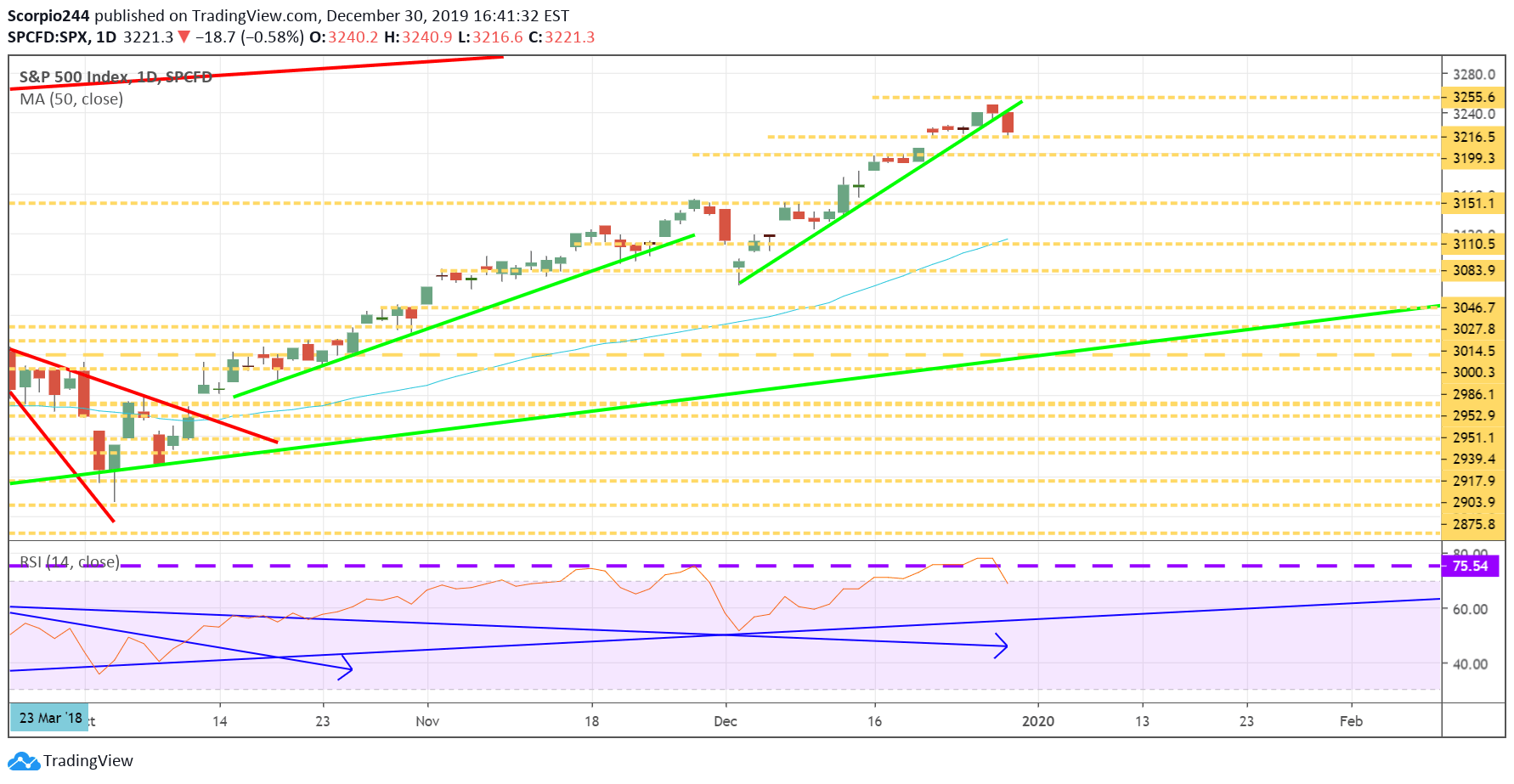

S&P 500

Stocks fell yesterday with the S&P 500 (SPDR S&P 500 ETF (NYSE:SPY)) dropping by roughly 55 bps to close at 3,222. The index did make it as low as 3,216, and it also managed to break the uptrend that has been working since December 3. Also, the RSI for the index managed to fall to 68.5 from 78.5. I’d take the RSI falling back to 56, that would please me. It would likely take the S&P 500 back to 3,180 to 3,200 range, and there would be nothing wrong should that happen.

