower perhaps to $297.

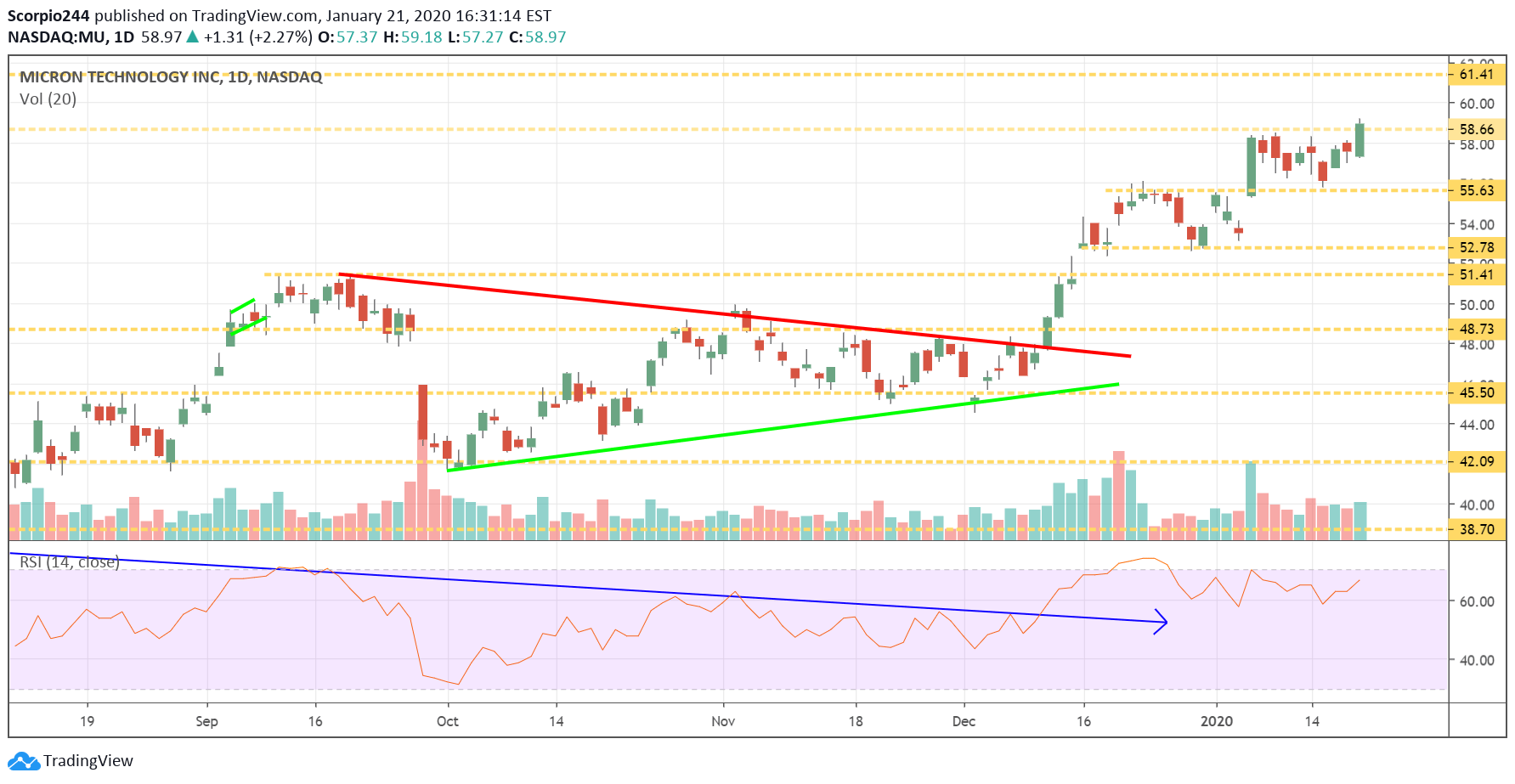

Micron (MU)

Micron (NASDAQ:MU) had a good day closing above resistance at $58.65. It is a good sign and could be a sign that the stock is finally getting ready for the stock to make that move to $61.40.