Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

S&P 500 (SPY)

Perhaps the market is tired, some, I’m not sure. For the second day in a row, stocks managed to fade, giving back the majority of the gains. It doesn’t take much in the way of newsflow to get the algorithms taking prices lower. It is hard to tell sometimes on a day to day basis just what the underlying story is for the broader trend. It seems fair to say that the S&P 500 is trying to stay as close to the uptrend as it can without breaking it. Well, for now, anyway.

If the uptrend is violated, it could result in a sudden fall to support at 3,250 and then to around 3,230.

Despite all the optimism, I have seen signs that some are preparing for a return to volatility or at least a move low in equity prices.

Again, I’m not saying anything significant is about to happen, but one needs to be on notice and looking for the signs.

Square (SQ)

Square (NYSE:SQ) managed to pop its head above $70, which is a good sign. The trend still points to higher prices, and so perhaps $75 is next.

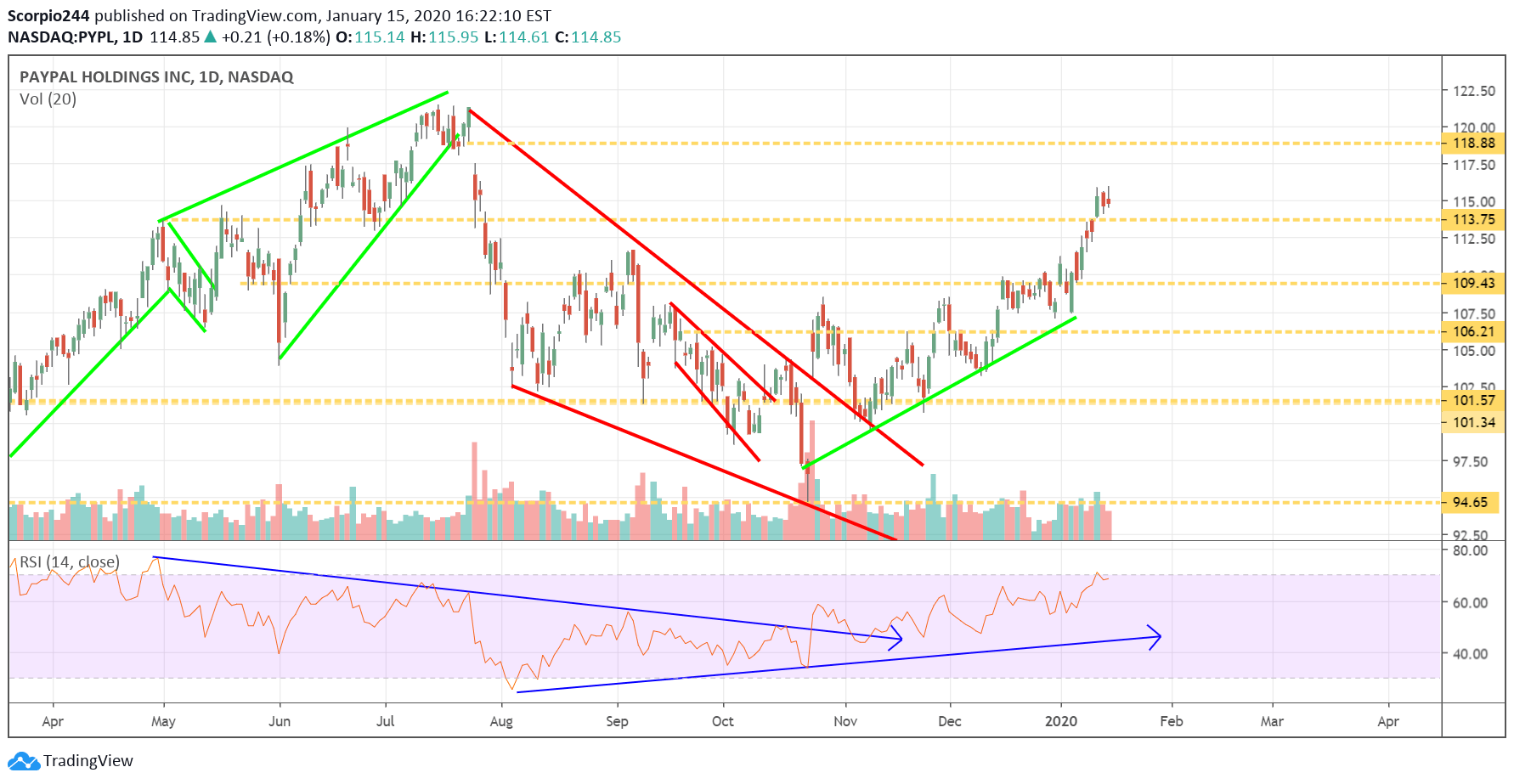

PayPal (PYPL)

PayPal (NASDAQ:PYPL) continues to work its way higher to fill the gap at $118.