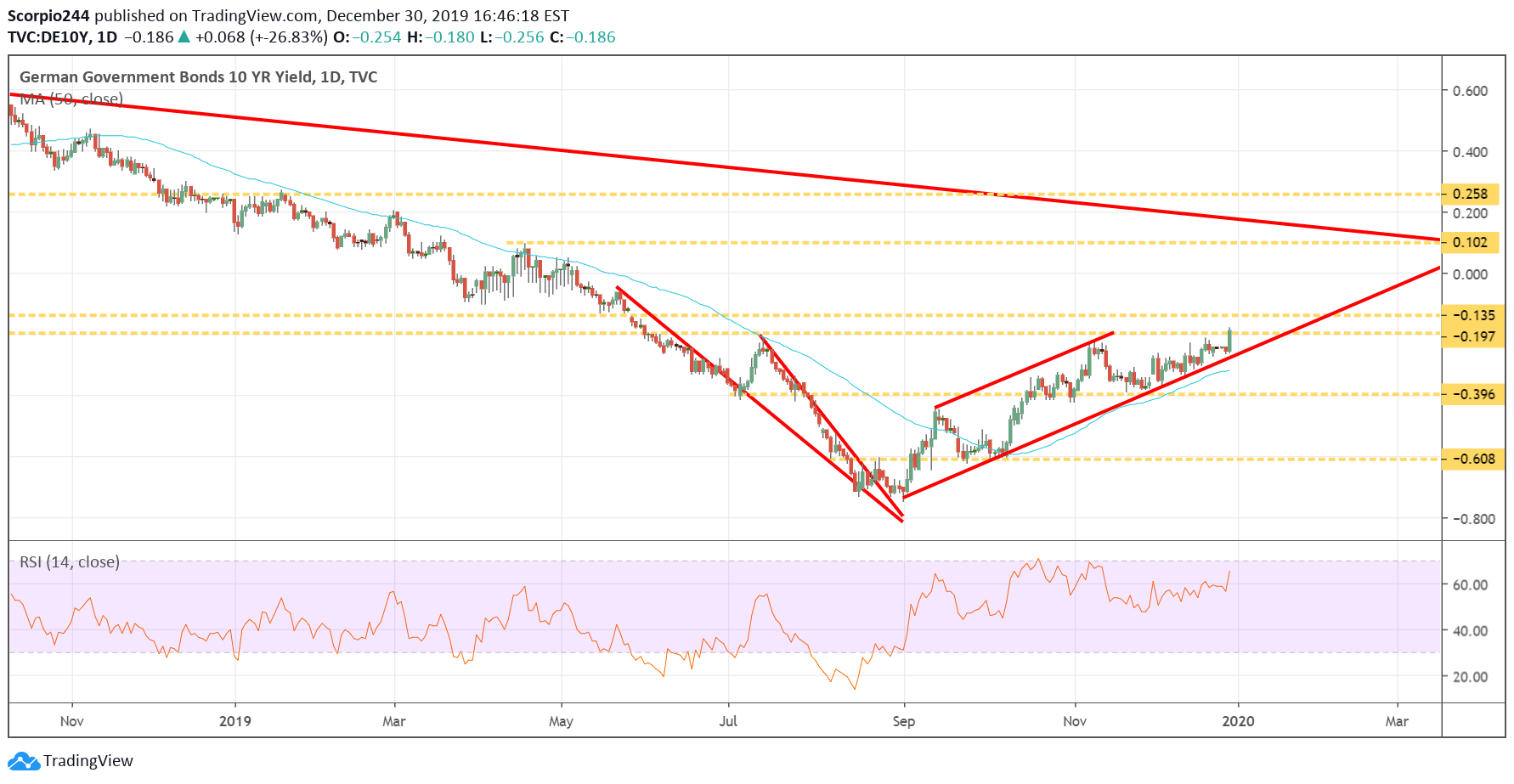

German 10-Year

The German 10-year bund did something it has notdone since June, that was close at negative 18 bps. It is a big breakout for the interest rate, and suggests a further increase to negative 13 bps.

