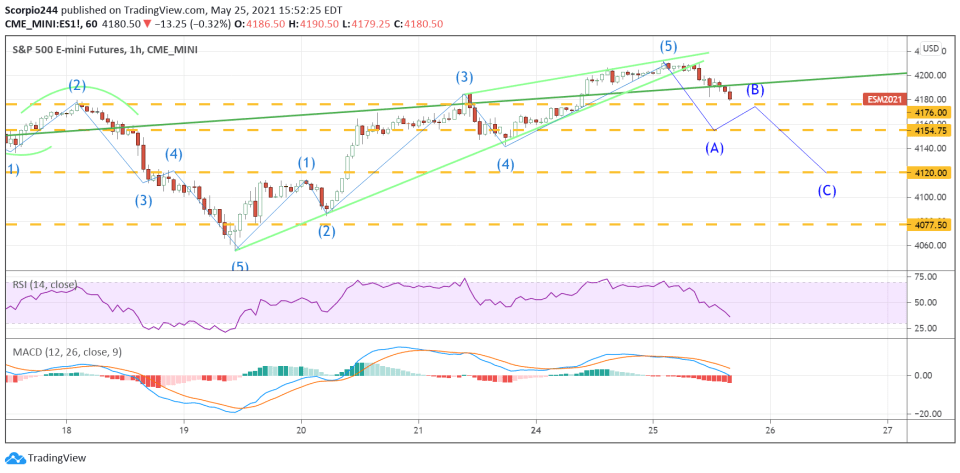

On May 25, the S&P 500 finished lower by around 20 basis points. The key here is that on Tuesday, the bulls tried to rally the S&P 500 but were unable to. This seems to confirm that a 5 wave count off the May 19 lows is now complete, and we should see a drawdown back to roughly 4,120.

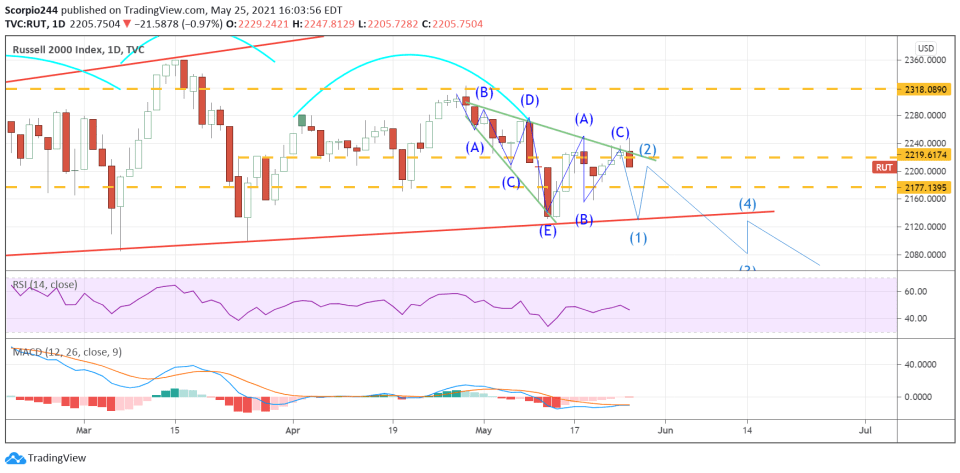

Russell 2000

It was not a good day for the Russell 2000 (IWM); after failing to break out Monday, it fell sharply yesterday. It looks more and more like this index has further to fall from here, as it continues to struggle at the downtrend. I’m looking for roughly 2,120 next.

