Today is the big CPI report, and I have nothing more to add here. Most of the data indicate consensus estimates are too low. But again, all we can try to do is look at the data and make the best-educated guess we can. The PPI report was mainly in-line, too hotter; core PPI was the only metric that came in lower at 7.2% less than the 7.3% estimate.

The market didn’t care much about the PPI report and finished lower by around 33 bps to close at 3,577. The pattern on the SPX looks pretty bearish at this point; with a descending triangle pattern and a gap lower today, I would think things get into motion for a test of 3,520 and potentially a drop to around 3,220.

To be honest, I’m unsure how I got to this point of looking for such a significant drop in the index. But this is what I am seeing and where the data have led me.

Volatility

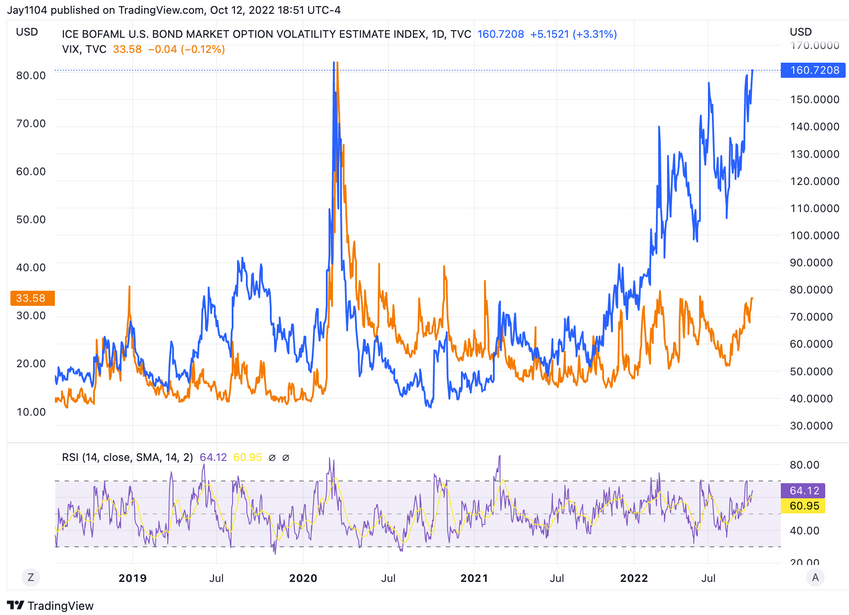

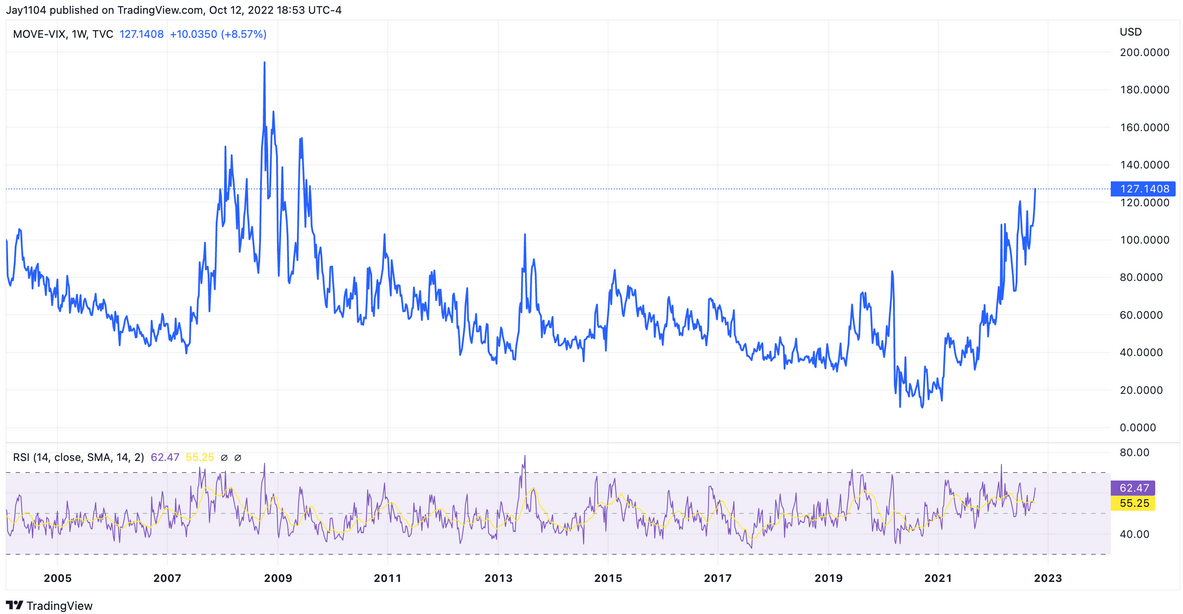

The ICE BofA Move index, which measures bond market volatility, reached a new high, while the VIX finished the day lower yesterday. The gap between the MOVE index and the VIX is quite large at this point, which is not usual.

What is interesting is that when you take the spread between the Move and the VIX indexes, you can see just how wide the spread is, and the last time this happened was in the 2008 and 2009 time frame.

2-Year

The 2-year looks as if it’s ready to race higher, too, with a bull flag within a bull flag.

Microsoft

Microsoft (NASDAQ:MSFT) fell to support yesterday, closing around $225. This has been a significant area of support. If support breaks, it probably speaks poorly not only for Microsoft but the market as well because there would be no technical support until around $212, about 7% from here.

UPS

United Parcel Service (NYSE:UPS) appears to have a head and shoulder pattern and a broadening wedge. Both of those patterns seem bearish to me, and for now, the UPS is finding support at $155. Should the $155 support break, the next significant support level comes at $134.

Airbnb

Airbnb (NASDAQ:ABNB) appears to have formed a double top and, to this point, has found support around $105. But there is a clear downtrend in the RSI, suggesting the decline isn’t over. If the stock breaks support at $105, there is further downside to around $92.