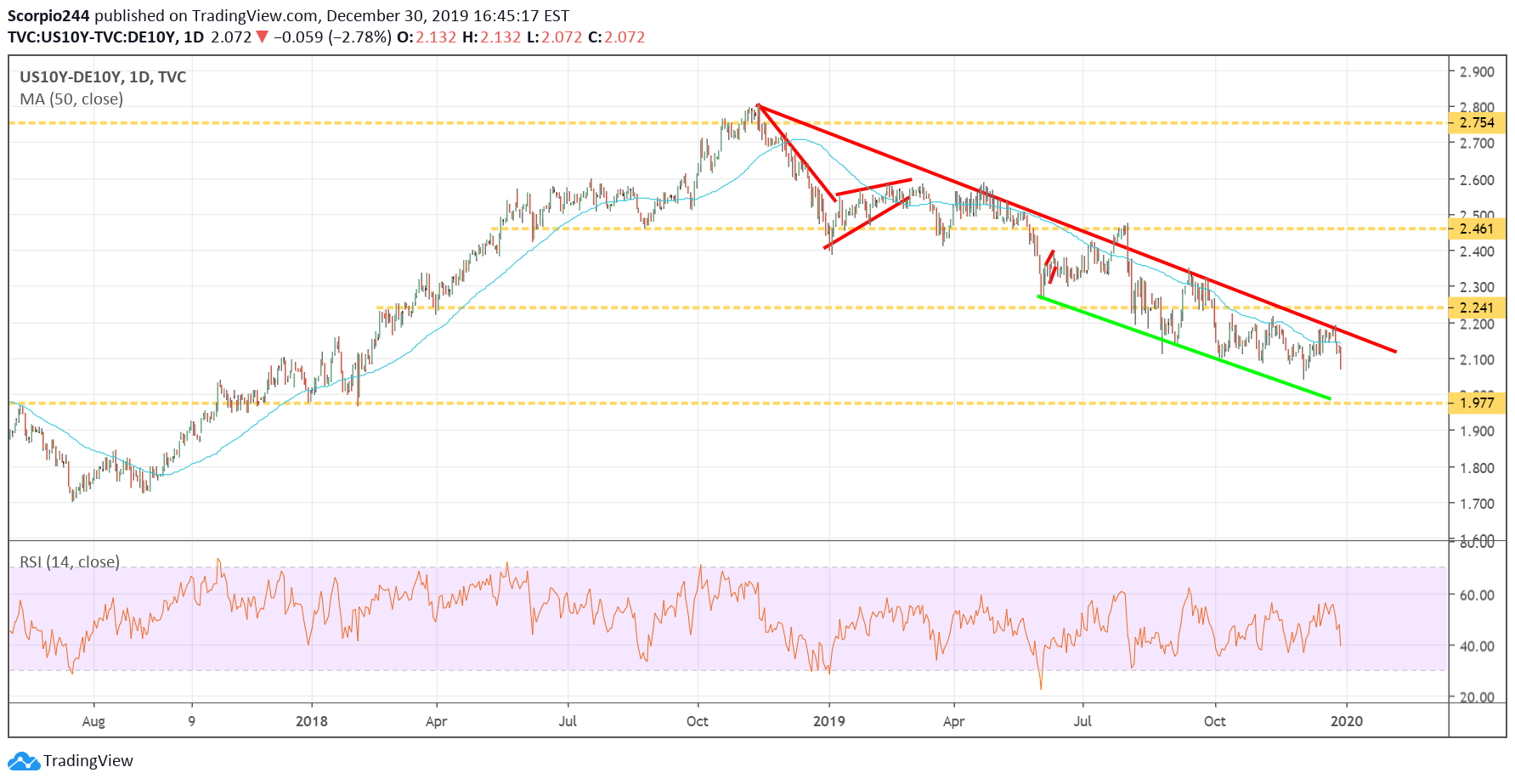

Spreads

It doesn’t sound like much, but this is one reason why the dollar is weakening. The spreads between U.S. and German bonds have contracted considerably in 2019, which is one explanation for why the dollar likely has even further to fall in the weeks ahead.

