Stocks finished the day lower today, with the S&P 500 falling 13 bps and the equal weight RSP ETF down 6 bps. A much more balanced day in terms of performance on the S&P 500 level. The Qs fell by 35 bps, while the Russell slipped 1.14%, and the Housing index fell by almost 2%.

S&P 500

The SPY is now well into the middle of the Bollinger band, with a gap and the 20 day-moving average potentially adding support around 4475.

The MACD, RSI, and the Advance/Decline are currently showing a downward sloping trend, which would indicate that momentum is growing more bearish at the momentum. That would leave me to believe we will see the index trade down to the lower Bollinger band.

The percent of stocks above the 200-day moving in the S&P 500 continues to slip currently at 73.6%. This number is diverging from the broader rising index. Now, it is worth noting that this happened 3 prior times 2015, 2017, and 2020. In 2015 and 2020, we saw big drops in the markets; in 2017, it proved to be a non-event for the S&P 500. The rest of the time, the two just seemed to be happy to move in the same direction.

Risk Aversion

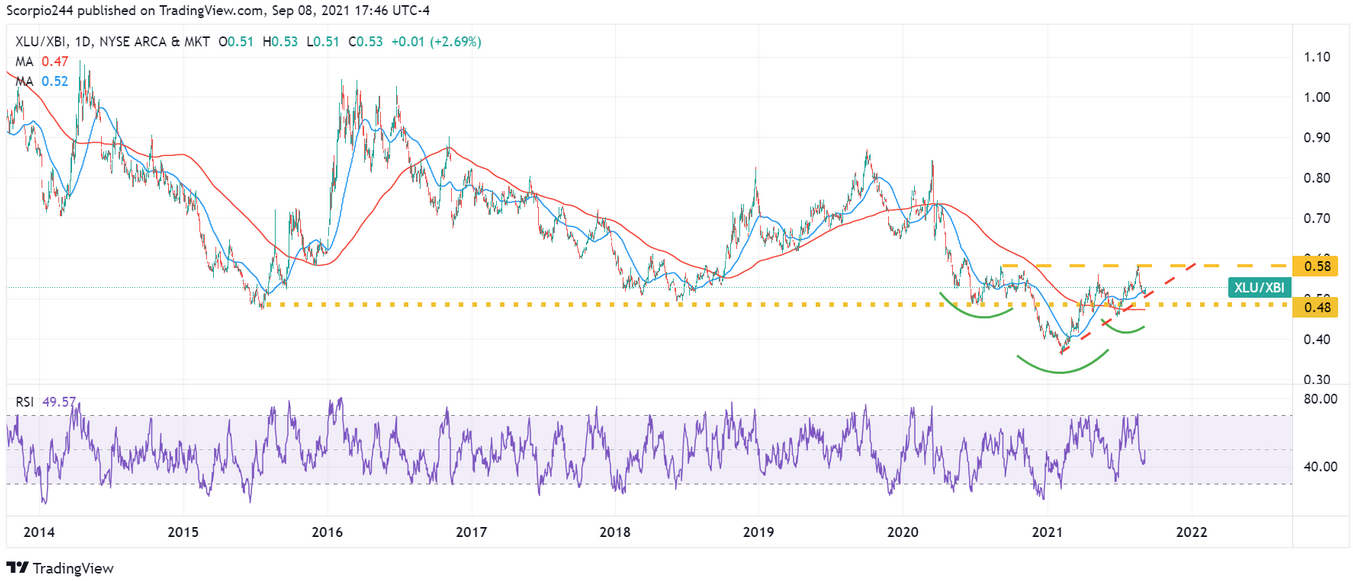

The Utility ETF (XLU) had a great day rising by almost 1.8%. When we think about risk in the equity market, I like to compare the two extremes. I consider the riskiest sector and most unpredictable to be the Biotech XBI ETF, to the stability of Utilities.

When you look at a ratio of XLU: XBI, the pattern appears to be that of an inverse head and shoulders, implying that the XLU outperforms the XBI in the future. This would indicate that investors are becoming risk-averse. This chart would seem to suggest we will be moving into a period of risk aversion.

The chart of the Utilities relative to Technology shows something similar. In fact, the technology sector has only been this richly valued relative to Utilities one other time, in March of 2000. Both of these charts would seem to suggest a peak in risk-on sentiment.

Square

Amazon (NASDAQ:AMZN) is reportedly working on a point-of-sale for third-party sellers. Square (NYSE:SQ) didn’t take the news very well, with the stock falling more than 4% today. The RSI would indicate that the declines are not over and no support until $245.

PayPal

PayPal (NASDAQ:PYPL) didn’t react well either. Luckily, it could fill the gap first; now, it can continue to decline and move back to $270.

Taiwan Semi

The $125 region has been a trouble spot in Taiwan Semiconductor (NYSE:TSM). A breakout would clearly be a big positive for the semiconductor sector, but at the same time, the odds of a breakout do not look too good.

Ok, have a good one!