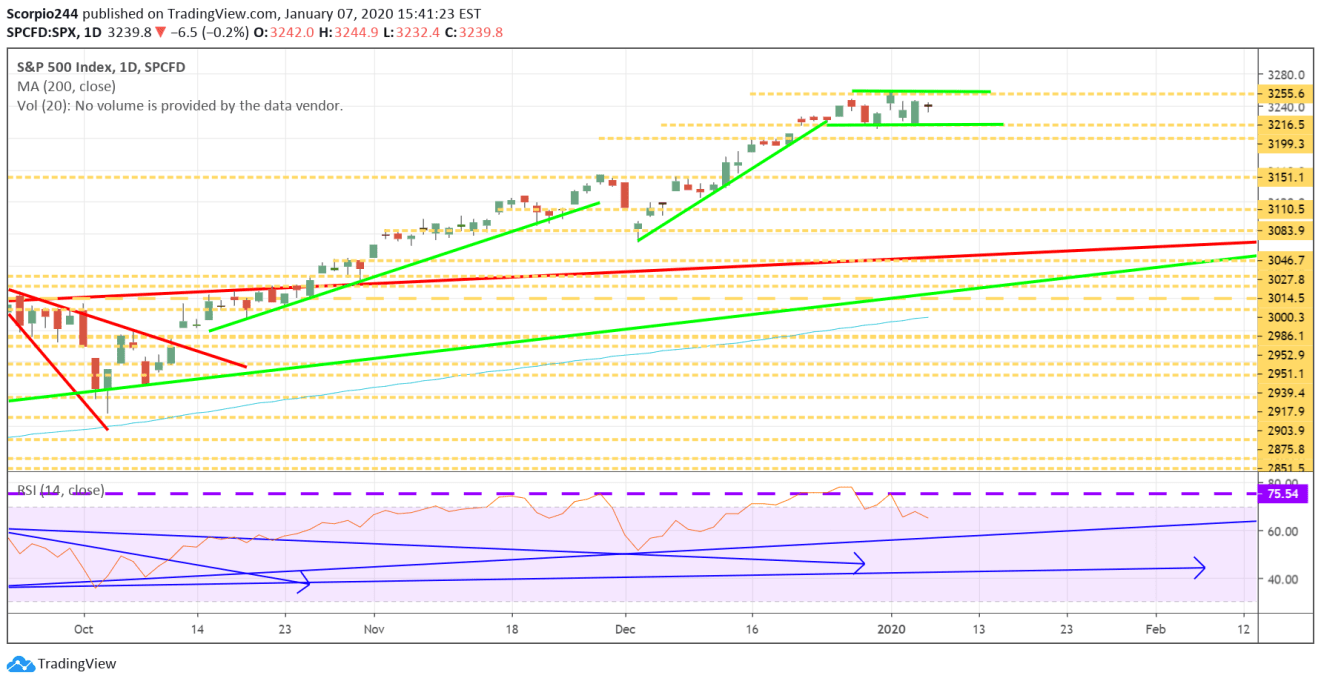

S&P 500 (SPY)

Stocks were unimpressed by the better than expected ISM non-manufacturing reading of 55. It was only mildly better than estimates for 54.5. Meanwhile, the report revealed some weakness in the employment component, which has me feeling a touch nervous, heading into the job report on Friday. Still, growth seems to be fine, with the ISM reading corresponding to growth of 2.2% for the fourth quarter. A weak unemployment print could be the most significant risk to the equity market at this point.

It seems like at this moment, the S&P 500 is just marking time waiting to make its next move.