Gold

That is one reason why I have been getting bullish on the commodity sectors recently. I have been talking about gold and the SPDR® Gold Shares ETF (NYSE:GLD) since last week in my member areas, and the ETF is now very close to breaking out and pushing to $147. I happen to think it will break out.

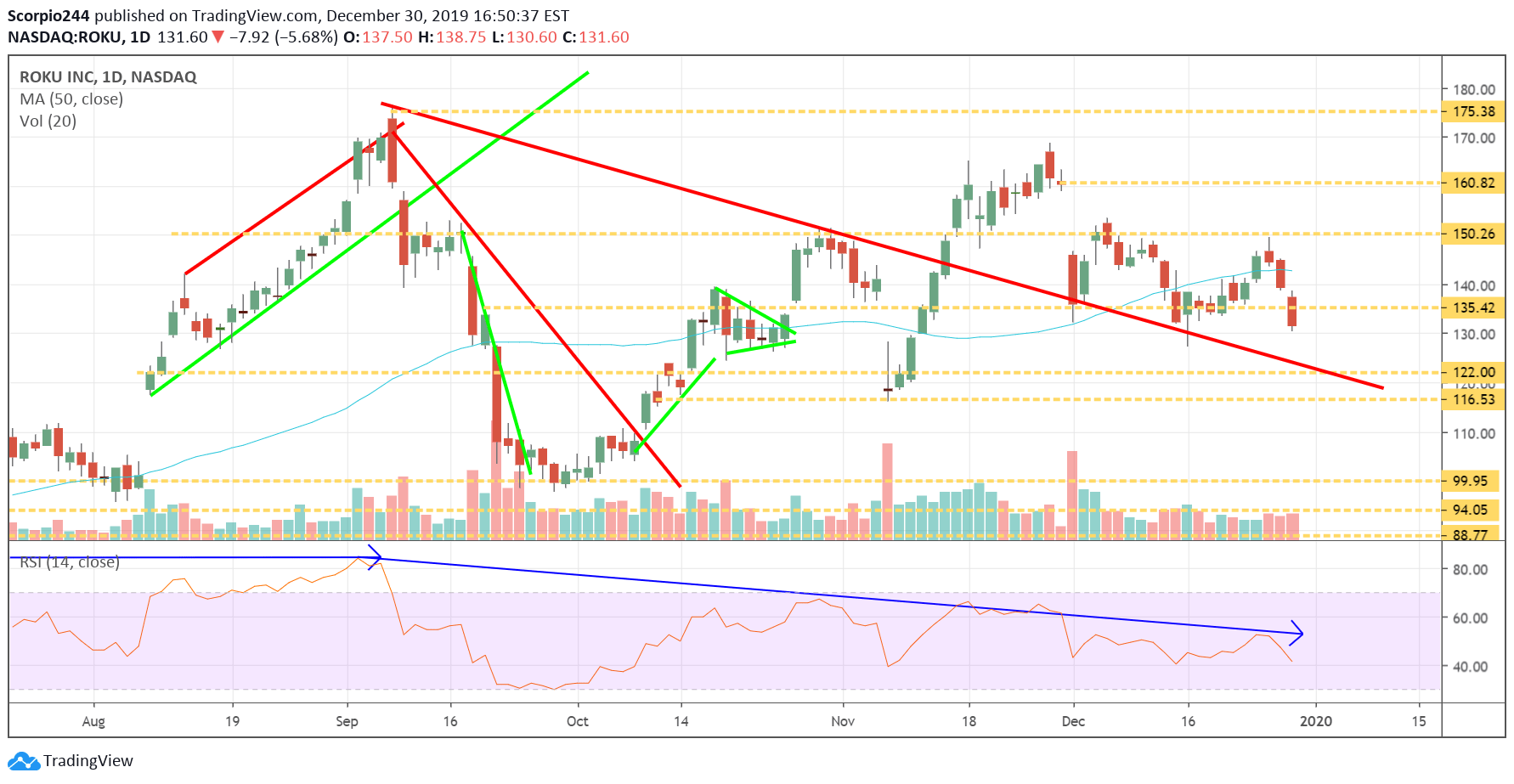

Roku

It figures that after I write a positive article on Roku (NASDAQ:ROKU), the stock goes down. Sometimes you can’t win. Perhaps ROKU falls back to $122 now.

