Stocks were up sharply at the open yesterday, but that faded quickly, with the S&P 500 finishing the day down by roughly 40 bps to close at 3,908. The declines followed a better-than-expected August ISM services reading that showed GDP is growing at an annualized pace of 2.5%. The news sent yields and the dollar soaring, allowing financial conditions to tighten further.

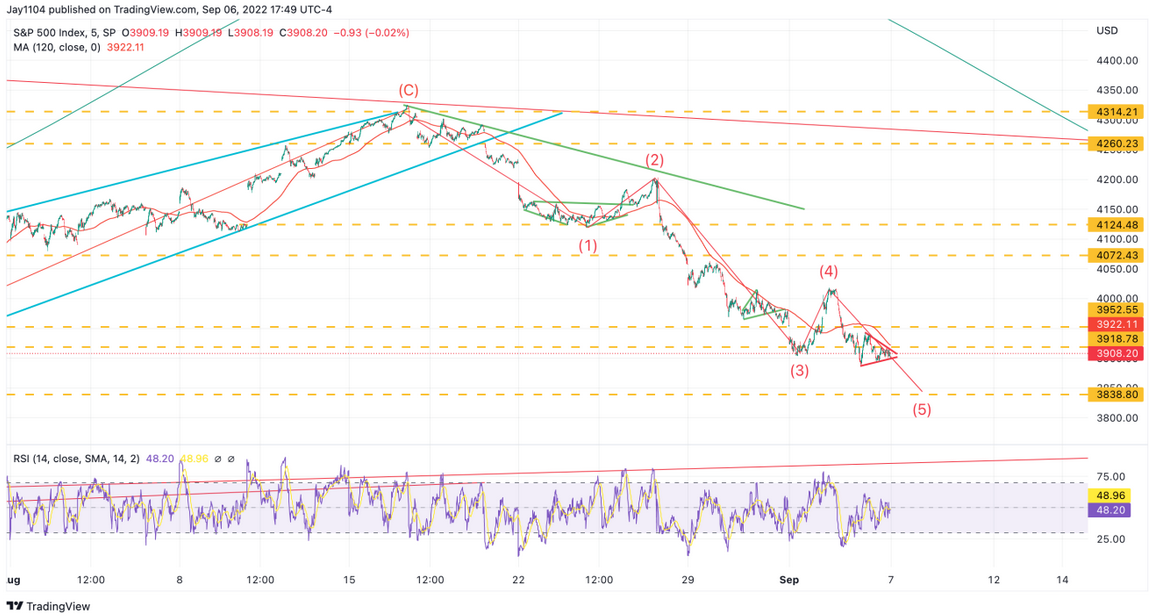

Yesterday's battle for the S&P 500 was between 3,900 and 3,920. Right now, the index is just consolidating and is likely to drop to around 3,820 over the near term to fill the gap at that level. You can see the symmetrical triangle, a consolidation pattern that typically resolves in the direction of the prior trend or down.

Meanwhile, the IEF/LQD ratio rose yesterday and is nearing its July 5 highs. As I have said for months, tighter financial conditions are bad for stocks, and the IEF/LQD ratio is an easy way to keep an eye on spreads between Treasury and corporate rates. Those spreads are widening.

Biotech

We may find out today just how serious the bears are about this decline. The biotech ETF filled the gap around $81 yesterday. If we start seeing the XBI rally in the next few days, it could be a terrible sign for the bears. But if the XBI breaks support around $79, we would also know that this sell-off will get much more severe.

NVIDIA

NVIDIA (NASDAQ:NVDA) is again testing support at $134, and there is nothing to say about this anymore. Once support breaks, I think it falls to $117.