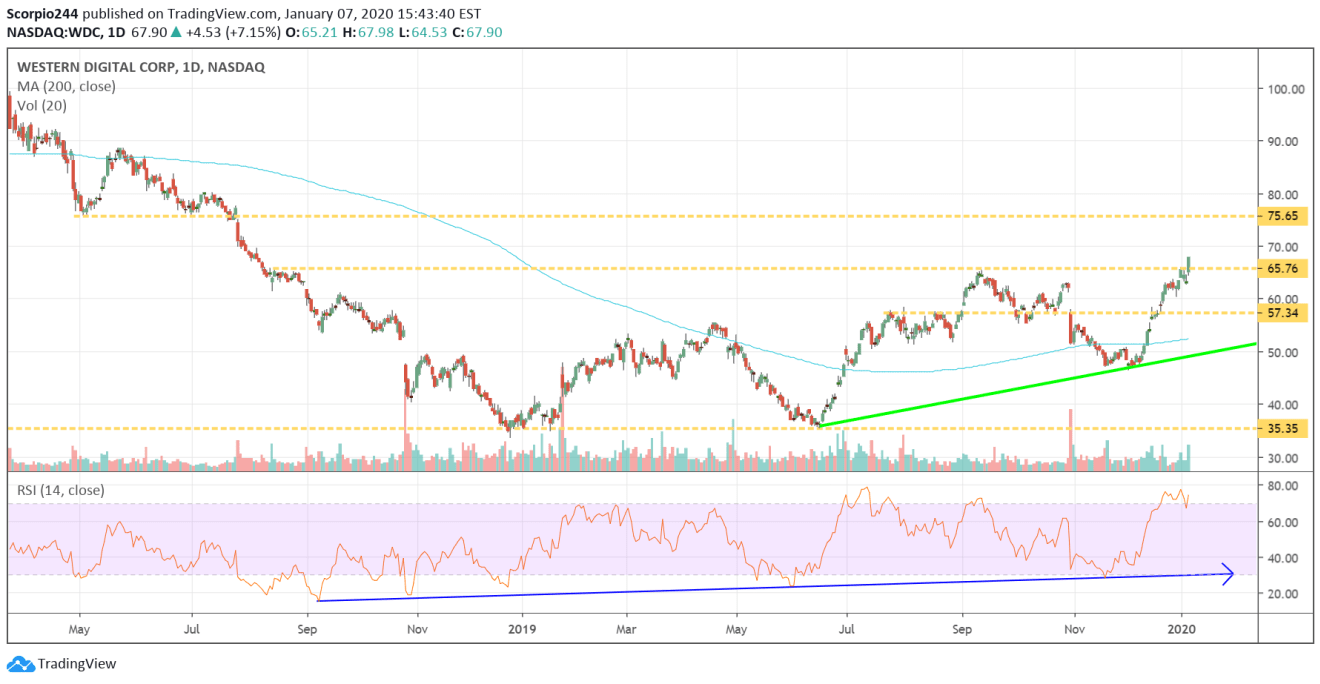

Western Digital (WDC)

Well, the options traders did it again, with Western Digital (NASDAQ:WDC) having a huge day, rising by over 7% following that upgrade this morning. The next level of resistance comes around $75.65.