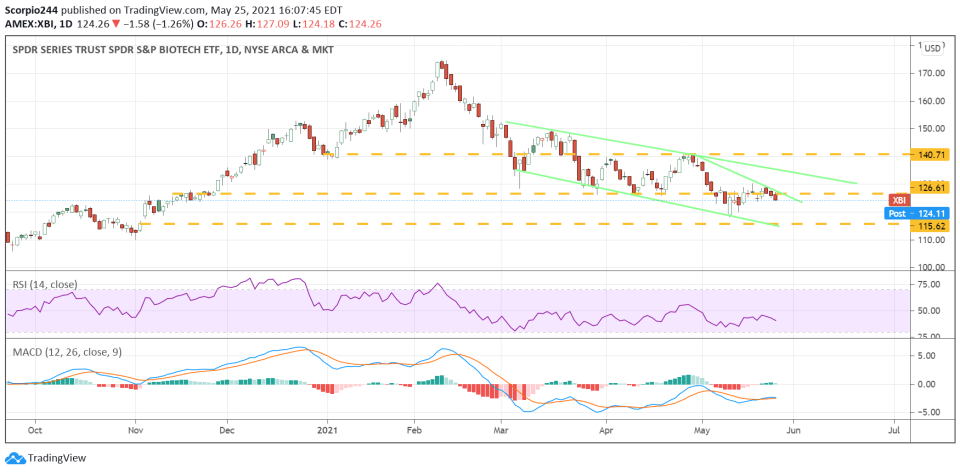

Biotech ETF

The SPDR® S&P Biotech ETF (NYSE:XBI) is very weak and is likely to lead the Russell 2000 lower. There is probably a good chance of going back to 115.60.

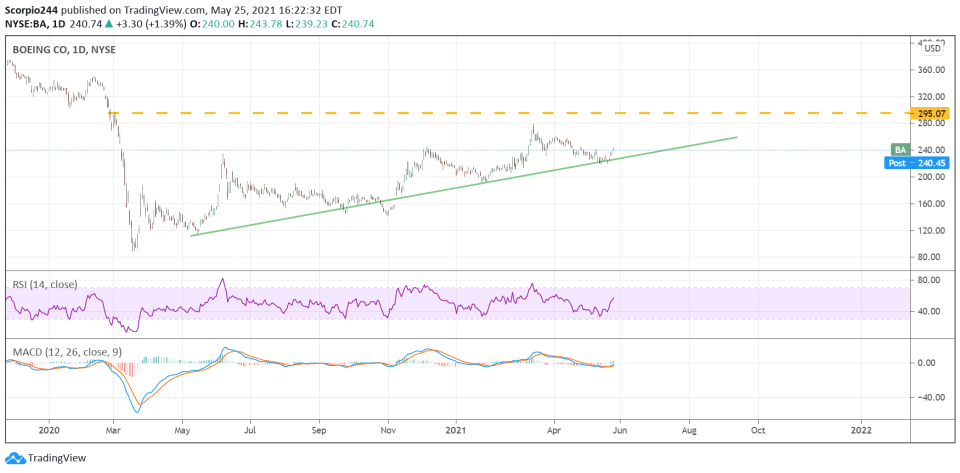

Boeing

Boeing (NYSE:BA) looks as if it is getting ready to take its next leg up. The stock appears to take these giant leaps and then move back to the trend line. If that pattern follows suit, it could be a push up to around $295.

