S&P 500 (SPY)

Stocks advanced yet again, with the S&P 500 quietly posting a gain of 70 bps and clearing resistance around 2,720. I see very little standing in the way of the indexes advance to 2,800. The next level of resistance will be a tremendous test for the bulls. The S&P 500 already failed 3 times at that level, and I’m not sure there is such a thing as a quadruple top. It would suggest to me that the index just keeps on rising –but what do I know…

Russell 2000

The Russell 2000 continues to march higher as well and is heading right for 1,562.

Alphabet (GOOGL, GOOG)

Alphabet (GOOG) (GOOGL) reported results tonight; nothing was glaring wrong with the results. Which is probably why the stock has hardly moved and is down just a touch after hours. The only thing investors –or better yet, algo’s, seem to care about is Alphabets shrinking operating margin.

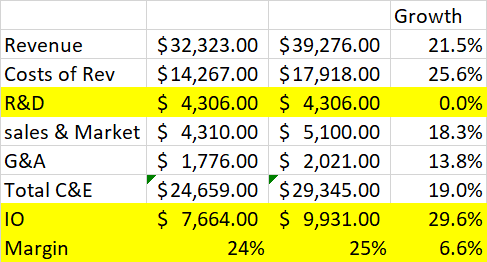

When looking at these numbers R&D for the business increased 40% to $6.0 billion, while Sales & Marketing increased 19% to $5.1 billion. If R&D had remains merely constant at $4.3 billion from a year ago, operating income would have been $9.9 billion, giving the company margins of 25%. So take it for what its worth.

Here is my little spreadsheet, I put together to see.

Then there is the cost per click, that fell 29% in the fourth quarter.

The stock spiked to $1,170 right to resistance, failed and is now trading lower to $1,100. Could the stock be heading towards $1,000? I don’t think so, there is a very nice uptrend, and I think that after investors digest the results the stock will be fine and continue to trend higher.

Amazon (AMZN)

Amazon (NASDAQ:AMZN) tried to rally a bit today, but the stock gave back much of those gains, to basically finish up 50 basis points. Not a good sign. I think the stock is going to break $1,620 and fall to around $1,500.

Roku Inc (ROKU)

Roku Inc (NASDAQ:ROKU) had a big day rising 5% well above our revised target of $48. The stock was up as high to $52 at one point, but had a steep sell off the last 10 minutes of the day, on some massive amounts of volume. That drop came after Comcast (NASDAQ:CMCSA) disputed the reports earlier in the day about Comcast using a Roku designed smart box. I have no thoughts now about the stock’s future direction. Today’s action messed up the apple cart for me.

Netflix (NFLX)

Netflix Inc (NASDAQ:NFLX) continues to trend towards $355. That is a very big level to watch for, as a rise above $355 sends the stock higher towards $380.

Apple (AAPL)

Apple Inc (NASDAQ:AAPL) continues to rebound and appears to be heading back to $182.

Nvidia (NVDA)

On the other hand, Nvidia’s rally appears to be ending as it fails at resistance after filling the gap.

Qualcomm (QCOM)

Qualcomm Incorporated (NASDAQ:QCOM) –someway, somehow, just continues to hold support around $49. It really is mystifying. There seems to be something magical about that price.

Disclaimer: Michael Kramer and the clients of Mott Capital own Alphabet, Apple, and Netflix.