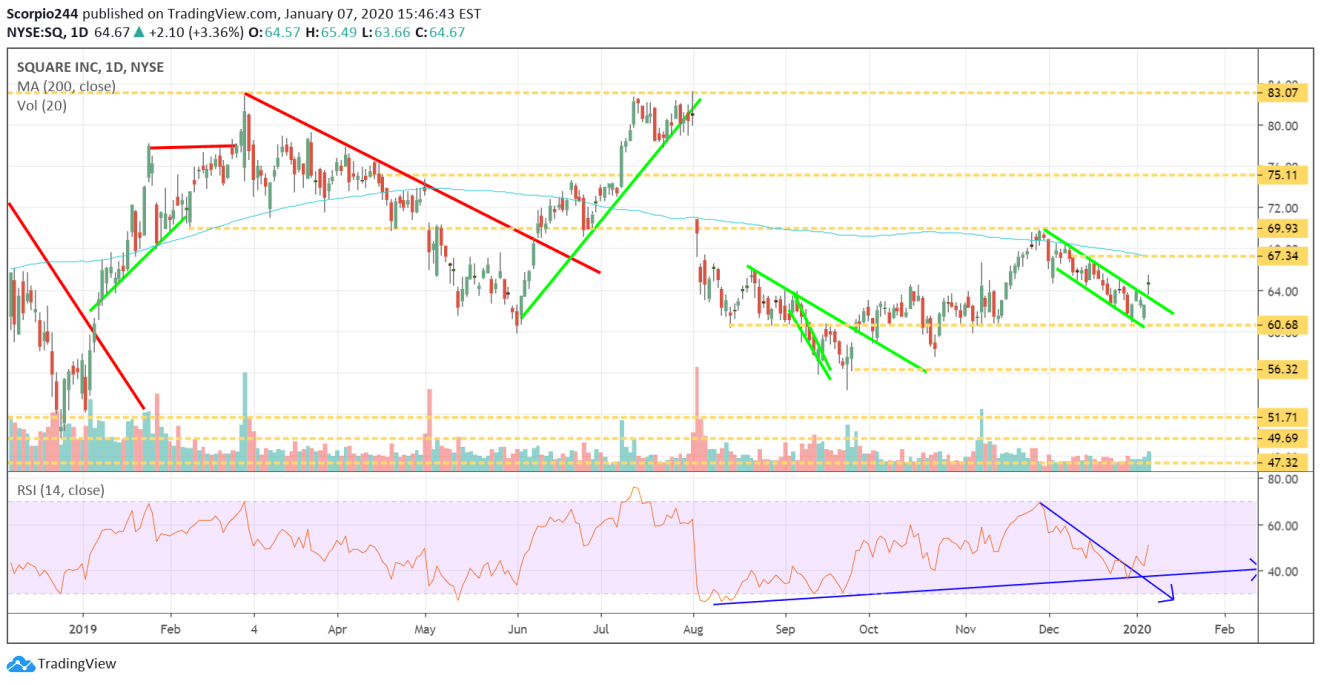

Square (SQ)

The options traders had a good day with Square (NYSE:SQ), too, making them two for two on the day. The stock popped above the downtrend, and so did the RSI. I think that sets up a move to $67.35.

