Stocks started the day higher, but that didn’t last for very long, with the S&P 500 finishing the day lower by almost 70 bps closing at 4,360, erasing that big rally we had last Thursday while filling the gap. The S&P 500 is in a clear downtrend at this point, and there is no denying that with each high lower than the previous.

The only thing left to be seen is if the next low is lower than the last. For that, we will need to break 4280; I don’t think that will happen Tuesday, but I think it will happen over the next few trading sessions.

The market mentality has changed; it is just that simple. It is not the same market it was before September; the tone has changed.

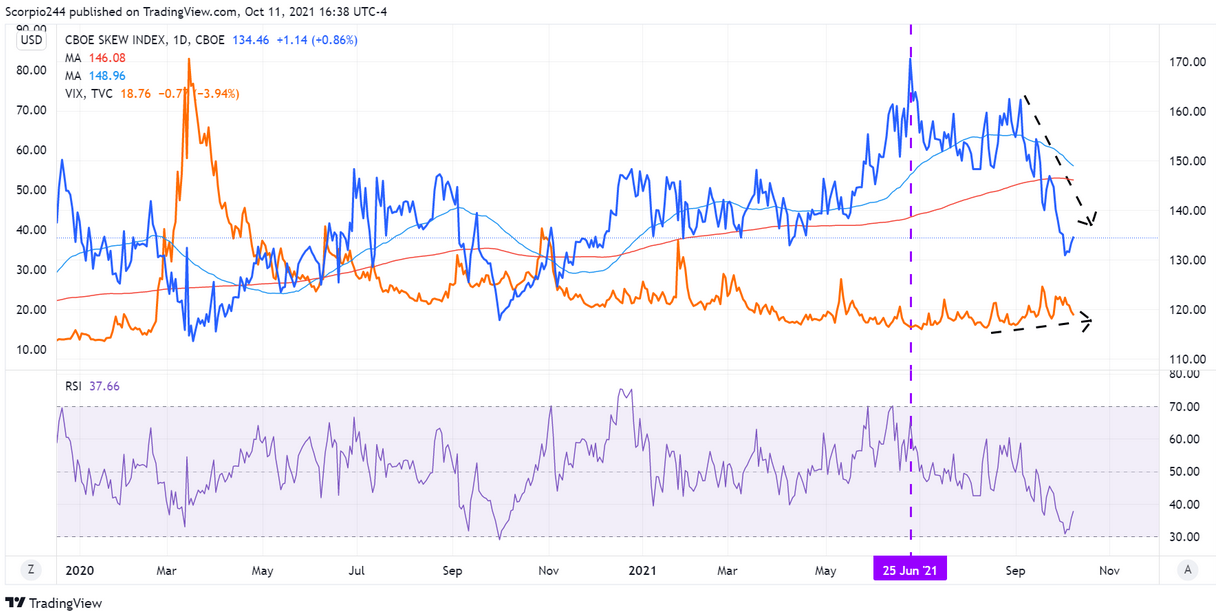

One such thing that has changed is the VIX. It moved up Monday back to around 20, after testing the lower end of its range around 18.5. Those waiting for the volatility sellers to come back may have a problem because it doesn’t look like they are coming back anytime soon. You can really see this on the SKEW chart, and perhaps I pointed it out here or not; I can’t remember.

Anyway, on Oct. 5, I noted here that I thought this time was different, noting all that tail-hedging that the SKEW index represents had topped out at the same time the VIX bottomed. It seems highly likely that the short-dated at-the-money volatility sellers were using out-of-the-money options to hedge against their short volatility positions.

But if they are not shoring volatility anymore, then there is nothing to hedge, and why the SKEW index has remained lower during this period of time.

So if the Vol sellers aren’t coming back, then the real risk here is volatility to break out to the upside. There are plenty of reasons for that to happen. The first being increasing uncertainty around earnings, which I reviewed in this post. I noted that 25 is the breakout point on the VIX. I think that is still the level to watch on the VIX.

Oil

Meanwhile, oil is at a significant inflection point here at $82. This is the trend line that goes back to 2013 highs. If oil breaks out it could go substantially higher, perhaps to around $91. The weekly chart shows that oil is overbought here, and if the dollar keeps rising at some point, it will put the breaks on oil’s rise. This will need to be watched closely. So have my doubts it can keep pushing higher, but I also said that at $76.

JPMorgan

Meanwhile, the banks were the worst-performing group yesterday, dropping by 1%. Now JPMorgan Chase & Co (NYSE:JPM) reports Wednesday morning, and the price action on Monday was curious, with the shares falling 2.1%. Now the stock is up a lot going into results, and as I noted yesterday expectations are very high for these banks. The market seems to be saying expectations are too high now. I could easily see this stock falling back to $153.

Micron

I’m so tired of Micron Technology (NASDAQ:MU) already. Why can’t it just break support and start heading lower already?

Disney

Walt Disney Company (NYSE:DIS) is kind of in the same boat as Micron. Just hugging support now for months, with all of these open gaps at much lower levels that need to be filled.