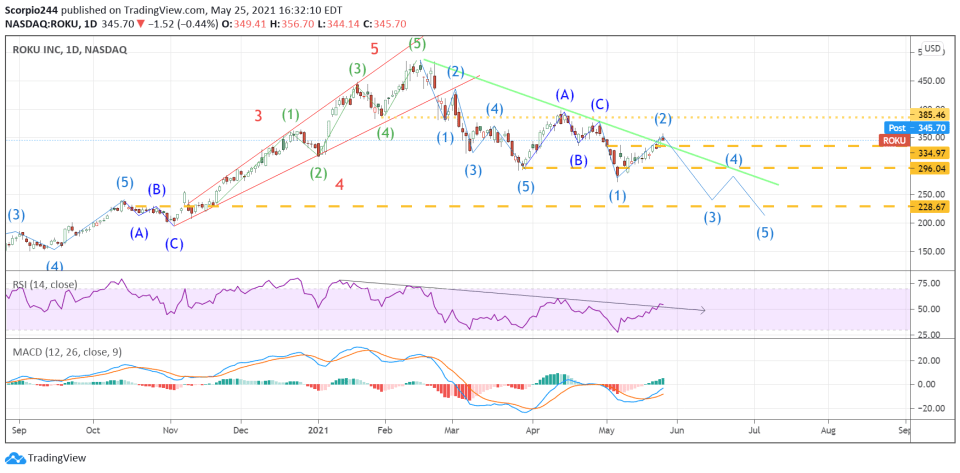

Roku

Roku's (NASDAQ:ROKU) little move higher is probably about over. I recounted the pattern, and it seems like we just finished a wave “2”. It works on a fib retracement too. So the next stop could be around $240.

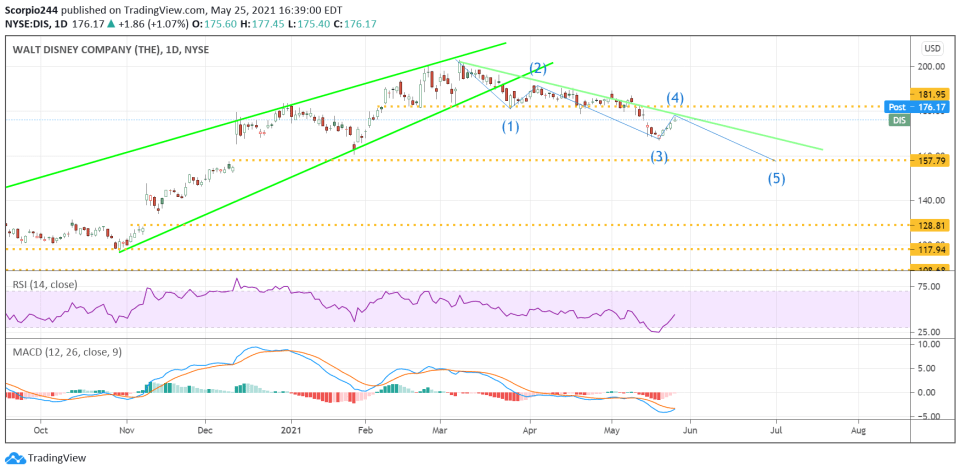

Disney

The rally in Disney (NYSE:DIS) is likely over, too, with its next stop completing the gap fill at $158.

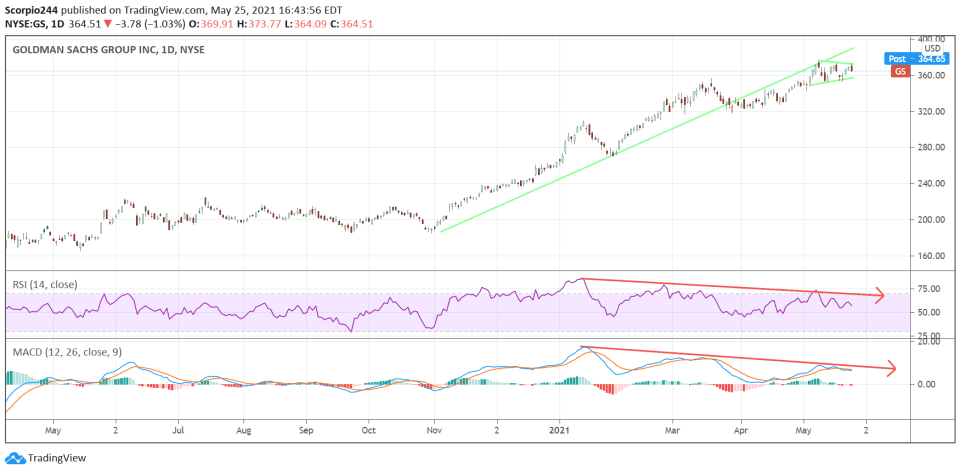

Goldman

Goldman Sachs (NYSE:GS) is consolidating as all the momentum continues to get sucked out of the equity. Perhaps it finally breaks lower.