Alibaba

Alibaba (NYSE:BABA) fell out of the trading channel yesterday. Now it is testing support at $211. It could result in the stock falling to around $201.

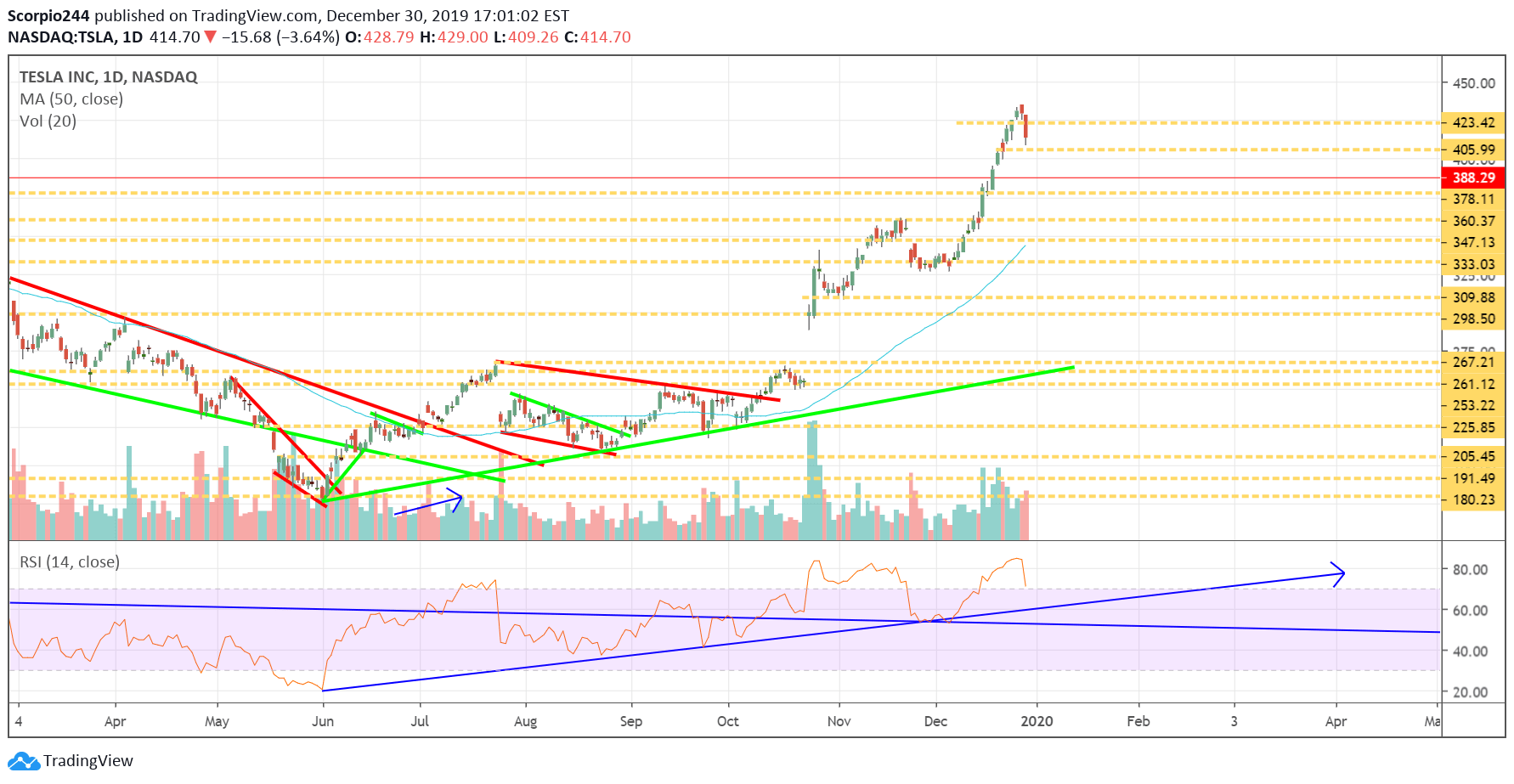

Tesla

Tesla (NASDAQ:TSLA) also fell yesterday, and it should not be a surprise, the stock can’t go up in a straight line. It is still overbought, and I think it probably falls back to $390 or so to test the breakout.