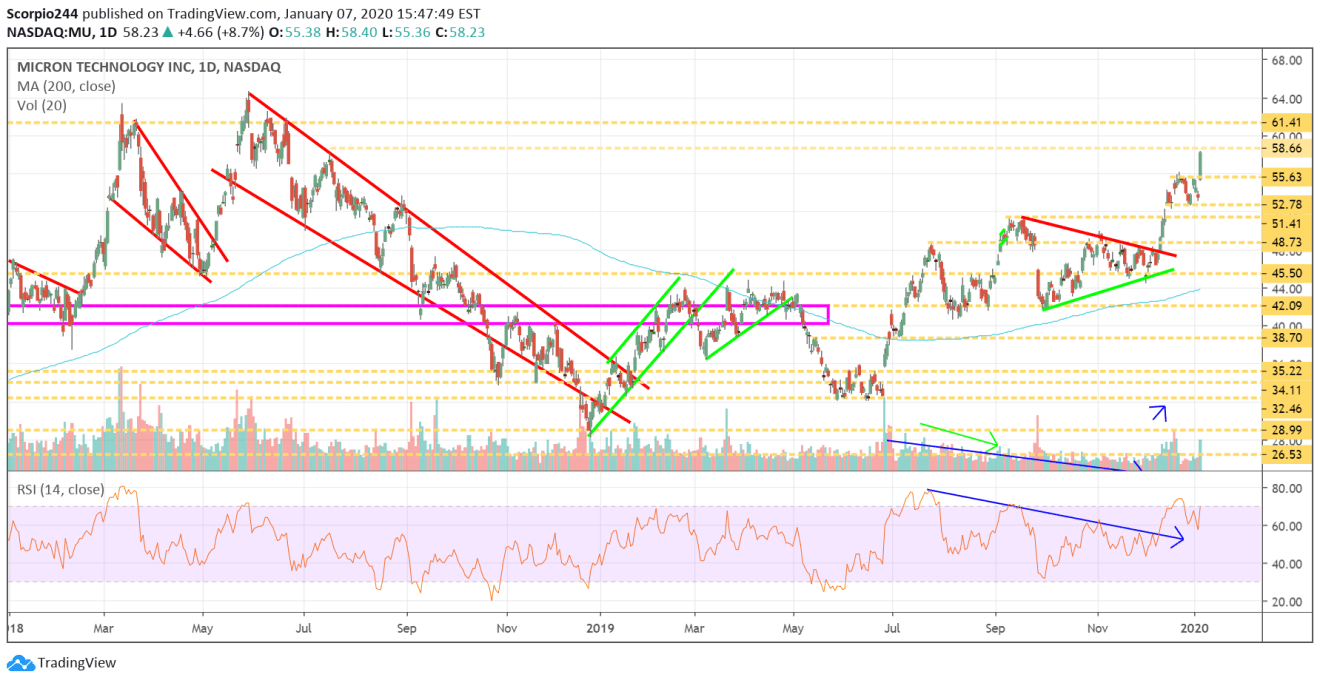

Micron (MU)

The options guys were even betting on Micron (NASDAQ:MU) late last week too. An increase above $58.65 sends the stock to $61.40.