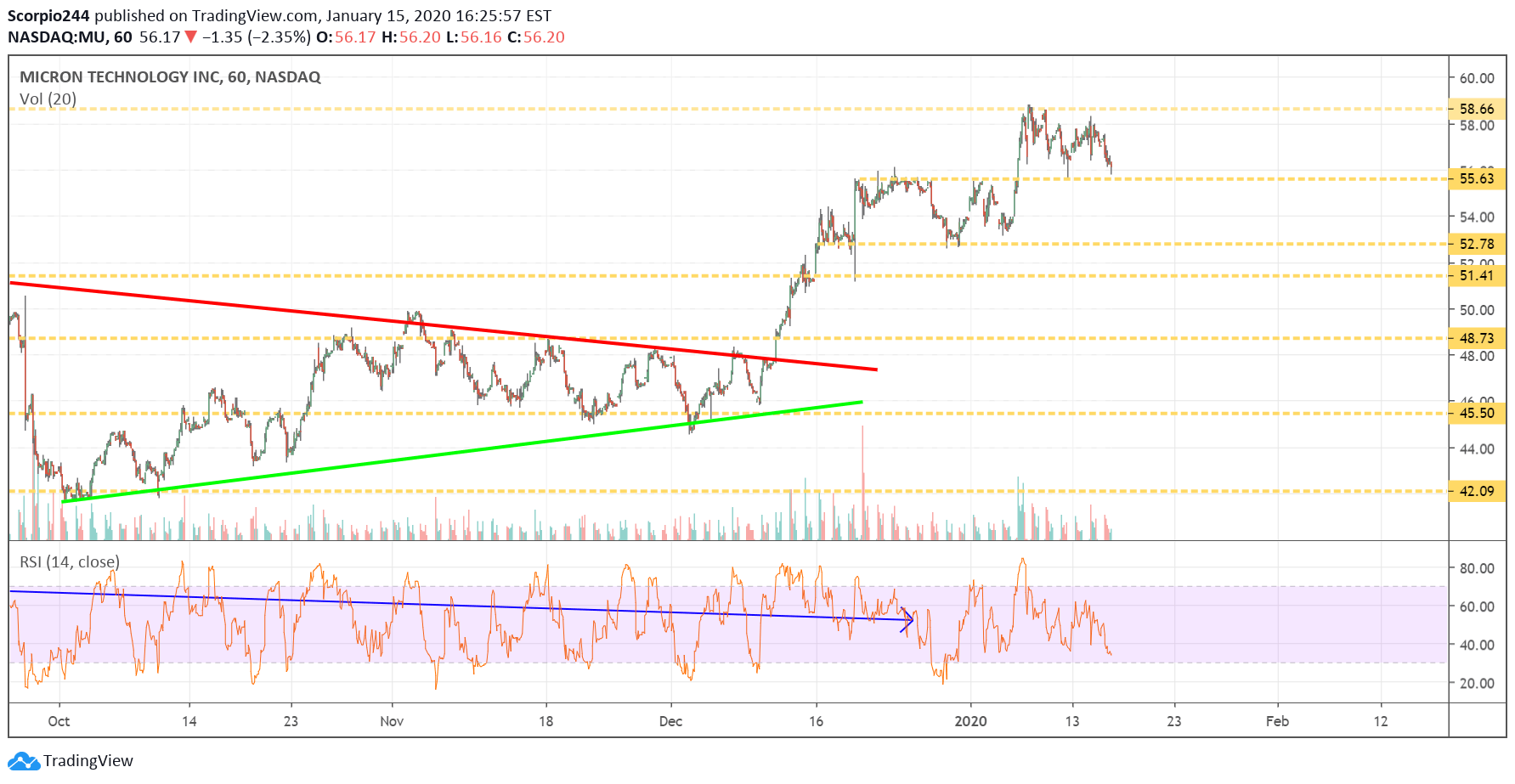

Micron (MU)

Micron (NASDAQ:MU) fell yesterday, but again, the stock continues to hold support. At this point, that is all that matters. A drop below support at $55.60 means the stock goes to $52.75. Let us hope that doesn’t happen, I don’t want to be wrong with my call for the stock to rise.