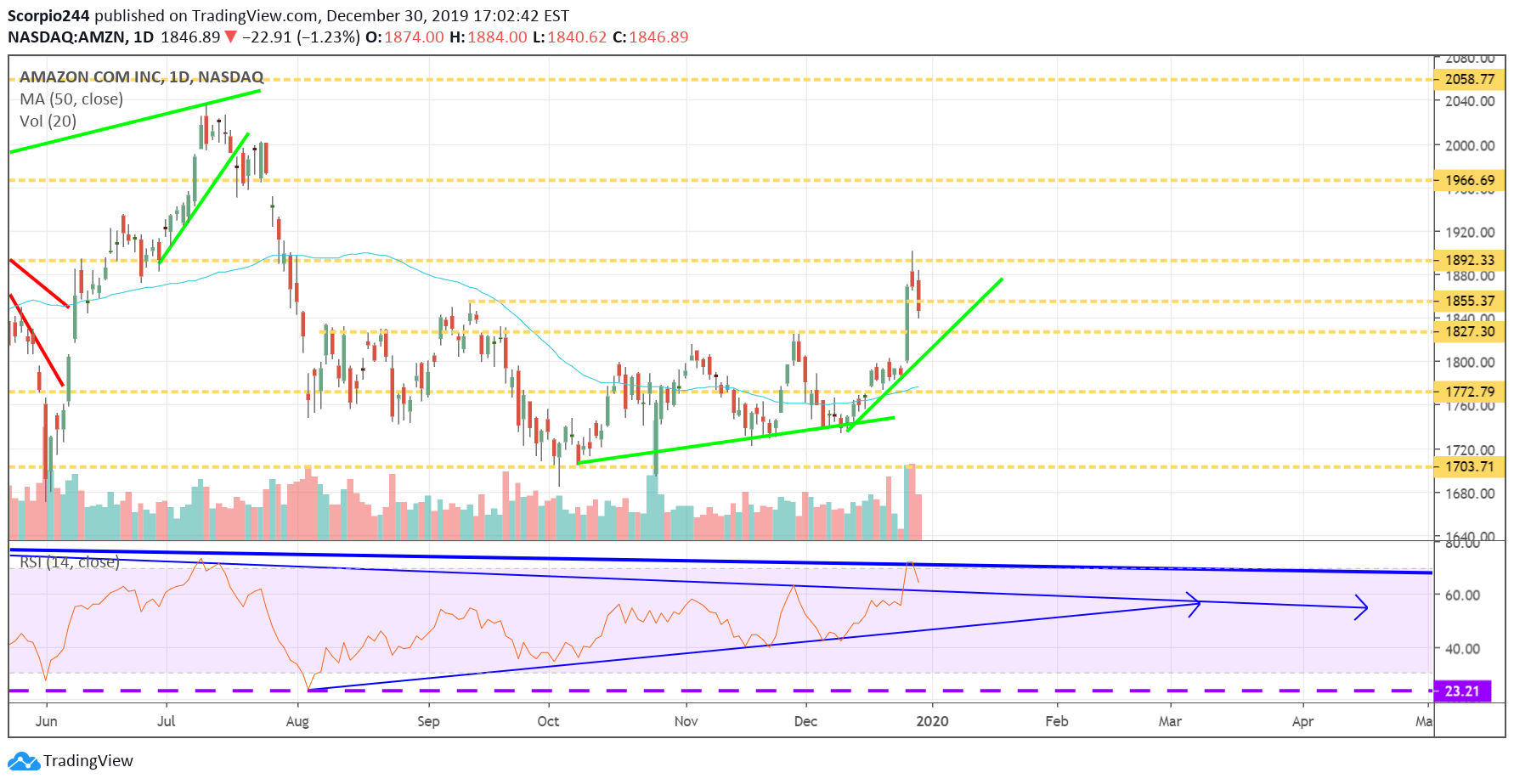

Amazon

Amazon (NASDAQ:AMZN) probably needs to pull back some more, too, perhaps to $1825.

