Investing.com’s stocks of the week

Stocks fell Tuesday, for whatever reason. Maybe it was China; maybe it was the news about masks or the combination of both. It could have even been some last-minute jitters over the Fed.

I’m not sure what the Fed will say today; I expect the Fed to announce the policy change on tapering at Jackson Hole and the first tapper in September or November. Maybe Powell says that they have begun planning the process of tapering asset purchases or thinking about how they want to go about tapering.

Whatever the case, it matters not. The Fed will start to taper at some point over the next 6 months; the only question is when it starts and how much. To this point, the equity market has brushed off everything the Fed has said, which is surprising because the bond and currency markets have not. We will see.

S&P 500

The S&P 500 fell by just 50 bps, which was enough at one point during the day to give back Friday’s gains and fill the gap. The good news was that there was a gap up at 4,420 that will need to be filled at some point, if not Wednesday morning ahead of the Fed.

The daily chart confirmed three downtrends in the S&P 500. The RSI, MACD, and the Advance/Decline. I can’t recall the last time that has happened; then again, I may not have been paying attention either. Regardless, beneath the surface, things are not healthy.

Earnings

That leaves us with the mega-cap names, which have done all the heavy lifting the last few weeks. There are only two left that still need to report results, Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB). Based on the data I see in the options markets regarding Amazon’s I think the stock is likely to drop following results, but we can save that for another day; things can change.

Apple

Apple (NASDAQ:AAPL) reported blowout results, beating everything everywhere. At time of writing, they haven’t given any guidance, and the market hates when Apple does not give guidance. No soup for you! That leaves the stock sitting on support at $145 after hours, and if that breaks, which I think it will, the stock will probably be heading lower, below $140.

Microsoft

Microsoft (NASDAQ:MSFT) reported great numbers too, and while Azure grew by 51% in the quarter, that wasn’t good enough; why? Because in constant currency, it grew by 45%, yep. Anyway, it’s trading below support at $279, with the next level to watch for coming around $271.

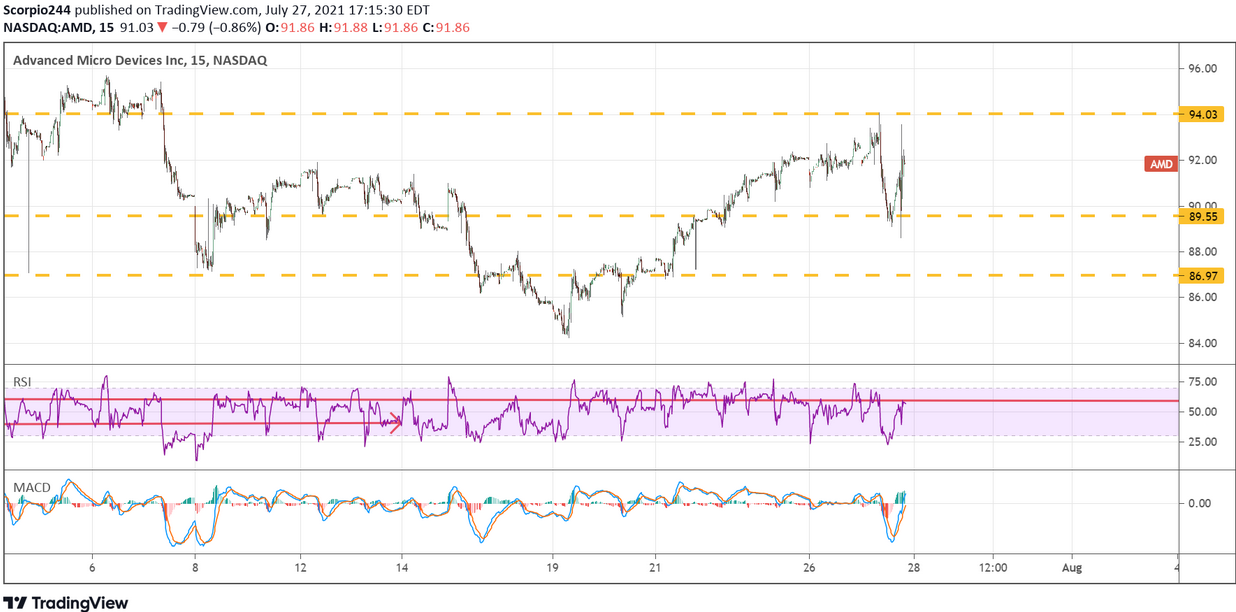

AMD

Advanced Micro Devices Inc (NASDAQ:AMD) was trading flat after it reported blowout results too. Unfortunately, it may not be good enough because the revenue of $3.85 billion, although beating the mean, was basically in line with the street-high estimates of $3.828 billion.

Additionally, the guidance of $4.1 billion, which was better than the consensus, was in line with a street high estimate of $4.1 billion. So these results, although better than expected, may not be good enough. It is probably why the stock was struggling to push through $94 in the after-hours; watch for $87 though.