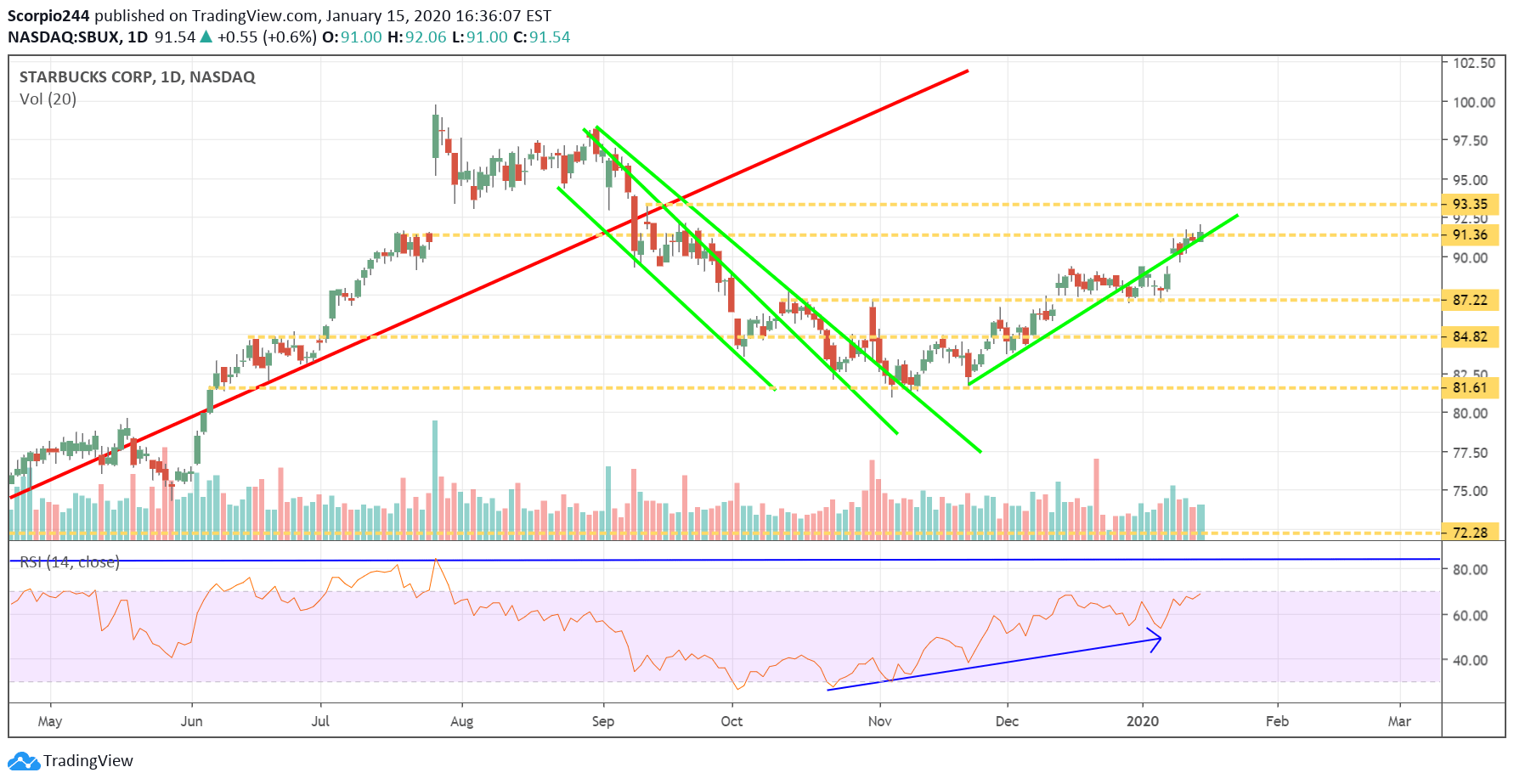

Starbucks (SBUX)

Starbucks (NASDAQ:SBUX) is challenging resistance at $91.50, and perhaps there is some further upside to around $93.35.