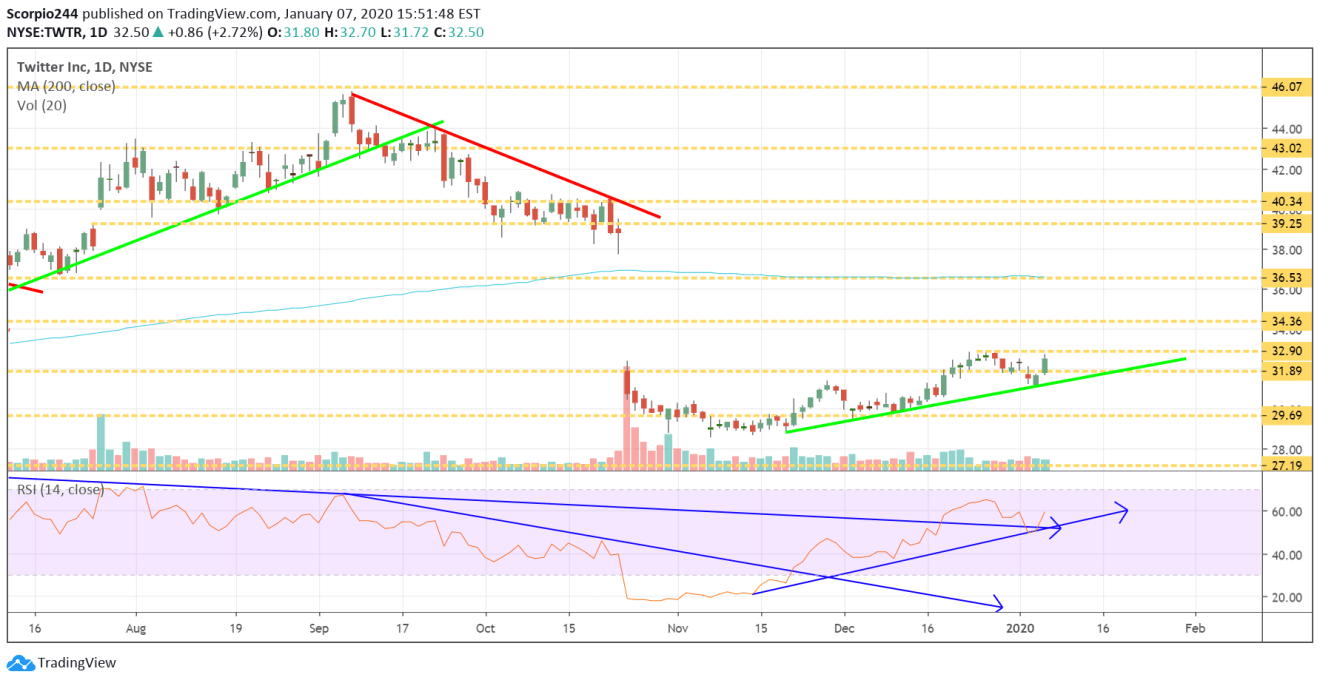

Twitter (TWTR)

I mentioned Twitter (NYSE:TWTR) yesterday in the mid-day updates, and based on the setup, the stock looks like it may be about to go higher.

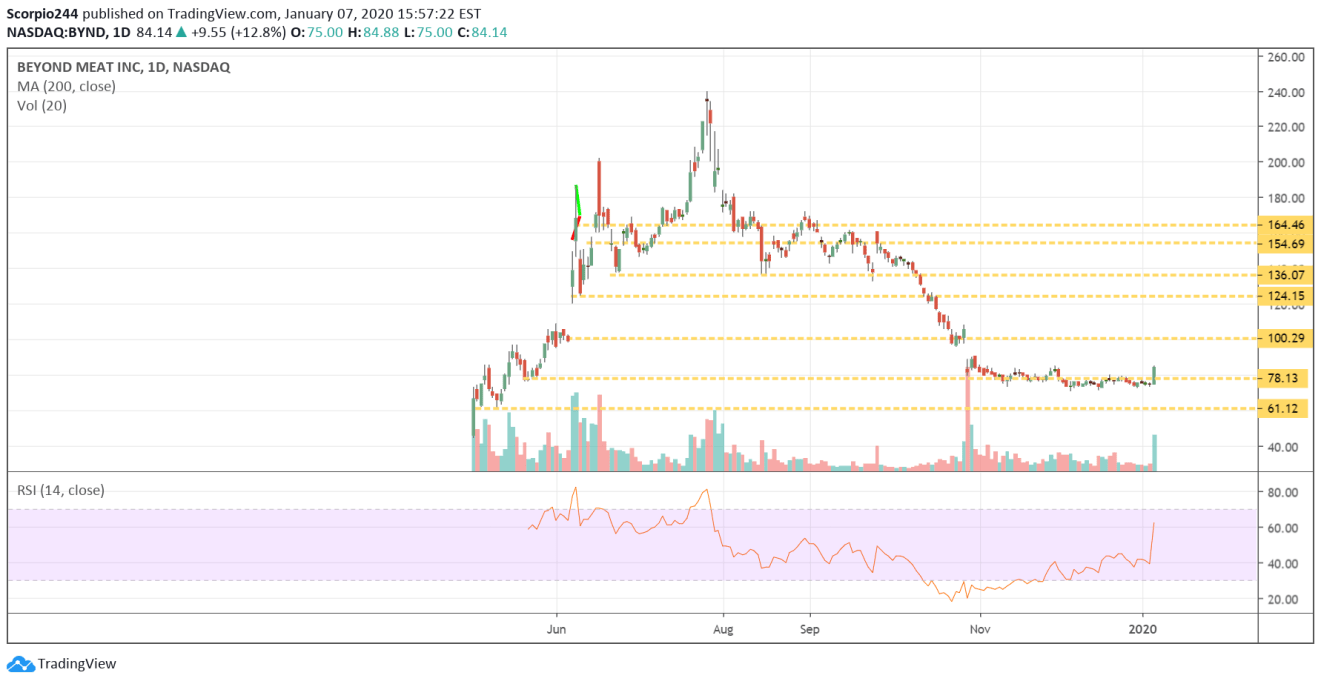

Beyond Meat (BYND)

Beyond Meat (NASDAQ:BYND) finally popped, and now it may on its way to $100 and eventually fill that gap.