Stocks fell sharply yesterday, Aug. 18, with the S&P 500 dropping by nearly 1.1%, while the Invesco QQQ Trust (NASDAQ:QQQ) dropped by almost 1%. The declines were pretty broad-based, because the Russell 2000 was also down by almost 85 bps.

The indexes all took a notable move lower following the Fed minutes, which confirmed much of what we have discussed here for some time—that the Fed is waiting for the labor market to start its tapering process, and that inflation has met its target.

The Fed’s minutes were from July, and therefore did not include the July employment report, which came during the first week of August. So one could argue that since that meeting, the job market has continued to improve, and is likely just one more strong report away from pushing the Fed to taper its asset purchases.

These minutes imply that tapering will happen, and it is just a matter of how soon. It doesn’t mean QE ends right away, just that the amount of accommodation will lessen over time.

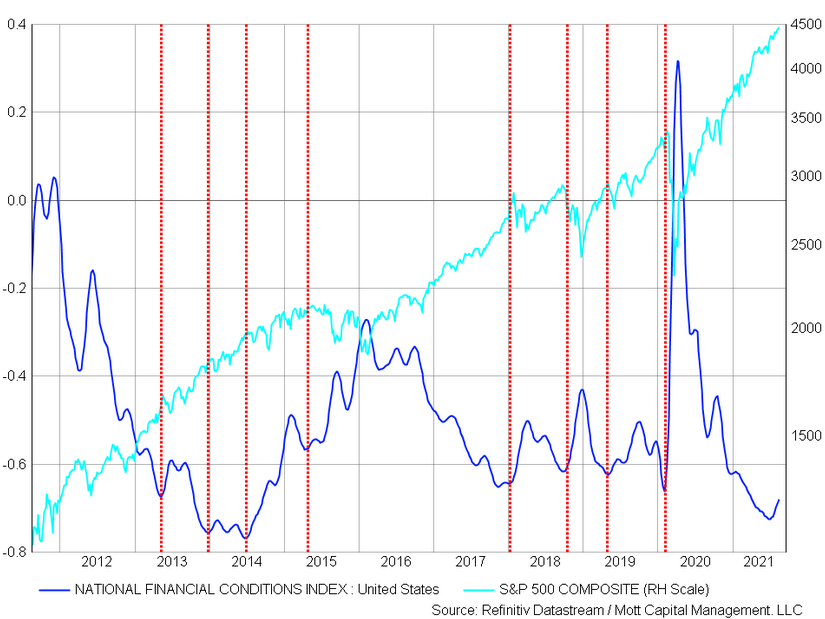

This will begin the process of tighter financial conditions and as I noted before, historically tightening financial conditions have lead to a lot of stock market volatility, and in turn, steep declines.

Overall, the breadth of the market has really deteriorated in recent days with the advance/decline now down 5 days in a row, with what appeared to be the formation of a head and shoulders pattern in that indicator. Now it wasn't a confirmed pattern, but a pattern worth watching, because if it continues to head lower, it would suggest the troubles in the market have just barely begun.

Additionally, our topping pattern in the SPDR® S&P 500 (NYSE:SPY) continued to stay powerful and suggested that the recent highs remained a very strong candidate for a market peak and that a turn lower could be rather steep.

We can confirm this bearish pattern in the SPY and in the QQQ ETF, which also showed a topping pattern based on an Elliott Wave analysis. Also, notice how the RSI was trending lower, as the MACD was firmly turning into negative territory.

There also appeared to be a head-and-shoulder pattern that has some serious potential of being confirmed in the NASDAQ 100 Futures. It will not take much more of a drop to confirm this bearish pattern, as it was sitting on support at that neckline at this point in time.

Oil

We saw further weakness in oil as it was sitting and testing support at $65. In reality, that support level has already given way, but it is best to wait for confirmation here, as the next level of support comes around $61, with a stronger level of support around $57.

Copper

Copper has now traded below its March 2020 trend line 2 days in a row and was also testing a big support level. A break of support at $4.10 sets up a drop to around $3.90.

Exxon

With oil prices slipping, it seems likely that stocks in the energy sector will struggle, and Exxon Mobil (NYSE:XOM) was not likely immune. Exxon has a big gap that needs to be filled at $51, and if oil keeps dropping that is probably the next stop for Exxon.

Advanced Micro Devices

The chart of Advanced Micro Devices (NASDAQ:AMD) was looking pretty bad, with the stock taking out support at $104, probably sending it back to around $99.

Zoom Video

Zoom Video Communications Inc (NASDAQ:ZM) is another stock that doesn’t look strong at all, with what appears to be a nearly confirmed double top pattern. All it will take here is a break of support at $340 for a decline to $280 to begin.