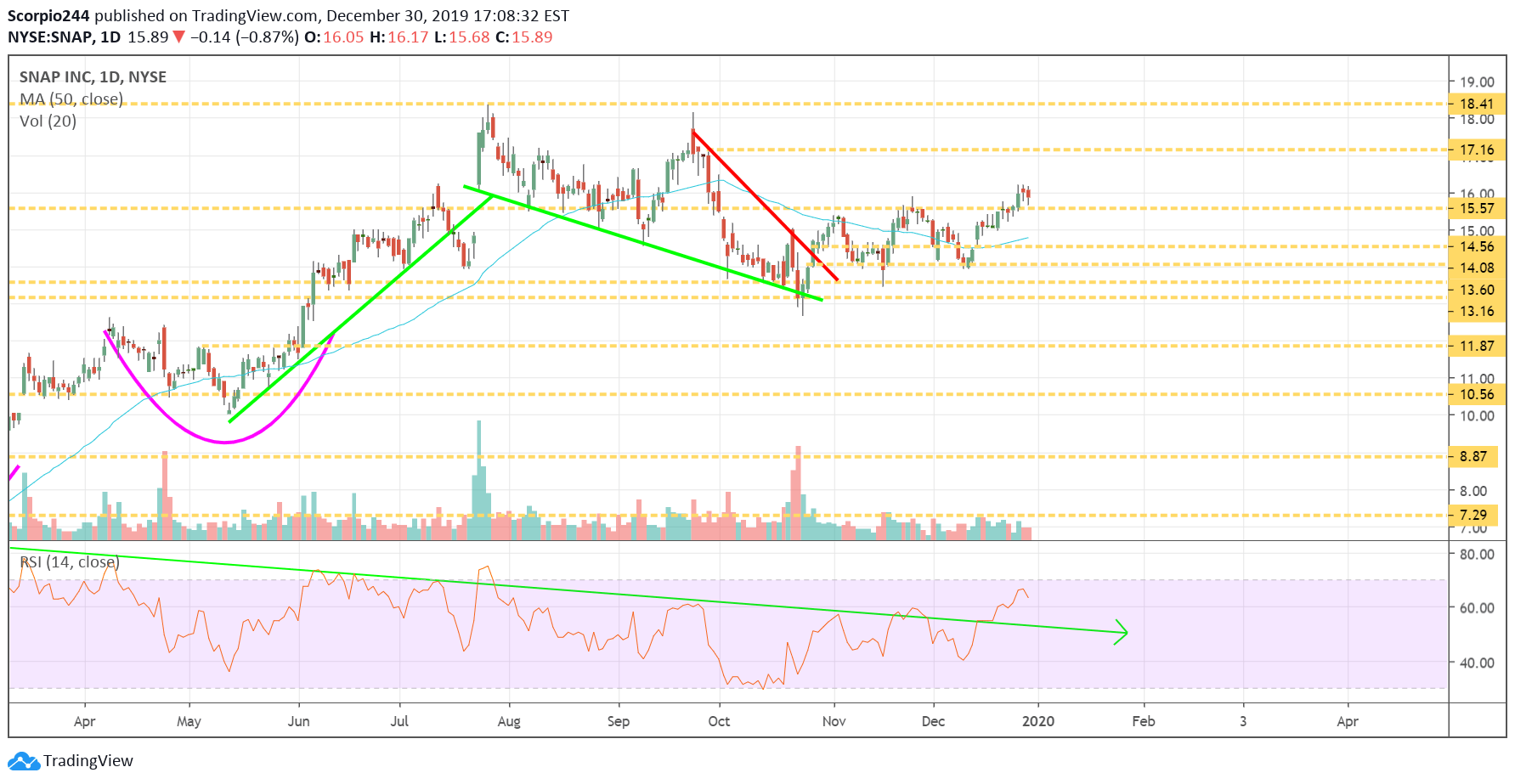

Snap

I noted in an article for Forbes, I saw some bullish option betting in Snap (NYSE:SNAP), which could result in a rally to start 2020.